LG Energy Solution Remained Top in Non-Chinese Global[1] EV Battery Usage[2] from Jan to September 2022

- The K-trio recorded 56.0% of market shares combined, while the Chinese makers boasted a ‘rapid growth,’ with CATL ascending to 2nd place

In

the ranking of battery installation for global electric vehicles (EV, PHEV,

HEV) excluding the Chinese market sold from January to September in 2022, Korea’s

LG Energy Solution stayed on top of the list, and SK-On and Samsung SDI safely

landed in the top 5 list. The combined market shares of K-trio recorded 56.0%, staying

in an upward trend.

This

tally excludes the usage of batteries installed in electric vehicles sold in China

from that of the global market.

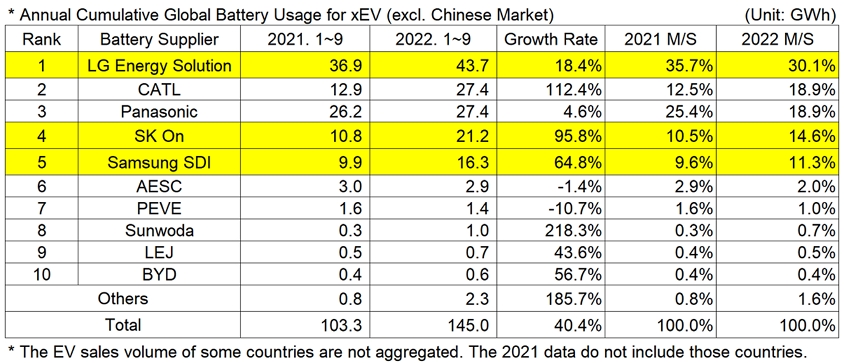

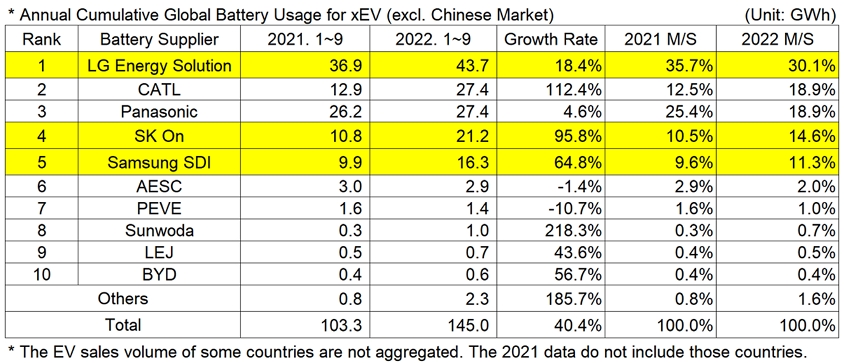

From

January to September 2022, the amount of energy held by batteries for electric

vehicles registered worldwide except in China was 145.0GWh, 40.4% YoY increase.

By

company, LG Energy Solution kept the No. 1 position with a 18.4% increase to

43.77GWh. CATL, one of the Chinese battery makers, climbed to be the 2nd

place, recording a magnificent 112.4% growth and outperforming Panasonic even

in the non-Chinese market.

(Source: Global EV and Battery Monthly Tracker – October 2022, SNE Research)

(Source: Global EV and Battery Monthly Tracker – October 2022, SNE Research)

SK-On

recorded 21.2GWh, a 95.8% YoY growth, and saw its market share increased by

4.1%p.

Samsung

SDI ranked 5th with 16.3GWh, a 64.8% YoY increase.

The

combined market shares of K-trio were 56.0%, a slight increase by 0.2%p

compared to the same period of last year.

On

the other hand, the Japanese battery manufacturers such as Panasonic, PEVE, and

LEJ showed a relatively sluggish growth. Except LEJ, the other Japanese makers

saw their market shares declined from the previous year.

Unlike

the Japanese counterparts, some of the Chinese manufacturers including CATL have

been enjoying a triple-digit high growth which should be described as ‘explosive’

in growth. CATL finally captured the 2nd place with a nearly 2.1

times growth from previous as BEV sales including Tesla Model (made in China

and exported to Europe, North America, and Asia), Mercedes-Benz EQS, BMW iX3, and

Cooper increased. Sunwoda ranked 8th as the demand for Dacia Spring

Electric by Renault in Europe increased.

The upward

trend found in the K-trio was mainly led by strong sales of electric vehicle models

equipped with batteries of each company. LG Energy Solution’s growth was based

on the steady sales of Volkswagen ID.4, Tesla Model 3 and Y, and Ford

Mustang Mach-E. SK-On enjoyed a high growth based on the popularity of Hyundai

Ionic 5, and KIA EV6. With a recent launch of new model like Ionic 6, SK-On got

boosted in its growth. Samsung SDI

was backed by solid sales of Audi E-Tron line-up, BMW i line-up, PIAT 500, and Jeep

Wrangler PHEV.

(Source:

Global EV and Battery Monthly Tracker – October 2022, SNE Research)

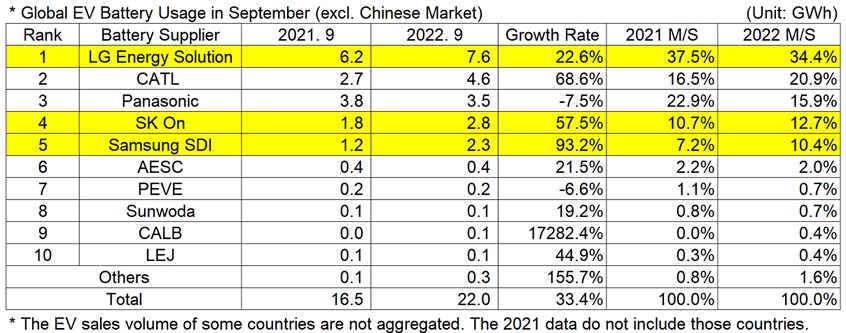

Meanwhile,

battery installation in September 2022 was 22.0GWh, a 33.4% YoY increase.

By

company, LG Energy Solution remained top on the list, and SK-On and Samsung SDI

showed a double-digit growth. CATL from China, with a growth rate of 68.6%, recorded

4.6GWh, chasing the frontrunner, LG Energy Solution. Sunwoda and CALB

maintained their upward trend, entering the top 10 list. CALB, in particular, showed

the highest growth among the top 10 companies, a dramatic increase from 0.48MWh

in the same month of last year to 83.95MWh in September 2022.

Same

as last year, LG Energy Solution ranked 1st from January to

September 2022 in the non-Chinese market. However, those explosive growths exhibited

by the Chinese makers such as CATL and Sunwoda made the competition with the

K-trio much fiercer. Recently, movements in the market to escape from China by lowering

dependence on the Chinese makers have been detected in response to the enactment

of Inflation Reduction Act in the US. More attentions should be paid to whether

the movements to escape from Chinese products may have impacts on the

non-Chinese market down the road.

[2] Based on battery installation for xEV registered during the relevant period.