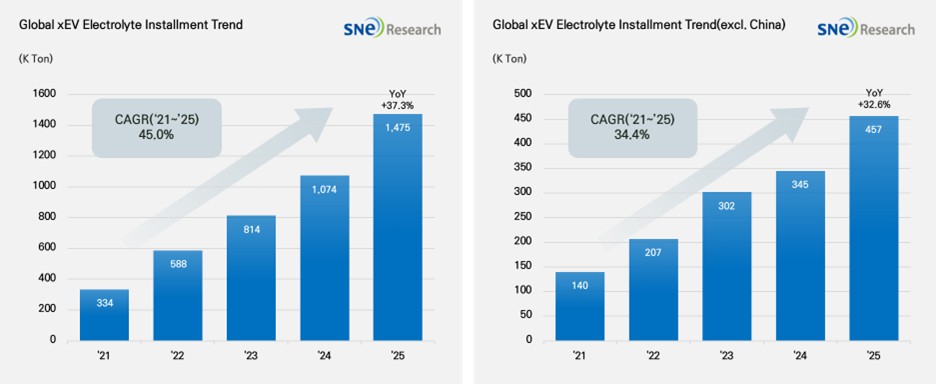

From Jan to Dec 2025, Global[1] Electric Vehicle Battery Electrolyte Installment[2] Reached 1,475K ton, a 37.3% YoY Growth

- In 2025, the

electrolyte market continued to post a double-digit growth, while the non-China

market showed a stable expansion in demand.

(Source: 2026 January Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Dec 2025, the total installment of electrolyte used in electric vehicles (EV, PHEV, HEV) registered around the world was approx. 1,475K ton, posting 37.3% YoY growth. Particularly in the global market outside China, the total usage of electrolyte for electric vehicles recorded 457K ton and 32.6% YoY growth, continuously exhibiting a stable expansion in demand.

Electrolyte is one of the key materials and facilitates the transfer of lithium ions inside batteries, directly affecting the battery charging speed, safety, and battery life. With the electric vehicle market expanding and demand for high-performance batteries increasing, the electrolyte market is expected to continue strong growth in the mid-to-the-long run.

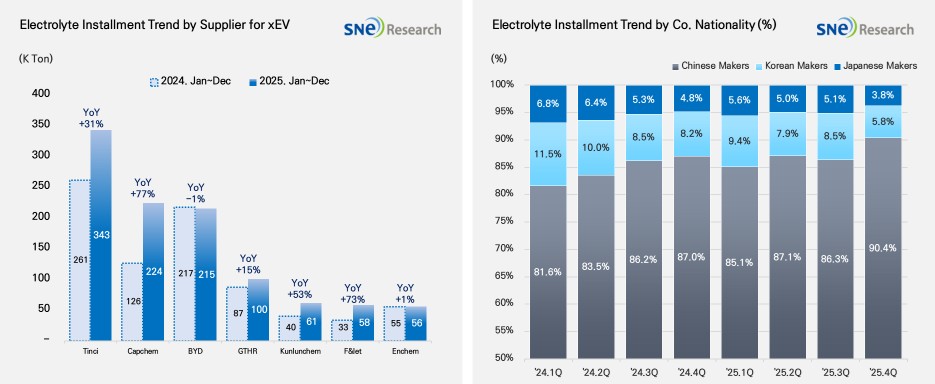

From January to December 2025, major suppliers in the global electrolyte market demonstrated prominent growth. Tinci maintained its top market position, recording 343K tons, a 31% increase year-on-year, followed by Capchem, which grew 77% to reach 224K tons. BYD recorded 215K tons, a slight 1% decrease compared to the previous year, while GTHR reached 100K tons, an 15% increase. Additionally, South Korean firms Enchem (56K tons, +1%) and Soulbrain (34K tons, +15%) sustained their growth momentum.

(Source: 2026 January Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

In terms of market share by nationality, Chinese companies continue to dominate the electrolyte market. As of the fourth quarter of 2025, the market share of Chinese firms reached 90.4%, while South Korean and Japanese companies recorded 5.8% and 3.8%, respectively. These figures represent a slight decrease compared to the same period last year. As the supply structure increasingly centers around Chinese suppliers, it is becoming more critical for non-Chinese companies to secure and enhance their competitiveness.

The 2025 global electrolyte market recorded double-digit annual growth, driven by the expansion of EV battery installations, confirming a robust demand base. While major suppliers, primarily from China, maintained high shipment volumes, South Korean and Japanese firms also continued their growth trends; however, the supply structure remained heavily centered on Chinese players throughout the year.

In 2026, the electrolyte market is projected to expand further, fueled not only by EV demand but also by various applications such as power grids and Energy Storage Systems (ESS). The market is expected to sustain its year-on-year growth trajectory in 2026, with global demand for high-performance lithium-ion electrolytes on the rise. In particular, increasing demand from the ESS battery market, beyond EVs, is expected to bolster future growth. Regarding electrolyte technology, key performance variables such as enhanced thermal stability and safety, as well as the development of high-voltage compatible products, are emerging as critical factors.

[2] Based on batteries installed to electric vehicles registered during the relevant period