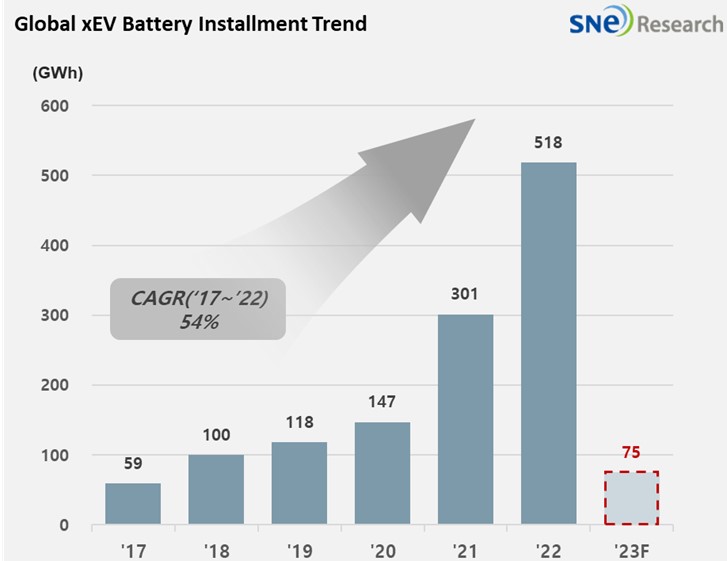

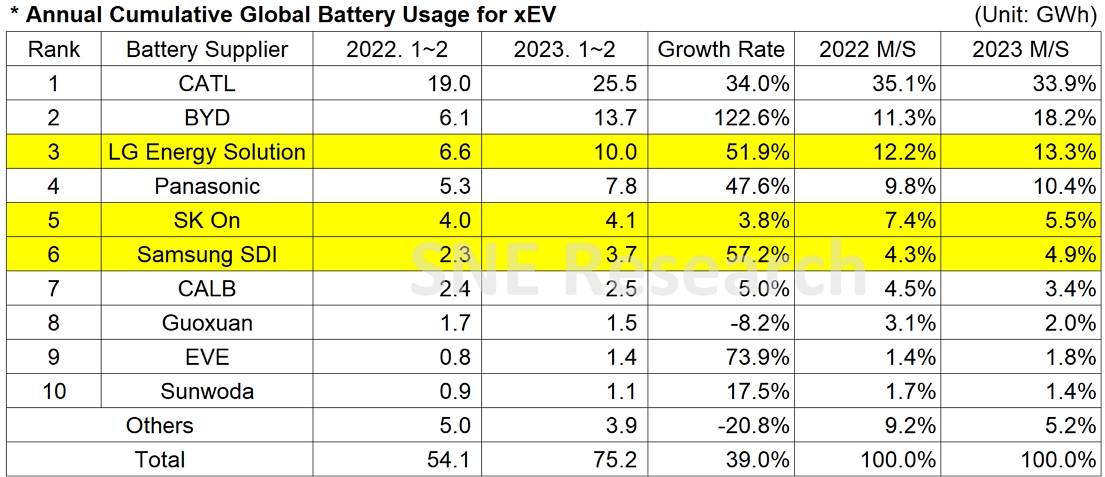

From Jan to Feb in 2023, Global[1] EV Battery Usage[2] Posted 75.2GWh, a 39.0% YoY Growth

- BYD, keeping the 2nd

position with a triple-digit growth

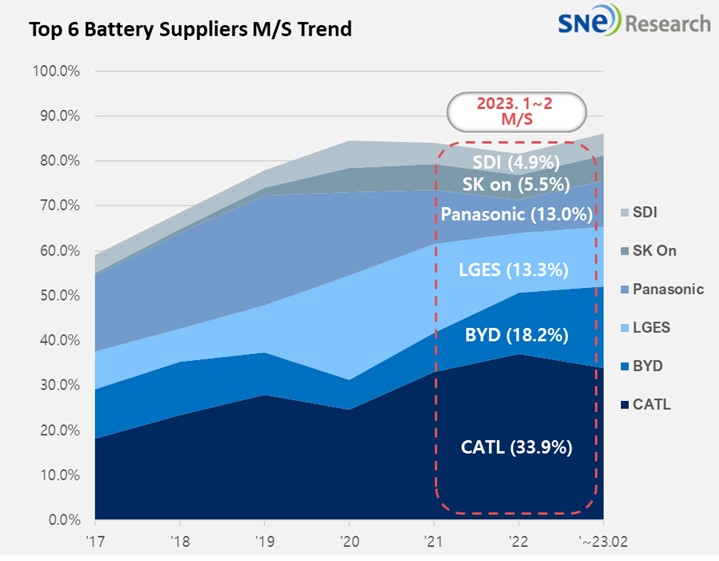

- K-trio’s M/S

recording 23.7%, with LGES

ranked 3rd on the list

From January

to February 2023, the

amount of energy held by batteries for electric vehicles (EV, PHEV, HEV)

registered worldwide was approximately 75.2GWh, a 39.0%

YoY growth. BYD from China showed more than two-fold growth compared to the

last year, keeping the 2nd position and following CATL on the list.

(Source: 2023 March Global Monthly EV and Battery Monthly Tracker, SNE

Research)

The combined market shares of

K-trio companies were 23.7%, 0.2% less than the same period of last year but

still remaining at a similar level to the previous. Overall, they were all in

an upward trend. LGES ranked 3rd, marking a 51.9% (10.0GWh) YoY

growth. SK On ranked 5th having a 3.8% (4.1GWh) YoY growth, while

Samsung SDI took the 6th position in the ranking recording a 57.2%

(1.8 GWh) YoY growth.

(Source: 2023 March Global Monthly EV and Battery Monthly Tracker, SNE

Research)

Such upward trend in the growth of K-trio was mainly affected by sales

of electric vehicle models equipped with batteries of each company. SK-On was

able to keep its growth momentum thanks to steady sales of Hyundai Ionic 5, KIA

EV6, and Ford F-150. As it has been publicly known that KIA EV9, which is about

to be launched soon, may use high-capacity battery, it should be closely

monitored whether EV9 can add more momentum to the growth of SK-On together

with EV6. Samsung SDI showed the highest growth among the three Korean battery

makers, based on the global popularity of Audi E-Tron and BMW i4 and iX as well

as the growing sales of R1 T/S, a pickup truck made by Rivian. LGES has continued

to grow at a double-digit rate due to strong sales of Tesla Model 3/Y, Ford

Mustang Mach-E, and Volkswagen ID 3/4.

Panasonic, the only Japanese

company in the top 10 on the list, recorded 7.8 GWh, a 47.6% YoY growth. As one of the major battery

suppliers to Tesla, the usage of battery made by Panasonic was mostly consisted

of those installed in Tesla models in the North American market

Based on a 34.0% YoY growth, CATL

from China remained top on the list, becoming the only battery maker with over

30% of market share in the global market. As CATL’s battery has been highly

sought after not only by Tesal for Model 3/Y but also in the Chinese commercial

and passenger vehicles such as S SAIC’s Mulan and Nio’s ET5, it is expected that CATL would

stand firmly on the top of the list. BYD has drawn a great popularity in the

Chinese domestic market based on its price competitiveness through vertical SCM

integration such as in-house battery supply and vehicle manufacturing. As BYD

is known to enter the European market as well as the Korean market soon,

attentions should be paid to potential changes in the growth of BYD.

(Source:

2023 March Global Monthly EV and Battery Monthly Tracker, SNE Research)

In January, the EV (BEV+PHEV)

sales in China slightly faltered due to the termination of national subsidy

policy. However, amidst a competition for low price stimulated by Tesla and BYD

as well as the electrification policy by the Chinese government, the EV sales

in China have been recovering. In this regard, it is expected that following

the next year, this year would also see a high growth in the EV and battery

market in China. Recently, the US and Europe announced protectionist measures,

which has made competitions in the field of EV and battery – regarded as key industries

of future – a lot fiercer. In addition, as it is forecasted that recycling of

waste battery would grow as another huge market in accordance with the battery

industry, it would become more important than ever to find countermeasures

befitting rapidly-changing global issues such as Battery Alliance.