Non-Chinese

Global EV Battery Usage in 2022 Posted 219.3GWh,

a 45.2% YoY Growth

- The K-trio’s

M/S reached 53.4% in 2022, with LG Energy Solution closing

the year as a leading company in Korea

Battery

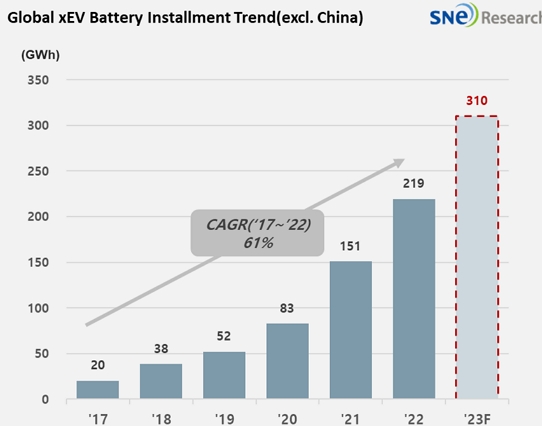

installation for global electric vehicles (EV, PHEV, HEV) excluding the Chinese

market sold from January to December in 2022 was tallied at approximately 219.3

GWh, which is another double-digit growth following 2021 and, compared to that

year, is roughly a 45.2% increase. According to the Global Monthly EV &

Battery Shipment Forecast based on the Tracker data provided by SNE, battery

usage in 2023 is

expected to be around 310 GWh.

(Source: Global Monthly EV

& Battery Shipment Forecast – January 2023, SNE Research)

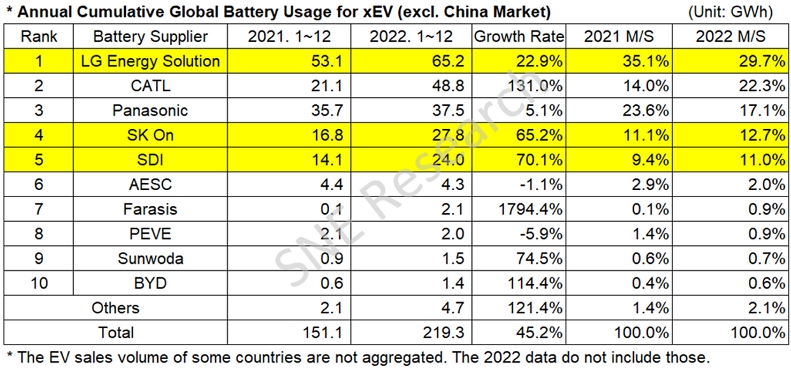

In the ranking of battery usage

for electric vehicles, LG Energy Solution maintained the leading position,

while SK-On and Samsung SDI also safely landed on their positions in the top 5.

The combined market shares of K-trio marked 53.4%, proving themselves still in

an upward trend. CATL, a Chinese battery maker, recorded a high growth of

131.0% even in the non-Chinese market with 48.8 GWh and took the 2nd

position on the list.

(Source: Global EV and Battery

Monthly Tracker – January 2023, SNE Research)

SK-On,

recording 27.8GWh, showed a 65.2% YoY growth with its market share increased by

1.6%p. Samsung SDI remained 5th in the ranking with 24.0 GWh, a

70.1% increase from the previous year. Its market share increased by 1.6%p.

Although

the three Korean battery makers all showed more than a double-digit growth from

the last year in terms of battery usage, their market shares combined were

53.4% declined by 2.2%p from 2021. The growth of K-trio was mainly led by solid

sales of electric vehicle models equipped with batteries of each company. LG

Energy Solution’s growth was driven by the increasing sales of Tesla Model 3

and Y, Volkswagen ID. 3 and 4, and Ford Mustang Mach-E. SK-On enjoyed a high

growth in battery usage thanks to the popularity of Hyundai IONIQ 5 and 6 and

KIA EV 6 from the global consumers. Samsung SDI was also in an upward trend based

on the sales of BMW i4 and iX, Audi E-Tron line-ups, and PIAT 500.

The

Japanese makers, on the other hand, were relatively sluggish in growth, and

their market shares also shrank from last year. Panasonic, one of the Japanese

battery makers, saw a 5.1% YoY growth, but a 6.5% decrease in market share. As

one of the major battery suppliers to Tesla, Panasonic managed to stay in a

growth trend driven by increase in the sales of Tesla vehicles and that of

TOYOTA BZ4X.

On

the contrary, some of the Chinese battery makers including CATL boasted an

explosive growth in 2022. CATL took the 2nd position in the

non-China market due to increases in the sales of Peugeot e-208/2008, MG ZS,

and Tesla Model 3 (made in China and exported to Europe, North America, and

Asia). Farasis, showing the sharpest growth among the top 10 companies, made a

long stride in 2022 thanks to strong sales of Mercedes EQ series, exported to

Europe, which has been also highly popular around the world. Farasis is

anticipated to show a steady growth in 2023.

(Source: Global EV and Battery Monthly Tracker

– January 2023, SNE Research)

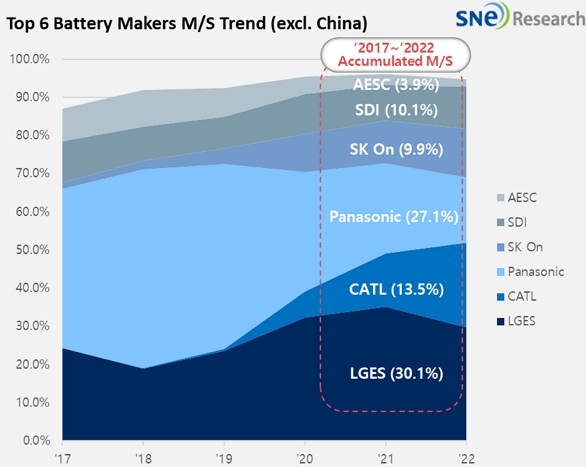

Similar

to last year, LG Energy Solution kept the top position in the non-Chinese

market from Jan to Dec 2022. However, given the circumstances of these days –

the IRA implementation by the US government and the explosive growth of Chinese

companies such as CATL, Farasis, Sunwoda, and BYD – it is expected that the

competition between the Chinese makers and K-trio companies will become much

fiercer than ever.

Forecast is updated every month in

accordance with the actual aggregated data of each month. (excl. the China

market)