From Jan to Dec 2025, Global[1] EV Battery Separator Installment[2] Reached 18,657Mil ㎡, a 40.0% YoY Growth

- With the increasing installment of batteries in electric vehicles in 2025, the global separator market maintained steady growth

(Source: 2026 Jan Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

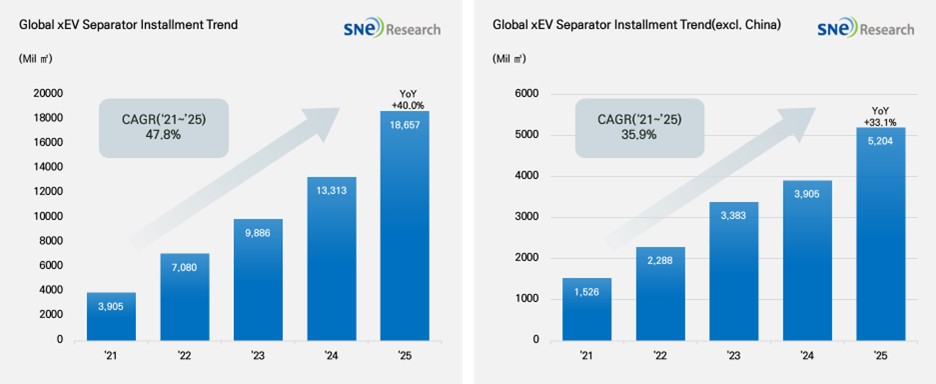

From January to December 2025, the total installment of separators used in electric vehicles (EV, PHEV, HEV) registered worldwide reached 18,657 Mil ㎡, representing a 40.0% year-on-year growth. During the same period, the market excluding China recorded 5,204 Mil ㎡, a 33.1% increase compared to the previous year, maintaining a steady upward trend.

The separator is a critical component that physically divides the anode and cathode within a lithium-ion battery while allowing the passage of lithium ions. It directly impacts both the safety and performance of the battery. As the electric vehicle market expands and the demand for high-performance batteries rises, the separator market continues to sustain its strong growth trajectory.

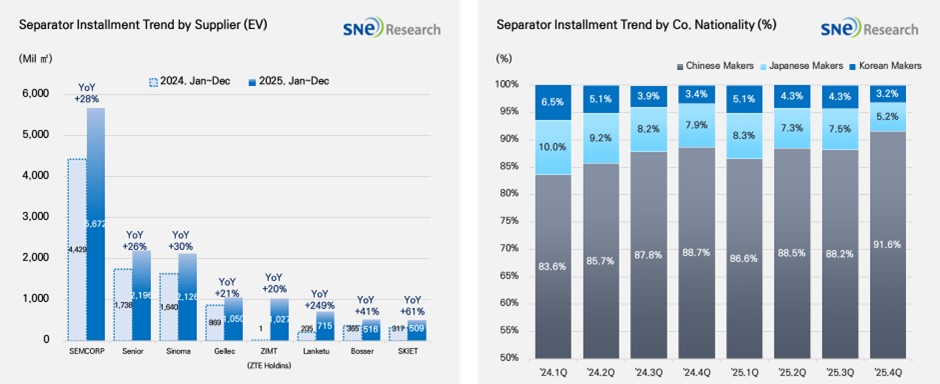

From January to December 2025, major suppliers in the global separator market showed remarkable growth. Notably, SEMCORP maintained its market leadership by recording 5,672 Mil ㎡, a 28% increase compared to the same period last year. The dominance of key Chinese players continued, with Senior (+26%), Sinoma (+30%), and Gellec (+21%) all showing strong performance.

Additionally, companies such as ZIMT and Lanketu expanded their market share by achieving double-digit growth rates. Meanwhile, South Korea’s SK IE Technology significantly strengthened its growth trajectory, recording 509 Mil ㎡, a 61% surge over the previous year.

By corporate nationality, Chinese companies maintain their dominance, accounting for over 90% of the total market. Since the first quarter of 2024, the market shares of Japanese and South Korean companies have shown a gradual downward trend, recorded at 5.2% and 3.2%, respectively, in the fourth quarter of 2025. As the market control of Chinese firms strengthens, the competitive landscape of the global separator market is being reshaped around China.

(Source: 2026 Jan Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

The

2025 global electric vehicle (EV) separator market reaffirmed its annual growth

trend, fueled by the expansion of battery installations, with market growth

driven by increased shipments from major suppliers amidst a China-centric

supply structure. However, in 2026, as the EV market growth momentum shifts,

the growth rate of demand for EV battery separators is expected to moderate

gradually. In contrast, demand for ESS battery separators is projected to

expand relatively rapidly, supported by grid stabilization efforts and the

expansion of renewable energy. Consequently, the separator market is likely to

undergo a restructuring where the weight of ESS-related demand progressively

increases within the traditionally EV-dominated structure. For suppliers, this

means that alongside competing for high-performance EV products, diversifying

customer portfolios to address ESS demand will become increasingly critical.

[2] Based on batteries installed to electric vehicles registered during the relevant period.