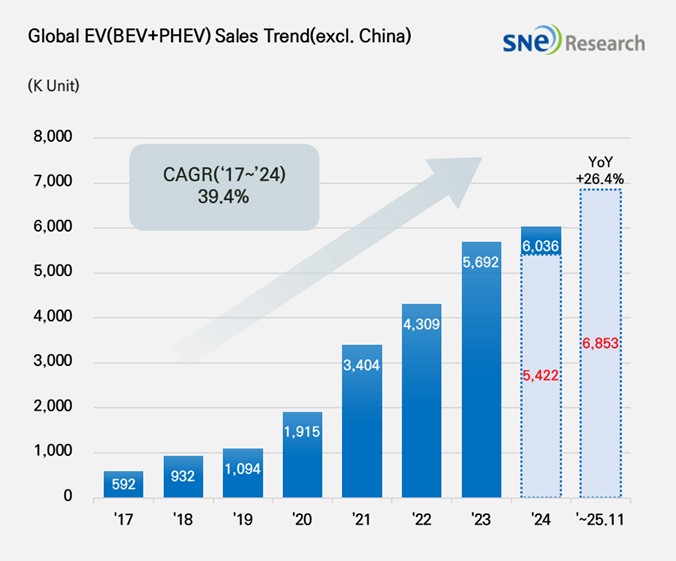

From Jan to Nov 2025, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded About 6.853 Mil Units, a 26.4% YoY Growth

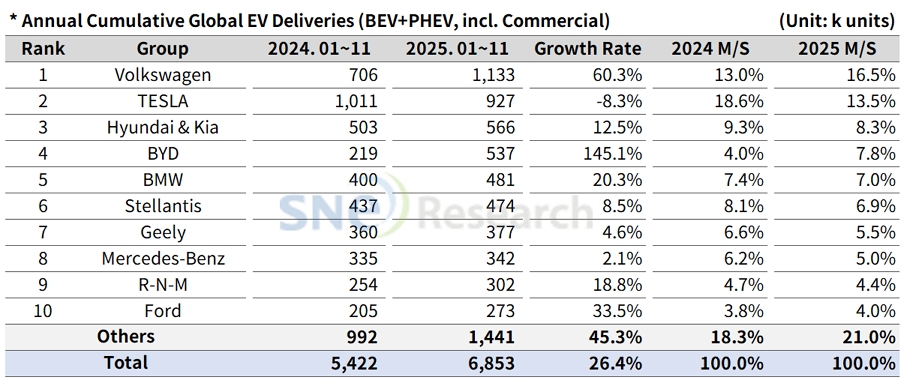

- VW took top rank with 60.3% growth; Tesla remained 2nd on the list

From Jan to

Nov 2025, the total number of electric vehicles registered in countries around the world except China was

approx. 6.853 million units, a 26.4% YoY increase.

(Source: Global EV & Battery Monthly Tracker – Dec 2025, SNE Research)

By group, Volkswagen Group outperformed Tesla and took the 1st place in the ranking of global electric vehicle deliveries (except China) by exhibiting a 60.3% YoY increase with 1.133 million units sold. VW’s major models such as ID.4, ID.7, and ENYAQ, based on MEB platform, led the expansion of sales mainly in the European market. Sales of new models such as A6 e-Tron, Q6 e-Tron, and Macan 4 Electric, to which the PPE platform is applied, have accelerated rapid growth of VW group. The integration of a diverse lineup—spanning from mass-market to premium and sports car brands—through a common platform strategy serves as a key factor in strengthening competitiveness within non-Chinese markets.

Tesla, which ranked second, saw its ranking in the non-Chinese market drop by one spot, delivering 927k EVs - an 8.3% decrease year-over-year. The core models, Model Y and Model 3, fell by 4.8% and 7.5% respectively, confirming a general slowdown in demand. Meanwhile, Model S (-55.2%) and Model X (-36.1%) recorded double-digit declines due to intensifying competition in the luxury segment and weakened price competitiveness. Cybertruck maintained its market presence within limited supply with 23k units delivered (a 34.4% YoY decrease), but this volume was insufficient to offset the overall decline in performance.

Ranked third, Hyundai Motor Group maintained a relatively stable growth trend in the global market, selling approximately 566k EVs, a 12.5% increase year-over-year. In the battery electric vehicle (BEV) segment, performance was driven by the IONIQ 5 and EV3, while compact and strategic models such as the Casper (Inster) EV, EV5, and Creta Electric are receiving positive responses in key global markets. Conversely, existing mainstay models like the EV 6, EV 9, and Kona Electric showed a slowdown in sales, failing to sustain their previous growth momentum. In the plug-in hybrid (PHEV) segment, 96k units were delivered; SUV-centered models like Sportage, Tucson, and Sorento maintained a solid trend, whereas some models, including Niro and Ceed, recorded a distinct decline.

By region, the group delivered approximately 157k units in the North American market, maintaining its third-place ranking behind Tesla and GM. Despite a 16.8% year-over-year decline in North America, its ability to outperform major global competitors such as Ford, Stellantis, Toyota, and Volkswagen is regarded as a significant achievement. With the global expansion of the EV 3 and the sequential addition of new models like the EV 4 and IONIQ 9, Hyundai Motor Group’s electrification portfolio is entering a phase of gradual diversification. Combined with an increased share of local production and region-specific optimization strategies, the group is projected to maintain a relatively stable profit structure amidst evolving tariff and policy environments.

(Source: Global EV & Battery Monthly Tracker – Dec 2025, SNE Research)

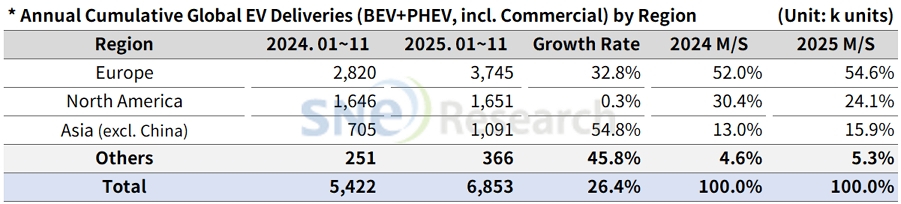

The European EV market recorded 3.745 million units from Jan to Nov 2025, a 32.8% increase year-over-year, accounting for 54.6% of the global market. However, analysts suggest that this recovery is a ‘limited growth’ shaped by shifting regulatory stances rather than a policy-driven surge. This is because policy uncertainty surrounding the EV transition is resurfacing, with discussions on adjusting deadlines for phasing out internal combustion engines (ICE) or easing regulations. These environmental shifts are directly impacting the electrification strategies of legacy automakers; major OEMs like Volkswagen, Mercedes-Benz, and BMW are now recalibrating the pace of their transitions or re-evaluating their strategic roadmaps.

The North American EV market recorded 1.651 million units, a marginal 0.3% increase year-over-year, which is effectively viewed as a period of stagnation. While demand was pulled forward ahead of the expiration of IRA-based consumer tax credits, the potential for a demand slowdown is increasing, particularly in price-sensitive low-to-mid-tier segments. In response, legacy OEMs are adjusting their electrification roadmaps and doubling down on Hybrid and EREV-focused strategies. Consequently, local production share, price competitiveness, and powertrain mix optimization are emerging as the decisive factors for future market share.

The Asian market (excluding China) recorded 1.091 million units, a sharp 54.8% increase year-over-year, accounting for 15.9% of the global share. In India, competition led by local manufacturers is intensifying alongside the proliferation of affordable domestic EVs. Meanwhile, Thailand and Indonesia are strengthening their roles as production and export hubs rather than mere consumer markets. Notably, major Southeast Asian nations are shifting away from import-led growth toward policies that emphasize local assembly and the nurturing of domestic industries.

Other regions (Middle East, South America, Oceania, etc.) recorded 366k units, a 45.8% increase year-over-year, accounting for 5.3% of the total market. EV adoption in these areas remains in its infancy, with significant disparities in government support and charging infrastructure across countries. While government-led initiatives and the expansion of Chinese OEMs are gaining traction in some areas, the lack of charging infrastructure and high vehicle prices continue to serve as major impediments to market penetration.

(Source: Global EV & Battery Monthly Tracker – Dec 2025, SNE Research)

The recent retreat in global electrification policies is unlikely to be a structural factor that permanently undermines the medium-to-long-term growth potential of the EV market. As Full Self-Driving (FSD) technology, spearheaded by Tesla, advances rapidly, and software-driven autonomous capabilities expand their real-world utility, the value proposition of EVs is poised to evolve beyond eco-friendly transport into a new mobility service platform. If autonomous technology permeates mass-market EVs at competitive prices, it could trigger a new demand cycle less dependent on government policy, reigniting growth momentum. From this perspective, global automakers are expected to recalibrate their pace in response to short-term policy shifts while simultaneously internalizing autonomous and software competencies to lead a new era of demand transformation.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period