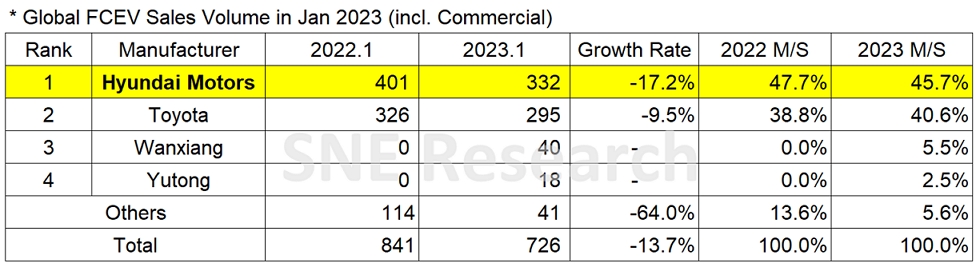

Global FCEV Market with 13.7% YoY Degrowth in January 2023

- NEXO from Hyundai Motor Group sold 329 units in Jan 2023, followed by Toyota who sold 295 units of Mirai and closed the gap in between.

A total number of globally registered FCEVs sold in January 2023 was 726 units, recording a 13.7% YoY decline. Hyundai Motors remained top in the FCEV market, selling 329 units of NEXO, while the sale of NEXO experienced a 17.3% drop compared to the previous year.

In

2022, Hyundai Motors took more than 50% of the entire market share, maintaining

the top position in the FCEV market for 4 consecutive years. However, in Korea

where NEXO, one of the main car models from Hyundai Motors, sold most, there is

a tendency in January that the EV sales significantly drop as most of the subsidy

fund may have been used according to the national subsidy policy in Korea. In addition,

another cause for the degrowth is assumed to be the fact that details of

government subsidy fund has not been finalized yet.

Compared

to the situations in Korea, Toyota, which had a 9.5% YoY degrowth this month

though, has seen a continuous recovery in sales of Mirai since Oct 2022. After Q1

2021 when Toyota was outpaced by Hyundai Motors, a gap between Toyota and Hyundai

Motors has kept widening. However, the gap has been noticeably closed from the beginning

of this year. As the sales of NEXO is expected to rebound after the 2023 EV

subsidy policy in Korea is finalized, it should be keenly monitored whether the

competition between Hyundai Motors’ NEXO and Toyota’s Mirai would go on.

(Source: Global FCEV Monthly Tracker – Feb 2023, SNE

Research)

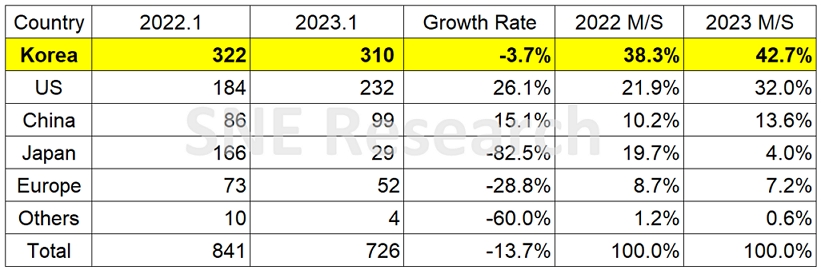

By country, although Korea managed to keep the biggest market share, it experienced a 3.7% degrowth. The US posted a 26.1% YoY growth, propped up with the sales of Mirai model from Toyota. China ranked 3rd on the list, recording a 15.1% YoY growth, as it has the largest demand for hydrogen commercial vehicles.

(Source: Global FCEV Monthly Tracker – Feb 2023, SNE Research)

Following 2022, this year started with a significant halt in the growth of FCEV market as the global green vehicle market has been focusing on electric vehicles and the charging infrastructure for hydrogen vehicles is insufficient. However, news about FCEV investment and development have recently been brought to the market. For instance, after 4 years of development, BMW introduced a pilot car for iX5 Hydrogen model developed based on the fuel cell of Toyota Mirai. Honda proclaimed that it would launch a new hydrogen electric vehicle based on Honda CR-V as it made an announcement on joint development of next-generation fuel cell system with GM. Hyundai Motors has a plan to release a follow-up model of NEXO equipped with a new, 3rd-generation fuel cell. With an increasing investment in FCEV and related development, a fiercer competition is expected among the market players to take the leadership.