In January 2023, Non-Chinese Global[1] EV Battery Usage[2] Posted 16.6GWh, a 48.2% YoY Growth

-

The K-trio recorded 44.4% M/S combined, with LGES remaining No.1

Battery

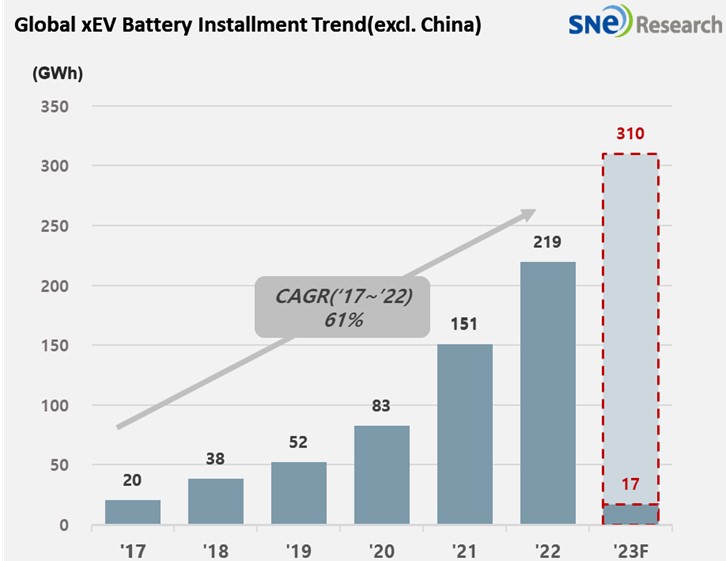

installation for global electric vehicles (EV, PHEV, HEV) excluding the Chinese

market sold in January 2023 was 16.6GWh, a 48.2% YoY increase and another

double-digit growth following last year. According to the Global EV % Battery

Monthly Tracker provided by SNE Research, battery usage[3] in 2023

is expected to be around 310GWh.

(Source: Global Monthly EV & Battery Forecast – February 2023, SNE Research)

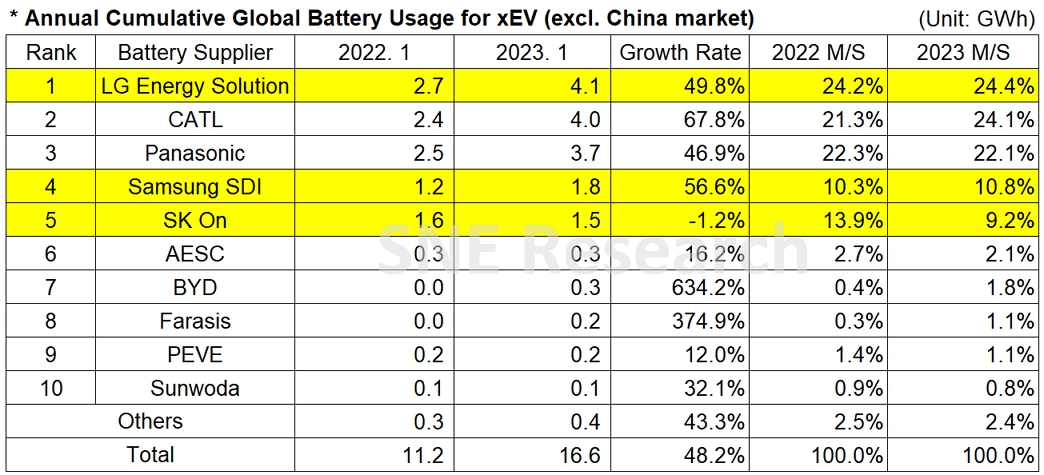

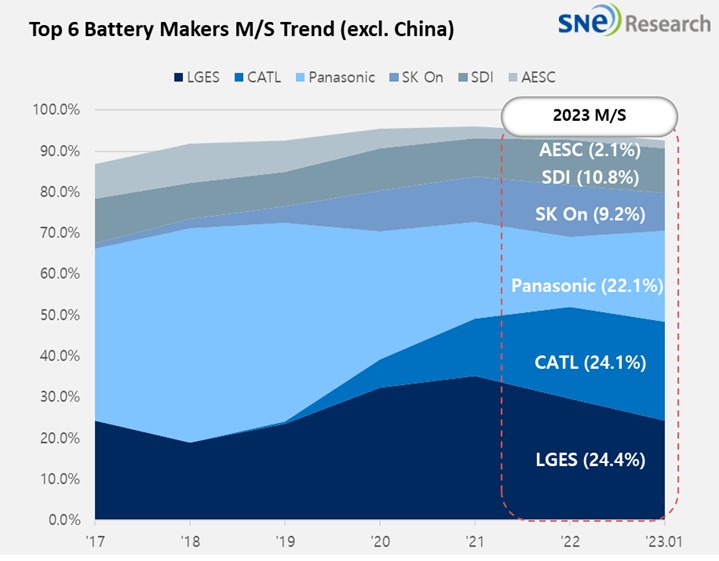

In the ranking of battery usage for electric vehicles, LG Energy Solution took No.1 position, while SK-On and Samsung SDI entered the top 5. The combined battery usage by K-trio makers increased by 1.9GWh from the same period of last year, but their market shares recorded 44.4% declined by 4.0%p YoY. CATL, a Chinese battery maker, posted a high growth of 67.8% even in the non-Chinese market with 4.0GWh and took the 2nd position on the list.

(Source: Global EV and Battery Monthly Tracker – February 2023, SNE Research)

SK-On recorded 1.5GWh, a 1.2% YoY decline, and saw its market share reduced by 4.7%p. Samsung SDI took ranked 4th with 1.8GWh, a 56.6% YoY growth, and had its market share increased by 0.5%p.

The upward

or downward trend in growth of battery cell makers was mainly affected by sales

of electric vehicle models equipped with batteries of each company. LG Energy Solution

kept its growth momentum based on solid sales of Tesla Model 3 and Y, Ford

Mustang Mach-E, and Chevrolet Bolt EUV. Samsung SDI’s growth is based on the

sales of R1T, Rivian’s pick-up truck, and BMW i4 and iX. SK-On found the sales of

Hyundai Ionic 5, KIA EV6, and Ford F-150 noticeably helpful for its battery usage

but saw a decline in the sales of Kona BEV.

Panasonic

posted 3.7GWh, a 46.9% YoY growth, and saw its market share declined by 0.2%p to

22.1%. As one of the major battery suppliers to Tesla, Panasonic stayed on an

upward track thanks to increases in sales of Tesla models in the North American

market and an increase in sales of Toyota BZ4X.

In addition to CATL, two other Chinese companies, BYD and Farasis, have grown as formidable players in the non-Chinese market. CATL took the 2nd place in the ranking based on increasing sales of Tesla Model 3 (made in China and exported to Europe, North America, and Asia), KIA Niro, and Nissan Ariya. BYD, who boasted the highest growth among the top 10 companies, was favorably affected by a surge in sales of Yuan PLUS EV (Atto 3) in the Asian region except China. Farasis, recording a sweeping 374.9% growth, is expected to enjoy a continuous growth in 2023 as Mercedes EQ series, exported to Europe are in great demand on the global stage.

(Source: Global EV and Battery Monthly Tracker – February 2023, SNE Research)

CATL posted a high growth throughout January 2023 even in the non-Chinese market, running after the top position. While the Chinese companies like CATL, BYD, and Farasis, are expected to enjoy a continuous growth, it should be closely monitored how the protectionist measures taken by the US and Europe would play in the non-Chinese market.

[1] The

xEV sales of 80 countries are aggregated. (excl. the China market).

[2] Based

on battery installation for xEV registered during the relevant period.

[3] Forecast is updated every month in accordance with the actual aggregated data of each month. (excl. the China market).