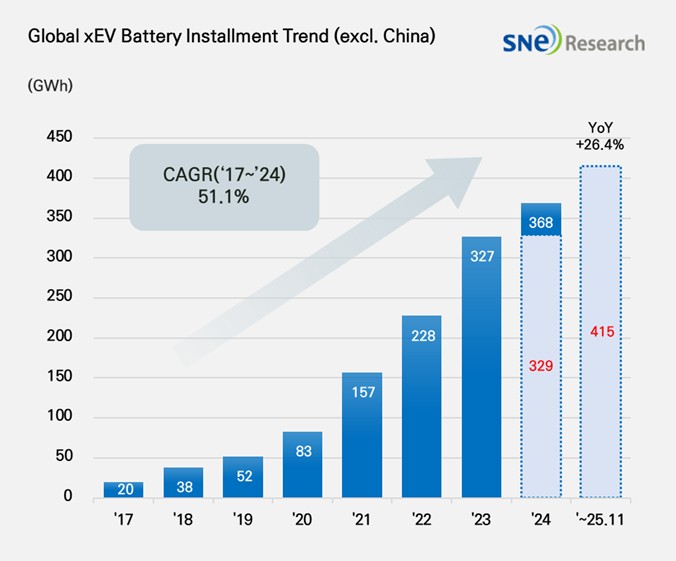

From Jan to Nov 2025, Non-Chinese Global[1] EV Battery Usage[2] Posted 415.1GWh, a 26.4% YoY Growth

- From Jan to Nov 2025, K-trio’s combined M/S recorded 37.2% (except China market)

Battery installation for global

electric vehicles (EV, PHEV, HEV) excluding the Chinese market sold from Jan to

Nov in 2025 was approximately 415.1GWh, posting a 26.4% YoY growth.

(Source: Global EV and Battery Monthly Tracker – December 2025, SNE Research)

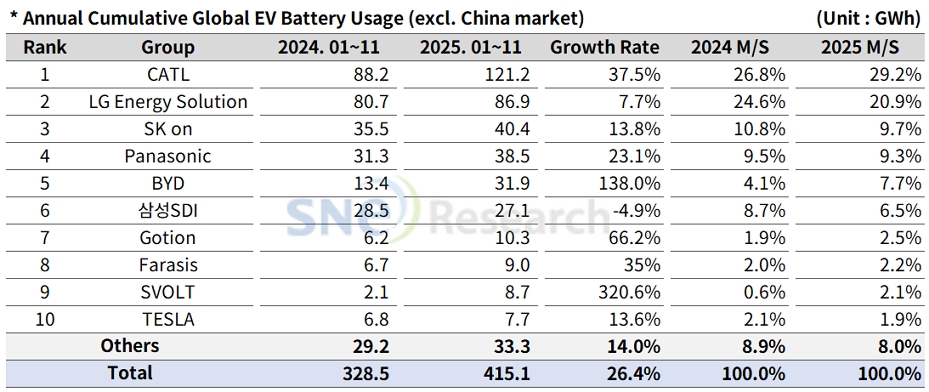

From Jan to Nov 2025, the combined market shares of LG Energy Solution, SK On, and Samsung SDI in global electric vehicle battery usage reached 37.2%, a 6.8%p decline from the same period last year. LG Energy Solution ranked 2nd on the list with 7.7%(86.9GWh) growth, while SK On took the 3rd position with 13.8%(40.4GWh) growth. On the other hand, Samsung SDI posted 4.9%(27.1GWh) degrowth.

(Source: Global EV and Battery Monthly Tracker – December 2025, SNE Research)

If we look at the usage of battery made by the K-trio in terms of EV sales volume, Samsung SDI’s battery was mainly supplied to BMW, Audi, and Rivian. BMW has Samdung SDI’s batteries in its major electrified models such as i4, i5, i7, and iX. With the increasing sales of electric vehicles to which Samsung SDI’s batteries are installed, the installation volume of their batteries has also increased, accordingly. In case of Rivian, although they recorded stable sales of R1S and R1T in the US, the newly launched standard range trim, to which Gotion’s LFP batteries are installed, has had a negative impact on the share of batteries supplied by Samsung SDI to Rivian. In addition, a slowdown in sales of Rivian has also affected the usage of Samsung SDI’s battery in a negative way. Meanwhile, Audi’s Q6 e-Tron, built on the PPE platform and equipped with batteries of SDI and CATL, has been received well mostly in Europe.

SK On’s battery was installed to electric vehicles made by Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen. Hyundai Motor Group has SK On’s battery in IONIQ 5 and EV 6 most. The steady sales of VW ID.4 and ID.7 also contributed to an increase in the usage of batteries made by SK On. On the other hand, although Ford F-150 Lighting, to which large-capacity batteries are installed, saw a slowdown in sales, thanks to favorable sales of Explorer EV, the volume of batteries used in Ford’s electric vehicles has seen a 12.3% YoY growth.

LG Energy Solution’s battery was mainly used by Tesla, Chevrolet, Kia, and Volkswagen. Due to a slowdown in sales of Tesla models, to which LG Energy Solution’s batteries are installed, the usage of LGES’ batteries by Tesla saw an 8.2% YoY decrease. On the other hand, thanks to favorable sales of Kia EV 3 in the global market and expanded sales Chevrolet Equinox, Blazer, and Silverado EV, to which the Ultium platform was applied, in the North American market were regarded as a major drive behind the increasing usage of batteries made by LG Energy Solution.

Panasonic, which mainly supplies its batteries to Tesla, ranked 4th on the list with the battery usage of 38.5GWh. Panasonic has been focusing on the improvement of efficiency in its North American production lines as well as the development of next-gen 4680·2170 cells in order to lower its dependence on Tesla as a major client. The transition process in Kansas·Nevada plants has accelerated, bringing about stability in the cost structure. In addition, as it has been further deepening discussions on new cooperation opportunities with North American OEMs, the Japanese battery maker has been solidifying a foundation for client diversification.

CATL remained top in the ranking of global battery usage (excl. China market), posting a 37.5%(121.2GWh) YoY growth. Not only major Chinese OEMs but many global OEMs like Tesla, BMW, Mercedes-Benz, and Volkswagen, have also adopted CATL’s batteries.

BYD ranked 5th with a 138.0%(31.9GWh) growth rate. BYD, which manufactures both batteries and electric vehicles (BEV+PHEV) in-house, has been expanding sales of various models based on its strong price competitiveness. It has been expanding its presence not only in the Chinese domestic market but also in the overseas market. In particular, BYD has boasted a noticeable growth in the European market. Between Jan and Nov 2025, BYD’s battery usage in Europe reached 12.7GWh, exhibiting a 206.6% increase year-on-year.

(Source: Global EV and Battery Monthly Tracker – December 2025, SNE Research)

In markets outside China, North America has seen a slowdown in EV growth, prompting OEMs to strengthen long-term procurement contracts and reorganize regional supply chains. Battery manufacturers, in turn, are seeking to defend volumes and profitability by diversifying across OEMs and vehicle segments. While ESS is expected to play a partial buffering role, the conversion of ternary-based facilities to prismatic LFP remains subject to cost and time constraints. In Europe, electrification continues, but with a stronger emphasis on profitability. Battery sourcing is becoming more segmented by vehicle class, and supply chain localization—through increased local assembly and materials sourcing—is becoming more pronounced. As a result, battery manufacturers are likely to expand not only ternary chemistries but also low-cost LFP and manganese-based systems, often through country-level project partnerships. Meanwhile, in emerging markets, affordability in entry-level segments is paramount. Low-cost LFP, durability-focused designs, and partial localization to reduce tariffs and logistics costs are becoming increasingly critical.

[2] Based on battery installation for xEV registered during the relevant period.