Non-China Global[1] Electric Vehicle Deliveries[2] in Jan 2023 Recorded 312,000 units, a 28.6% YoY Growth

- Tesla ranked 1st and Hyundai-KIA ranked 5th in the non-China EV market

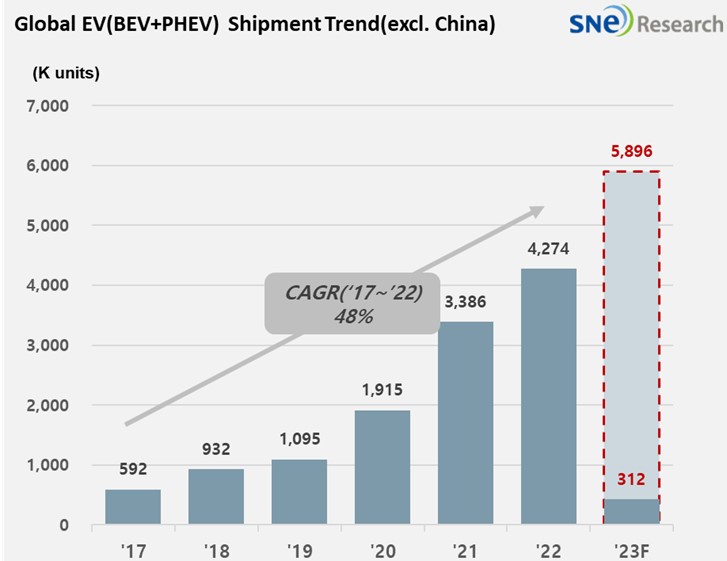

The

total number of electric vehicles registered in countries around the world except

China in January 2023 was 312,000 units, a 28.6% YoY growth. According to the

Global Monthly EV & Battery Shipment Forecast based on the Tracker data

provided by SNE Research, the EV deliveries[3] in 2023 are

expected to be around 5.896 million units.

(Source: Global Monthly EV

& Battery Shipment Forecast – February 2023, SNE Research)

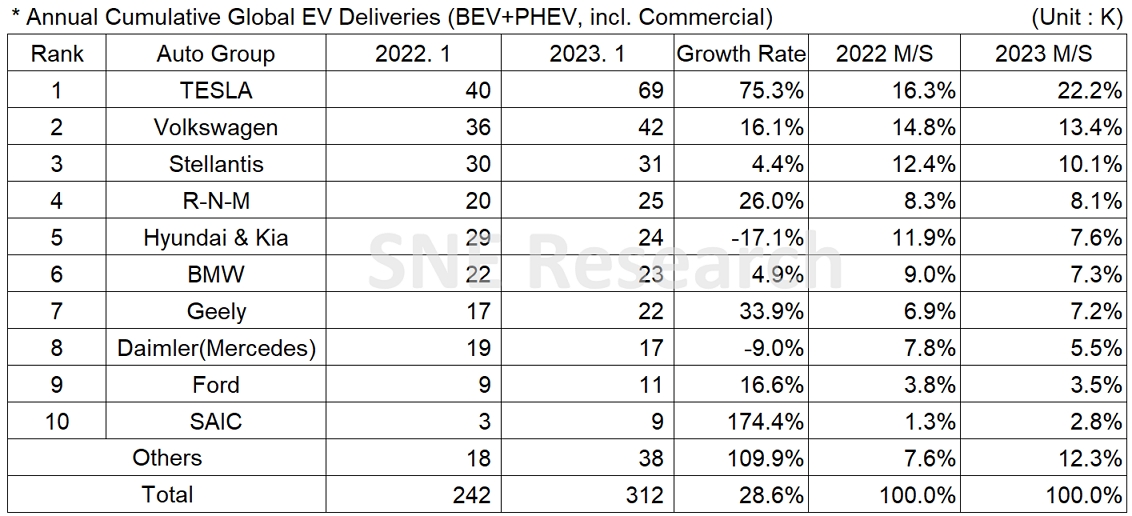

In Jan 2023, the sales of Tesla’s main models – Model 3 and Y – have led the growth of Tesla who took No. 1 position in the ranking of EV deliveries in the non-China market. Tesla remained top on the list, posting a 75.3% YoY growth. The Volkswagen group, which owns Volkswagen, Audi, and Skoda brands, recorded 16.1% growth compared to the same period of last year. The 3rd place on the list was taken by Stellantis group, where Peugeot, Jeep, and Fiat belong to, posting a 4.4% YoY growth. Particularly, solid sales of Peugeot e-208 model and Jeep Wrangler 4xe acted as a major driver for the growth. Hyundai-KIA, ranked 3rd last month, dropped to 5th this month due to a significant decline in EV sales in Germany and Korea where the EV subsidy fund was reduced or entirely abolished in 2023.

(Source: Global Monthly EV & Battery Shipment Forecast – February 2023, SNE Research)

The aforesaid decline in EV sales caused by changes in the subsidy policy did not only negatively affect the Hyundai-KIA group but also the Daimler group in Germany, making both of them post a degrowth in the top 10. SAIC Motor, which achieved a high growth by successfully implementing a strategy to target the mini-EV market, exhibited a triple-digit growth again this month based on strong sales of HS, MG’s SUV model in Europe such as the UK and France.

(Source: Global Monthly EV & Battery Shipment Forecast – February 2023, SNE Research)

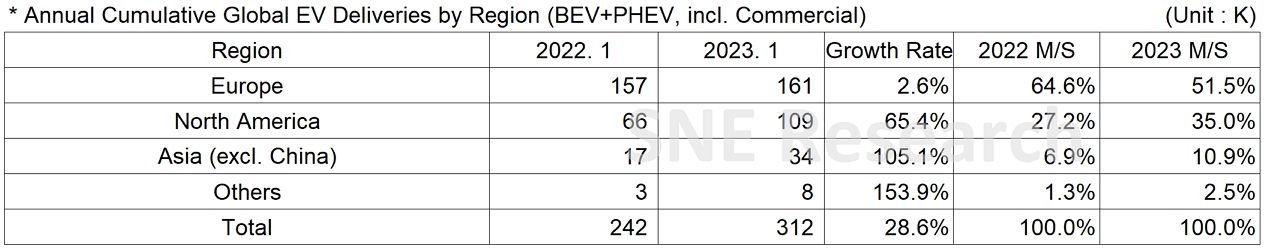

All regions maintained their growth momentum driven by increasing deliveries of electric vehicles compared to the last year. In accordance with the gradually-expanding EV market, the charging infra/tech market is also expected to rapidly grow in coming years. The US IRA, for instance, includes clauses about charger production as one of the preconditions for receiving the EV subsidy. The EU Commission also sets a goal of increasing the number of public charging stations to 3 million by 2030. In Korea, it is planned to gradually increase the ratio of charging stations per parking lots, while it is known that Japan also has a plan to enhance the EV charging infrastructure by mitigating its regulations on fast charging. Amidst the world’s increasing effort to improve the EV charging infrastructure, anticipation gets heightened to witness the advent of various business models and influences on the overall electric vehicle market.

[1] The xEV sales of 80

countries are aggregated (excl. China).

[2] Based on electric

vehicles (BEV+PHEV) delivered to customers or registered during the relevant

period.