최근

전 세계는 에너지 전환의 흐름에 진입하며 전기차(EV)와 에너지 저장 시스템(ESS) 중심으로 이차전지 시장도 재편되고 있다. 중국 이차전지 업체인 CATL, BYD, CALB 등이 중국 정부의 지원과 거대한 내수 시장을 발판으로 글로벌 M/S를 더욱 확장하고 있는 가운데, 중국을 견제하기 위한 한국과 일본 등 중국 외 업체들의 움직임도 매우 활발하다.

이러한

격변의 시대 속에서 미국의 47대 대통령으로서 도널드 트럼프가 확정된 현재, 향후 산업 정책과 규제 환경의 변화가 예상되는 가운데 미국을 넘어 전 세계 전기차 및 이차전지 시장에도 중대한

변동이 있을 것으로 생각된다.

도널드

트럼프 행정부의 출범은 글로벌 산업 정책과 무역 환경에 큰 변화를 초래할 가능성을 제기하고 있다. 특히 'America First' 기조에 따라 자국 내 제조업 부흥과 기술 패권 강화를 목표로 하는 정책들이 시행될

경우, 이차전지 전해액 산업에도 영향을 미칠 수 있다.

우선, 트럼프 행정부는 기존의 전기차 보조금 정책을 축소하거나 폐기하려는 움직임을 보이고 있으며, 이를 통해 전기차 시장 성장을 억제할 가능성이 제기되고 있다. 또한, 외국 업체들에게 높은 관세를 부과하고, 자국 내 생산을 강요하는 '온쇼어링(Onshoring)' 정책을 강화함으로써, 미국 내 제조업 부흥을 꾀하고 있다.

이에

따라 미국 내 전기차 및 이차전지 제조사들은 공급망의 현지화를 요구받을 가능성이 높아지며, 이는 전해액

제조업체들에게도 미국 내 생산 거점을 마련하거나 현지 파트너와 협력을 강화할 것을 강하게 요구할 것이다. 이러한

온쇼어링 기조는 글로벌 전해액 시장에서 기존의 경쟁 구도를 흔들고, 특히 중국과의 무역 관계에 큰 영향을

미칠 가능성이 높다.

중국

업체들은 이미 리튬염(LiPF6)과 같은 주요 원료 시장에서 독점적인 위치를 차지하고 있어, 미국의 관세 및 규제 강화는 이들의 시장 확대를 저해할 수 있다. 반면, 한국과 일본의 전해액 제조업체들에게는 기술과 품질 경쟁력을 바탕으로 미국 시장 내 입지를 강화할 기회로 작용할

수 있다. 특히, 한국의 동화일렉트로라이트, 솔브레인, 엔켐은 이미 주요 전기차 배터리 제조사와의 협력을 통해

글로벌 공급망에서 중요한 역할을 하고 있으며, 이러한 관계를 활용해 미국 시장에 직접 진출하거나 생산을

현지화할 가능성을 타진해야 한다.

첨가제(Additives) 시장에서도 변화가 예상된다. SEI 보호막 형성, 과충전 방지, 전도특성 향상 등 리튬이온 이차전지의 성능에 결정적인

역할을 하는 첨가제는 한국의 천보, 켐트로스 등이 기술력을 바탕으로 점유율 확대를 도모하고 있다. 미국의 자국 내 생산 요구가 강화됨에 따라, 첨가제 제조업체 역시

현지화를 포함한 전략적 대응이 필요하다.

동시에, 주요 시장인 중국과 유럽에서도 전해액 제조업체들은 현지화 전략과 기술 고도화를 통해 경쟁력을 강화하려는 움직임을

보이고 있다. 이러한 상황에서 한국, 일본, 그리고 신흥국의 전해액 제조업체들은 품질 경쟁력과 친환경 기술을 바탕으로 글로벌 시장에서의 입지를 확대하려는

노력을 기울이고 있다.

또한, 리튬이온 배터리 중심에서 전고체 배터리와 같은 차세대 배터리 기술로의 전환이 가속화됨에 따라 전해액의 기술적

요구사항도 변화할 것으로 보이며, 이에 따라 전해액 기업 간 협력과

M&A가 활발히 진행될 가능성도 있다. 이러한 변화의 물결 속에서 글로벌 전해액

시장은 새로운 기회와 도전에 직면하고 있다.

이러한

변화 속에서 전해액 업체들은 다음과 같은 전략적 대응이 요구된다. 첫째, 미국의 온쇼어링 기조에 부응하기 위해 현지 생산시설 설립이나 합작 투자 등 적극적인 현지화 전략을 추진해야

한다. 둘째, 고부가가치 리튬염 및 첨가제 개발을 통해 기술적

차별화를 강화하고, 품질을 통해 미국 및 유럽 시장의 신뢰를 확보해야 한다. 동시에 전고체 배터리 등 차세대 배터리 기술로의 전환을 대비해야 한다. 셋째, 원가 경쟁력과 안정적인 공급망 확보를 위해 글로벌 원료 소싱 다각화 및 생산 공정 최적화에 주력해야 한다.

이와

같이 혼란스러운 시장의 변화는 단기적으로는 어려움을 초래할 수 있지만, 적절한 대응 전략을 마련해 운영한다면

전해액 업체들은 글로벌 시장에서의 입지를 강화하고 새로운 기회를 창출할 수 있을 것이다.

이러한

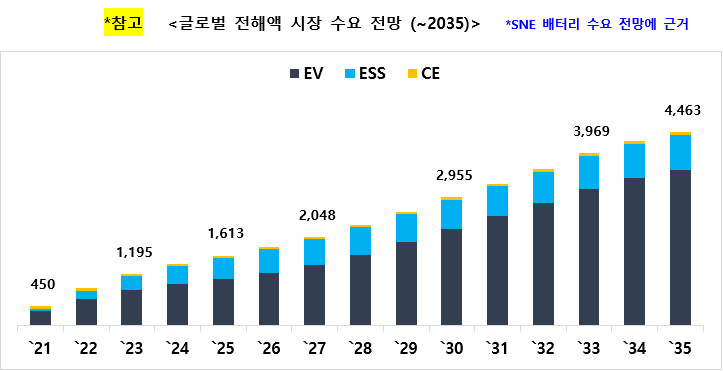

변화를 앞두고 있는 현재, 당사는 본 리포트를 통해 향후 전해액에 대한 수요 및 시장을 전망하여 독자들이

전체적인 규모를 파악하고 변화할 전해액 시장에 대해 파악할 수 있도록 돕고자 하였다. 또한, 리튬이온 이차전지에 적용하기 위한 전해액 완제품 및 각 구성재료에 대한 기술적 정보를 상세하게 정리하였으며, 차세대 배터리에 적용될 고체전해질에 대한 정보도 담았다.

마지막으로, 주요 배터리 제조업체의 전해액 수요 및 각 전해액 업체들의 공급 현황과 전망을 정리함으로써 이 분야의 연구자

및 관심있는 이들에게 기술부터 시장에 이르는 넓은 범위의 통찰력을 제공하고자 노력하였다.

본 보고서의

Strong point

1. 전해액 완제품 및 구성재료에 대한 전반적인 기술 정보 수록

2. 기존 LIB 외의

차세대 전지에 적용될 고체전해질 기술에 대한 소개

3. 당사의 전망자료에 근거한 전해액 시장전망을 통해 객관적인

데이터 제공

4. 한,중,일 주요 전해액 Player의 제품 및 제조 현황에 대한 상세한 정보

수록

[목 차]

Chapter Ⅰ. 개 요

1.1 배경 ············································································ 6

1.2 LIB 전해액 개요 ······················································· 10

1.3 전해액 구성요소 및 특성············································· 17

Chapter Ⅱ. 전해액 개발 동향

2.1 액체 전해질의 구성 ······························································ 24

2.2 액체 전해질의 특성 ······························································· 42

2.3 난연소재 ··············································································· 58

Chapter Ⅲ. 전해액 구성요소별

개발 동향

3.1 용매 ··············································································· 89

3.1.1 환형

카보네이트 ······························································ 89

3.1.2 선형

카보네이트 ······························································ 93

3.1.3 고전압

양극재용 용매 Concept ································· 102

3.1.4 고엔트로피

전해질 Concept ········································ 110

3.1.5 고출력

전해질 Concept ··············································· 113

3.2 리튬염 ··································································· 115

3.2.1 리튬염

개요····································································· 115

3.2.2 리튬염

종류별 기능 및 특징 ············································ 119

3.3 첨가제 ·································································· 134

3.3.1 고전압

양극향 피막 형성용 첨가제 ·································· 134

3.3.2 저전압

음극향 피막 형성용 첨가제 ·································· 151

3.3.3 환원분해형

화합물에 의한 음극 SEI 형성과정 ··················· 161

3.3.4 구조적으로

파괴된 SEI 층의 재생성하는 기능성 첨가제······ 162

3.3.5 전지

성능 저하를 일으키는 반응성 화합물 제거형 첨가제···· 166

3.3.6 High-Ni계 양극

계면 안정화를 위한 전해액 첨가제 ·············· 170

3.3.7 출력

특성 향상을 위한 전해액 첨가제 ······································· 176

3.3.8 LiFSI 염을 사용하는 전해액 ············································· 180

3.3.9

열 안정성 향상을 위한 난연성

첨가제 ··························· 181

3.3.9 고용량

음극 계면 안정화를 위한 첨가제 ························· 183

3.3.11 Ni-rich and High Voltage System 첨가제 (w/ or w/o SiOx) ······· 184

3.3.12 실리콘

음극용 첨가제 ····················································································· 186

3.3.13 LFP 양극용

첨가제 ··························································································· 186

3.3.14 LMFP 양극용

첨가제 ··························································································· 191

3.3.15 LFP & LMFP 양극용 HF, Metal scavenger 기능 첨가제·········· 192

3.3.16 LMR 양극용

첨가제 ·········································································· 194

3.3.17 안전성용

첨가제 ···················································································· 195

Chapter Ⅳ. 차세대 전지용 전해질

4.1 전고체전지의 필요성 대두 ··················································· 198

4.2 전고체전지 요구 특성 ······················································ 203

4.3 고체 전해질 종류별 특성 (유·무기

고체전해질) ····················· 206

4.3.1 Oxynitride 고체전해질

···················································· 206

4.3.2 Garnet 고체전해질

·····························································

208

4.3.3 NASICON형 고체전해질

······················································· 210

4.3.4 LISICON형 고체전해질

·····························································

212

4.3.5 황화물계

고체전해질 ····································································· 213

4.3.6 thio-LISICON형 고체전해질

························································· 217

4.3.7 고분자

전해질 ···················································································· 219

4.3.8 유∙무기 하이브리드 고체전해질 ······························································· 226

Chapter Ⅴ. 전해액 시장 동향

및 전망

5.1 국가별 전해액 출하량 현황 ··························································· 231

5.2 용도별 전해액 출하량 현황 ······························································ 233

5.3 전해액 공급 업체별 시장 현황 ························································· 235

5.4 LIB 업체별 전해액 수요 현황 ···························································· 244

(삼성SDI / LGES /

SKon / Panasonic / CATL / BYD / EVE / Guoxuan / CALB / Sunwoda)

5.5 용도별 전해액 수요 전망 ···································································· 320

5.6 전해액 CAPA 및 수급 전망 ································································ 321

5.7 전해액 가격 동향 ······················································································ 324

5.8 전해액 시장 규모 전망 ··················································································· 327

Chapter Ⅵ. 전해액 생산업체

현황

6.1 한국 업체 ································································································· 329

Enchem /

Soulbrain / Dongwha Electrolyte / Duksan Electera / Foosung /

Chunbo /

Chemtros

6.2 중국 업체 ································································································· 383

Tinci

Materials / Capchem / Ruitai / Kunlunchem / F&let / DFD / Yongtai /

Shinghwa

6.3 일본 업체 ······························································································· 447

MU Ionic

Solutions / Mitsubishi Chemical / Central Glass / Tomiyama

Ube

Corporation/ Nippon Shokubai / Kanto

Denka

Chapter Ⅶ. Reference ·············································································

495