<2023년 신간> 이차전지용 바인더 기술개발 현황 및 전망

리튬이온전지(LIB)는 높은 에너지밀도와 전력밀도로 인해 전기자동차

및 하이브리드 장치에서 사용되는

에너지저장 수요 증가를 해결하기 위해 가장 유망한 에너지저장장치의 하나로, 탄소저감을 위한 친환경 에너지

활용에 대한 관심의 증가와 함께 그 사용량이 급격히 늘고 있다.

SNE Research에 따르면, 새로운

에너지저장장치와 전기자동차의 급속한 발전 이후 LIB에 대한 수요는 꾸준히 증가하여 전기차 배터리 시장

규모는 연평균 21% 성장하며, ‘25년 196B$에서 ‘30년 401B$로

성장할 것으로 전망된다.

LIB의 특성은 전극에 따라 크게 좌우되는데, 뛰어난 배터리 성능을 달성하기 위해서는 전극구조를 최적화하는 것이 최우선 과제라고 할 수 있다. 현재 상용화된 LIB에서 뿐만 아니라 연구분야에서도 양극과 음극의

활물질은 많은 관심과 함께 연구 및 검토되고 있는데 비해, 비활성인 바인더는 낮은 중량비(≤5wt%)로 전극의 온전함을 유지하고 전기화학적 공정을 지원하며, 활물질과 도전재와 함께 전극의 성능 구현 측면에서 중요한 위치를 차지하지만 중요성에 비해 덜 주목받고 있는

것이 현실이다.

바인더는 전극 내에서 차지하는 부분이 매우 작은 편이지만, 전극 전체

성능을 결정짓는 중요한 역할을 한다. 바인더는 양극 및 음극의 활물질 및 도전재를 집전체인 각 극판에

잘 부착시키고, 내구성을 높이는 역할을 한다. 바인더는 (1)전해질에 전기화학적으로 안정적이여야 하고, (2)유연성과 불용성을

가져야 하며, (3)특히 양극 바인더의 경우 산화에 의한 부식방지 기능이 있어야 한다.

따라서, 활물질과 도전재를 집전체와 효과적으로 연결하고 부피 팽창을

수용하여 충방전 동안 우수한 전극 구조를 보장할 수 있는 높은 결합강도와

탄성을 지닌 기능성 바인더가 필요하다. 최근 바인더 스크리닝(screening)

및 설계에 대한 더 많은 통찰력을 통해 연구의 초점이 기계적 안정화 관점에서 구조적 지지체 뿐만 아니라 전기화학적으로 이점을 제공하는

다기능성으로 이동하고 있다.

최근, 실리콘 음극재 채택이 늘어나면서 바인더가 리튬화(lithiation)반응에 많은 영향을 주어 전극 용량 및 사이클 안성성 향상에 도움이 된다는 연구가 나와 차세대

연구가 활발히 진행되고 있다. 기존 바인더는 양극재에는 주로 불소수지인 PVDF(PolyVinyliDeneFluoride)를, 음극재에는 합성고무인

SBR(Styrene-Butadiene-Rubber)과 CMC(Carboxyl

Methyl Cellulose) 바인더를 사용했으나, 실리콘 음극재에서는 부피변화가 커서

사용에 부적합하다.

최근에 양극재에는 PTFE(PolyTetraFluoroEthylene)바인더가

음극재에는 PAA(PolyAcrylicAcid), PI(PolyImide)계 등 수계 바인더 등이 각광을

받고 있다.

PAA, PI 등의 바인더는 수계 바인더로, 물 기반 수계 용매를 전해질로 사용하는 실리콘 음극재에 사용된다. 위

바인더들은 기존 바인더에 비해 인장강도가 높고, 접착력이 높아 실리콘 음극재의 부피 팽창에 강하며 활물질을

감싸서 안정적인 SEI(Solid Electrolyte Interphase)층을 형성한다.

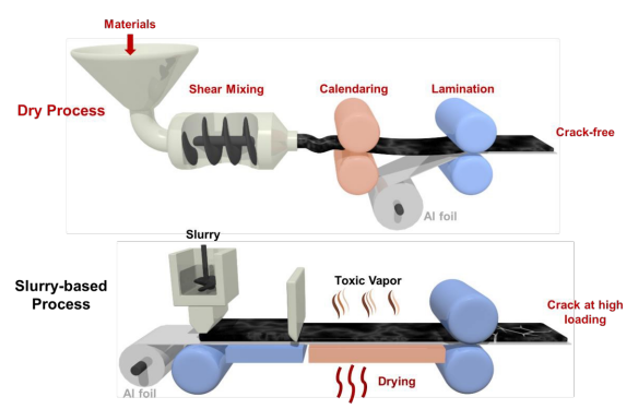

차세대 양극재용 바인더인 PTFE는 건식 전극공정용 바인더로 내화학성, 내열성이 매우 뛰어난 소수성 소재로 건식

전극공정이나 전고체전지에서 주목받을 것으로 보인다.

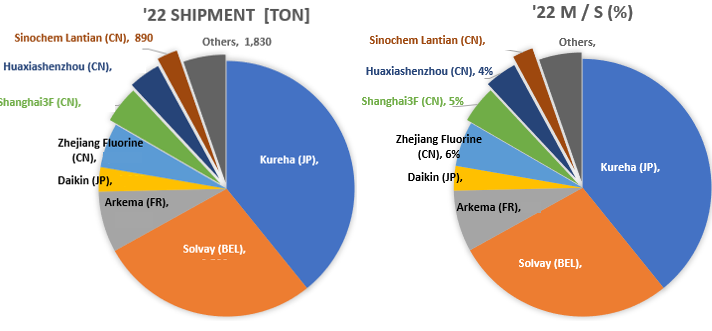

PVDF 바인더는 일본의 Kureha,

벨기에의 Solvay, 프랑스의 Arkema가

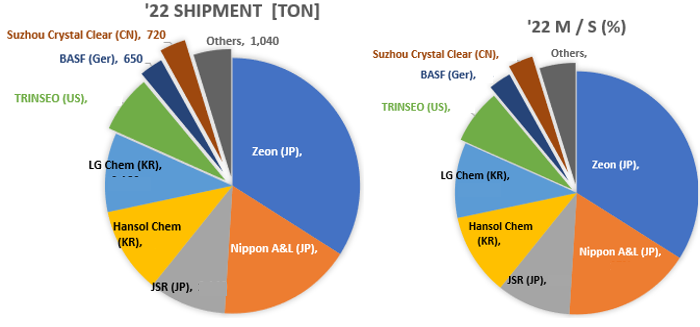

생산하고 있으며, SBR 바인더는 일본의 Zeon에서 생산하고

있어 모두 외국산 비중이 높은 고가 품목이다.

양극재 바인더는 국내의 켐트로스, 음극재 바인더의 경우 국내의 한솔케미칼이

국산화에 성공하여 삼성SDI와 SK On에 공급하고 있으며, LG Chem.과 금호석유화학도 음극재 바인더 공급에 나서고 있다.

한편 SNE Research의 글로벌 리튬이온전지용 바인더 수요 전망을

보면, 2025년 89,000톤에서 2030년 232,000톤으로 증가할 것으로 전망되며, 금액으로는 2030년에 약 4.4조원이

될 것으로 전망하고 있다.

고에너지밀도 배터리는 고성능 바인더에 대한 요구사항이 더 높아질 것으로 예상되며, 이러한 관점에서 바인더 설계는 다음을

고려해야 한다.

(1) 기계적

강도와 접착력을 잃지 않고 바인더 함량은 전체 전극 질량의 3wt%이하 일 것. (2) 저비용

및 지속 가능’25년 성 관점에서 수계 및 건식 기반 고분자를 이용한 합성의 단순화. (3) 필요한

모든 기능을 하나의 고분자에 통합할 수 있는 다기능성 고분자 바인더. (4) 고분자 분산 및 분해 메커니즘에 대한 깊은 통찰력

등이다.

본 리포트에서 SNE는 리튬이온 전지 전극을 위한 바인더 설계, 합성 및 전지에의 적용에 대한 지금까지의

문헌에 나온 정보를 상세하게 정리하였으며, 당사의 리튬이온 전지에 대한 전망자료를 기초로 바인더에 대한

수요 및 시장을 전망하였으며, 부록에는 외부 리서치 기관의 시장규모 및 전망을 인용하여 독자들이 전체적인

규모를 파악하는데 도움을 주고자 하였다.

마지막으로, 바인더 제조업체의 현황 및 주요 제품을 정리함으로써 이

분야의 연구자 및 관심있는 분들에게 전체적인 통찰력을 제공함으로써 전지의 에너지밀도, 급속 충전 능력

및 장기 수명 특성 등 전지의 성능을 향상시키는데 큰 도움이 될 것으로 기대한다.

본 보고서의 Strong Point

① 바인더에 대한 전반적인 개요 및 풍부한 기술내용 수록

② 바인더의 개발사례를 통해 핵심 point인 설계, 합성 시 고려 사항을 수록

③ LIB뿐만 아니라 차세대 전지인 Li-S나 전고체전지용 바인더 개발

현황 및 사례 분석 정리

④ SNE

Research의 배터리 전망치에 근거한 객관적인 바인더 시장 전망을 통해 바인더 시장에 대한 객관적인 수치 제공

⑤ 주요

바인더 기업 개발 현황 및 제품 현황에 대한 상세한 정보 수록

[PVDF binder 제조기업들의 출하량 및 M/S]

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

[SBR binder 제조기업들의 출하량 및 M/S]

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

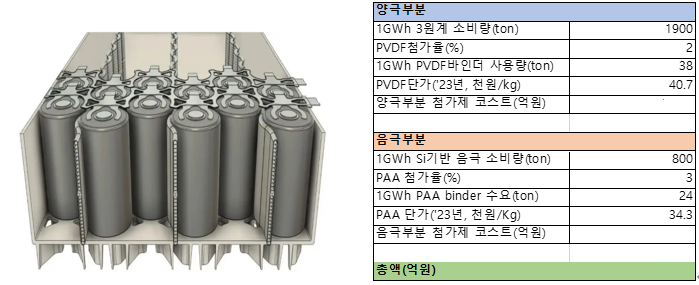

[Tesla향 4680 전지용 바인더 코스트 분석]

• 양극: NCM811, 음극:

Si계

• 1 GWh 전지용 PVDF

양극 바인더 소요량 및 비용: 약 38톤

• 1 GWh 전지용 PAA 음극

바인더 소요량 및 비용: 약 24톤

![]()

![]()

![]()

[전극 제조용 건식공정과 습식 공정 모식도]

1. 바인더 개요·······························································································································

8

1.1. 서론·································································································································

8

1.2. 정의, 역할 및 요구물성·····················································································

9

1.2.1.

역할 및 기능···································································································

9

1.2.2.

요구 물성·······································································································

10

1.3. 유형 및 종류··········································································································

10

1.3.1.

유형(types) ····································································································· 10

1.4. 작동 메커니즘········································································································

12

2. 바인더의 종류 및 연구개발 사례·······································································

16

2.1. 양극 바인더·············································································································

17

2.1.1.

비수계 바인더·····························································································

17

2.1.2.

PVDF양극 바인더 산업 현황······························································

18

2.1.3. (CMC+SBR) 음극 바인더 산업 현황·············································

18

2.1.4. 수계 바인더··································································································

19

2.1.5.

기타 바인더··································································································

27

2.2. 음극 바인더·············································································································

28

2.2.1. 삽입형 음극 바인더··················································································

29

2.2.1.1. 흑연전극용 바인더········································································

29

2.2.1.2. LTO전극용 바인더··········································································

31

2.2.2. 합금형 음극 바인더··················································································

35

2.2.2.1. 선형 고분자 바인더·····································································

37

2.2.2.2. 가교 고분자 바인더·····································································

40

2.2.2.3. 갈래(분지) 및 초대형 고분자

바인더·······························

42

2.2.2.4. 전도성 고분자 바인더································································

45

2.3. 차세대 전지용 바인더 (1) ··········································································· 49

2.3.1. 리튬-황 전지용 바인더···········································································

49

2.3.2. 건식공정용 바인더·····················································································

59

2.4. 차세대 전지용 바인더 (2) ··········································································· 63

2.4.1. 고체전해질용 바인더················································································

63

2.4.1.1.

전고체전지 개요·············································································

63

2.4.1.2. 황화물계 전고체전지···································································

64

2.4.1.3. 전고체전지 제조 및 바인더의 필요성····························· 67

2.4.1.4. 양극용 바인더 기술·····································································

72

2.4.1.4.1. 습식공정용 바인더 기술··············································

73

2.4.1.4.2. 건식공정용 바인더 기술··············································

78

2.4.1.5. 전해질층용 바인더 기술···························································

82

2.4.1.6. 음극용 바인더 기술·····································································

85

2.4.1.6.1. 흑연기반 음극 바인더 기술······································ 86

2.4.1.6.2. 차세대 음극 바인더 기술··········································· 87

3. 바인더 시장····························································································································

90

3.1. 바인더 시장 전체 전망·················································································

90

3.2. 글로벌 LIB용 바인더 시장 전망······························································

91

3.2.1. 글로벌 배터리 시장 수요····································································

92

3.2.2. 글로벌 LIB배터리용 바인더 수요 전망·······································

93

3.2.3. LIB배터리용 바인더 가격 전망························································· 94

3.2.4. LIB배터리용 바인더 시장규모 전망··············································· 95

3.2.5. 글로벌 LFP배터리 수요 및 양극재 수요 전망·······················

96

3.2.6. LFP 배터리용 PTFE 가격 및 시장 전망······································ 97

3.2.7. LFP 배터리용 PTFE 바인더 사용량················································

98

3.2.8. 실리콘계 음극용 바인더 시장 전망·············································· 99

3.2.9. 실리콘계 음극재 시장 전망·····························································

100

3.2.10. 실리콘 음극용 바인더PAA 시장 전망···································· 100

3.2.11. Tesla향 4680 전지용 바인더 코스트 분석···························

101

3.2.12. PVDF

binder 제조기업들의 출하량 및 M/S·······················

102

3.2.13. SBR

binder 제조기업들의 출하량 및 M/S···························

103

3.2.14. CMC

binder 제조기업들의 출하량 및 M/S·························

104

4. 바인더 제조업체 현황·····························································································

105

[1] Arkema·····················································································································

106

[2] BASF SE····················································································································

117

[3] Solvay························································································································

119

[4] Kureha·······················································································································

134

[5] ZEON·························································································································

140

[6] JSR·······························································································································

142

[7] Fujian Blue Ocean

Black Stone·································································

146

[8] Dupont·····················································································································

149

[9] Ashland Inc············································································································

150

[10] MTI Corp.·············································································································

155

[11] TRINSEO················································································································

157

[12] Xinxiang

Jinbang Power Technology···················································

162

[13] Lihong Fine

Chemical···················································································

166

[14] 켐트로스···············································································································

168

[15] 한솔케미칼··········································································································

171

[16] 금호석유화학·····································································································

178

[17] Daikin

Industry··································································································

180

[18] Nanografi

Nano Technology····································································

183

[19] Nippon Paper Group·····················································································

186

[20] APV

Engineered Coatings LLC································································

187

[21] Sichuan

Indigo Materials Science & Technology························

189

[22] Guangzhou Songbai Chemical Co·······················································

197

[23] Nippon

A&L Inc·······························································································

201

[24] Daicel

Miraizu Ltd···························································································

202

[25] Sinochem

Group Co······················································································

204

[26] Ube Corp. ·········································································································· 211

[27] AOT Battery

Equipment Technology···················································

214

[28] Shanghai 3F

New Materials······································································

215

[29] GL Chem···············································································································

217

5. 부록(참고용)·······················································································································

225

6. References···························································································································

227