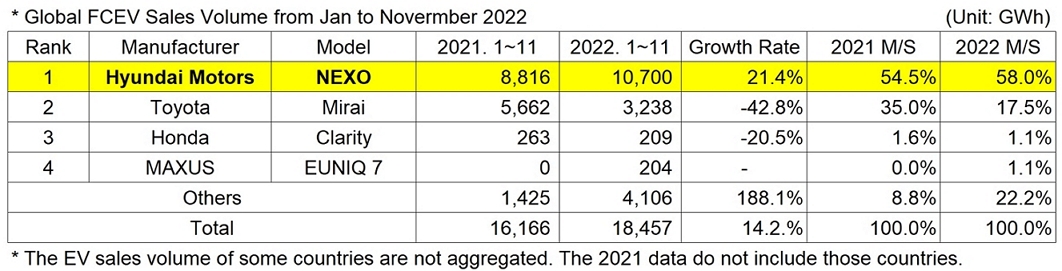

Global FCEV Market with 14.2% YoY Growth from January to November 2022

- No. 1 Hyundai Motors has sold over 10K units of NEXO in 2022, while No. 2 Toyota saw Mirai taking a favorable turn.

From January to November 2022, there existed numerous unfavorable factors; the global eco-friendly car market disproportionally focusing on electric vehicles, a sharp increase in installment interest rate of cars with the benchmark interest rate raised, and the shortage of semiconductors for vehicles. Despite all these obstacles, Hyundai Motors managed to sell 10,700 units of Nexo in 2022, leading its double-digit growth compared to the same period of last year. It has also widened a gap with Toyota, seemingly possible to capture No. 1 in sales volume over the year of 2022.

A total number of globally registered FCEVs sold from January to November 2022 was 18,457 units, an increase of 2,291 units from 16,166 units in the same period of last year. While Hyundai’s Nexo enjoyed a steady sale in November 2022, Mirai 2nd generation from Toyota saw a huge YoY drop in sales. However, in November, the sales volume of Mirai 2nd generation recorded 211 units in the US alone, showing a slight recovery. The Japanese carmaker also sold 56 units of Mirai in Japan and 41 units in Germany, witnessing an increase in sales compared to the previous month and recording the overall sales of 341 units in November.

The two leading companies in the FCEV market, Hyundai Motors and Toyota, are both known to launch their main models – Nexo and Mirai – to the Chinese market. Hyundai Motors also reportedly has a plan to review the launch of Xcient, its large hydrogen truck model, to the hydrogen commercial vehicle market in China, which is anticipated to offer an opportunity for the Korean carmaker to rebound in the Chinese FCEV market.

By company, Hyundai Motors with a continuous growth has kept the leading position in the FCEV market, while Toyota and Honda have been negatively affected by supply chain issues in Japan, especially with auto parts and semiconductors. Honda, whose production of Clarity terminated in August 2021, has remained in the sluggish condition. The EUNIQ 7 FCEV model by MAXUS from China saw a decline in sales in early 2022 but has gradually recovered, leading to a forecast that it may outperform Honda’s Clarity in terms of sales.

(Source: Global FCEV Monthly Tracker – Dec 2022, SNE Research)

According to the 2022 December issue of Global FCEV Monthly Tracker published by SNE Research, the sales of Nexo is more than three times greater than that of Mirai in the global market. However, when it comes to its sales in overseas markets except Korea, Nexo has been sold less than Mirai. The Tracker also showed that the number of commercial FCEVs sold in China was approximately 3,900 units, taking up a large portion in the FCEV market.

Amidst a temporary slowdown in growth witnessed in the FCEV market of 2022, Hyundai Motors has been a peerless player in the hydrogen mobility market. However, OEMs in China and Japan are expected to aggressively pursue after the frontrunner, based on their government support and state investment for hydrogen vehicle development. In particular, the socialist state is well known for its powerful policy enforcement which has successfully promoted its electric vehicle market to become the world’s largest one. In this regard, it should be watched with keen interest whether, with the Chinese government showing a strong will to promote the hydrogen industry, a sharp growth in the hydrogen commercial vehicle market of China would lead to a growth in the hydrogen passenger car market.