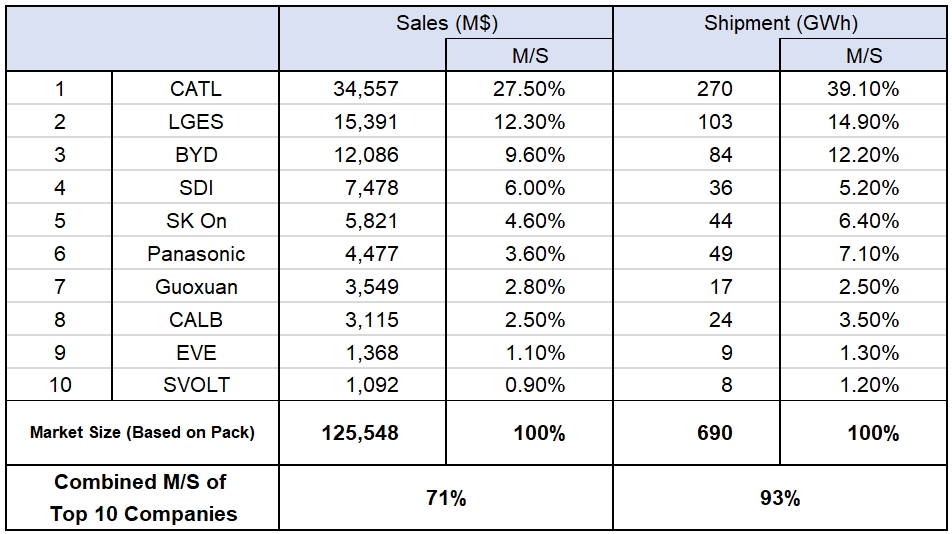

Global Top10 Battery Makers’ Sales Performance in 2022

In 2022, the total sales of xEV battery posted 690 GWh, and the battery market based on pack was aggregated to be worth of 125 billion US dollars.

Among

them, the combined shares of global top 10 battery makers based on their sales

were 71% and those based on their capacity reached 93%.

CATL

from China took No. 1 position, recording the market share of 28% based on

sales and 39% based on shipment. Among the K-battery trio, LGES ranked 2nd

with the market share of 12%, Samsung SDI ranked 4th with 6%, and SK

On ranked 5th with 5% of the market share based on sales.

BYD,

outperforming Tesla and selling the most units of electric vehicles in the

global market, recorded the market share of 10% based on sales and 12% based on

shipment. Currently standing firm on the 3rd place, BYD is expected

to keep its solid momentum.

Panasonic,

which sells battery cells to Tesla, ranked 4th with the market share

of 7% based on shipment, but its rank slightly goes down to 6th with

the market share of 4% based on sales.

Among

the global top 10 battery makers, the Chinese companies are the main stream

except the K-trio companies and Panasonic from Japan. It seems there won’t be any

noticeable change for a while in the landscape of battery industry.

Given that Sunwoda, Farasis, and AESC currently ranked outside the top 10 do not have a big gap with EVE and SVOLT ranked 9th and 10th respectively, their positions are highly likely to change at any time. However, for other global battery makers than the Chinese companies, it seems practically impossible to enter the top 10 on the list within a short period of time.

[xEV Battery Sales by Maker in 2022]

*) SNE Research Estimate

Even among the top 10 players, there have been growing gaps between the scale of sales by companies.

Based on shipment, CATL

recorded the market share of 39% in the global market, while the shares of top

3 players combined reached 66%, proving a growing dominance of those top-tier companies

in the market.

The market shares of companies

ranked from 4th to 6th ranged from 4 to 6% based on their

sales and 5 to 7% based on shipment, showing a significant gap with the top 3 players.

The market shares of companies ranked from 7th to 10th ranged

from 1 to 3% based on both sales and shipment, also seeing a gap with those

ranked 4th to 6th.

In the electric vehicle market, there have been close cooperations between car OEMs and battery makers. in addition, car OEMs have been working on the construction / expansion of their own battery plants for in-house battery production and the establishment of joint venture plants with battery manufacturers. Against this backdrop, it is expected the current landscape of battery industry would be maintained without any noteworthy changes before these battery production lines operate in earnest. |