Global Electric Vehicle

Deliveries Recorded 10.83 Mil

Units in 2022, a 61.3% YoY Growth

- BYD and Tesla

ranked 1st and 2nd / Hyundai-KIA ranked 6th

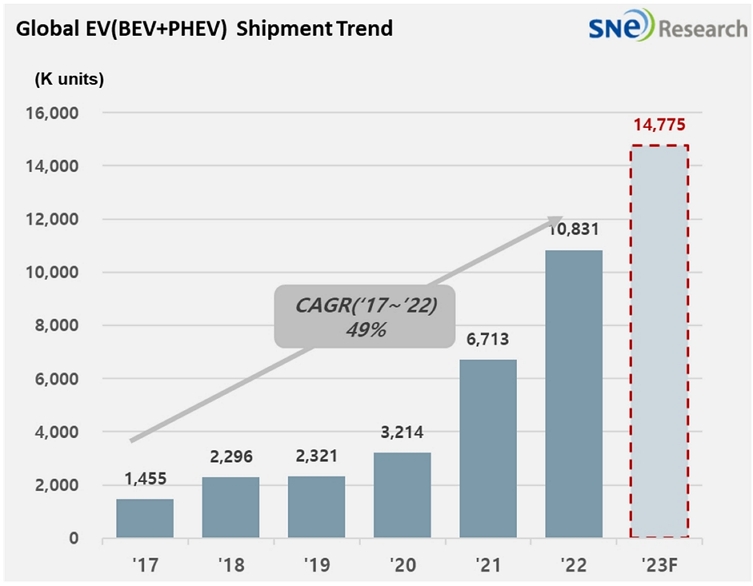

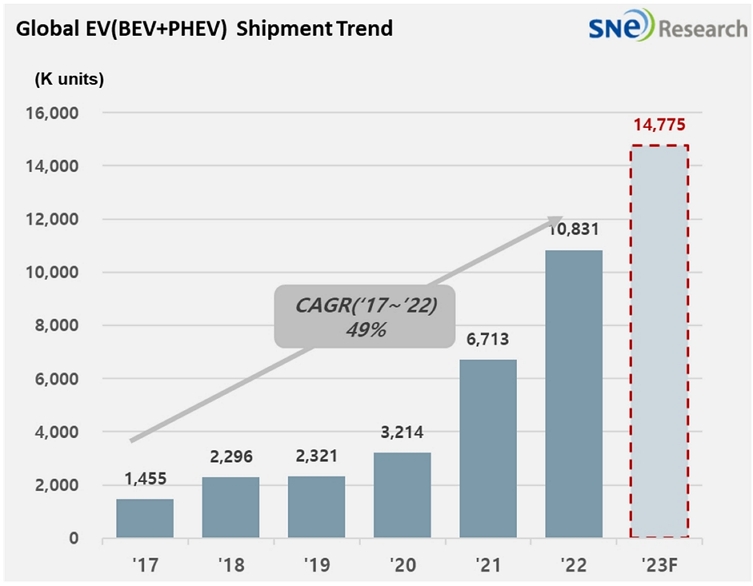

The total number of electric vehicles registered

in countries around the world from January to December 2022 was 10.83 million

units, a 61.3% growth from the previous year. According to the Global Monthly

EV & Battery Shipment Forecast based on the Tracker data provided by SNE Research,

the global EV deliveries in 2023 are expected

to reach approximately 14.78 million units.

(Source: Global Monthly EV

& Battery Shipment Forecast – January 2023, SNE Research)

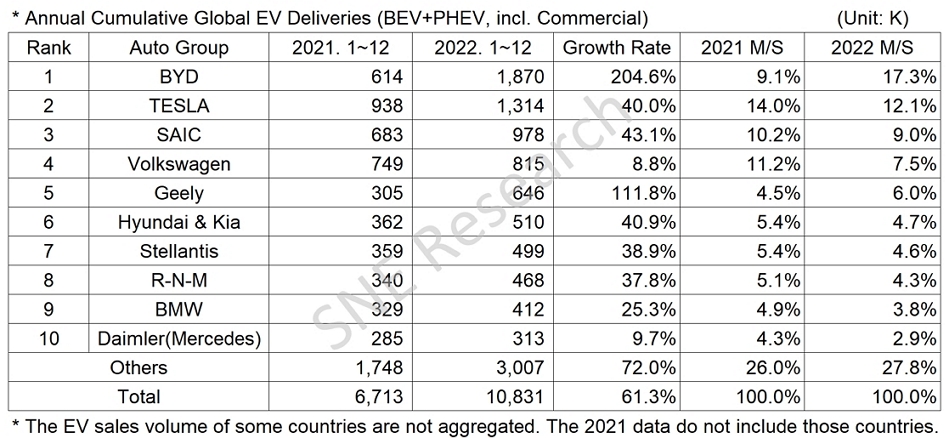

BYD,

which enjoyed a massive YoY growth of 261% in 2021, posted another trip-digit-growth

of 205% in 2022 with 18.7 million units, taking the top position on the list.

Tesla was outrun by BYD and ranked 2nd despite a 40% growth from the

previous year. The 3rd place was taken by SAIC Motor recording 978,000

units, and Volkswagen ranked 4th with a relatively lower,

single-digit growth. Geely followed the German carmaker with 646,000 units, and

Hyundai-KIA ranked 6th delivering 510,000 units.

(Source: Global EV and Battery

Monthly Tracker – January 2023, SNE Research)

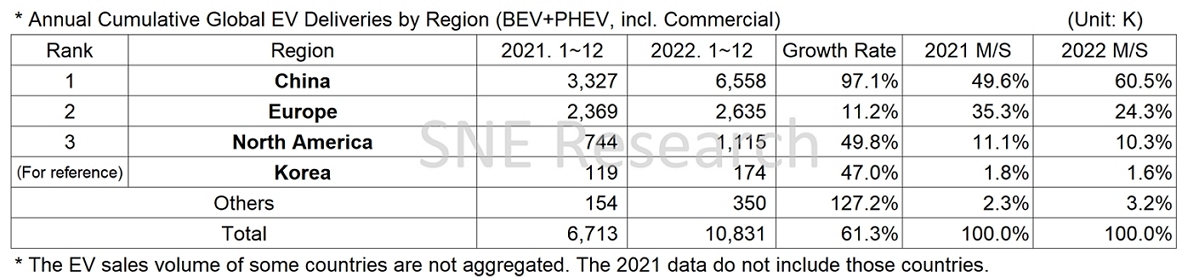

Favorably affected by the circumstances

in the Chinese domestic market, only BYD and Geely among the top 10 companies

recorded a triple-digit growth. While the EV sales volume in China reached 6.56

million units in 2022, a 97.1% increase from the previous year, the EV sales in

Europe and the North American region only saw a 11.2% and 49.8% growth

respectively. This has led to significant changes in market shares held by automakers.

Except the two Chinese companies, other top 10 makers witnessed their shares dropping

from the previous year.

(Source: Global EV and Battery

Monthly Tracker – January 2023, SNE Research)

In

the global EV market of today, competitions have become fierce with companies between

11 and 20 in the ranking delivering more than 120,000 to 300,000 units in 2022.

Furthermore, except Ford ranked 14th, all of them are Chinese automakers,

meaning that a domestic competition inside China has been overheated more than

ever. Amidst market forecasts expecting the Chinese EV market possibly going

through a relatively sluggish year in 2023, attentions should be drawn to ripple

effects from the IRA implementation by the US government.

Forecast is updated every month in accordance

with the actual aggregated data of each month.