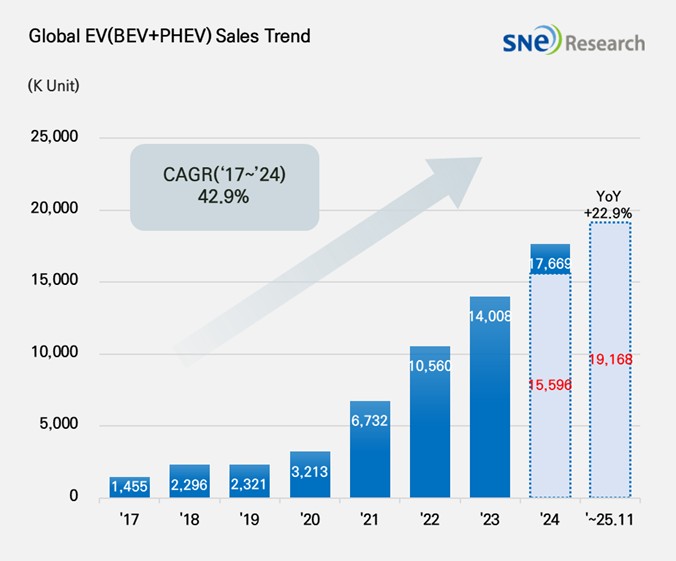

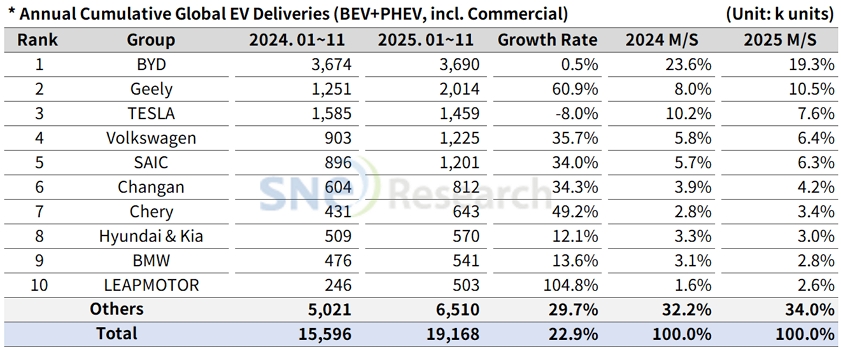

From Jan to Nov 2025, Global[1] Electric Vehicle Deliveries[2] Recorded Approximately 19.168 Mil Units, a 22.9% YoY Growth

- BYD remained top by selling 3.690 mil units; Geely ranked 2nd with 60.9% by selling 2.014 mil units

From Jan to

Nov 2025, the number of electric vehicles

registered in countries around the world was approximately

19.168 million units, a 22.9% increase from the same period of last year.

(Source: Global EV and Battery Monthly Tracker – Dec 2025, SNE Research)

From Jan to Nov 2025, BYD remained top in the global ranking by selling approx. 3.690 million units, recording a 0.5% YoY growth. Despite an overall slowdown in the global EV market, BYD has been flexibly responding to recent changes in tariffs and subsidy policies by building production sites in the European region (Hungary and Turkey) the Southeastern Asian region (Thailand, Indonesia, and Cambodia). While maintaining its price competitiveness by expanding its local production sites, BYD is continuously enhancing its brand awareness based on price competitiveness and technology. In particular, BYD has been working to diversify from the previous portfolio which focused on passenger BEVs by expanding its commercial and small vehicle line-ups. Through its effort to diversify portfolios befitting local demand, BYD has been successfully solidifying its presence throughout the entire ecosystem of electric vehicles.

Geely Group, ranked 2nd on the list, continued to enjoy double-digit growth by selling approx. 2.014 million units and posting a 60.9% YoY growth. Geely’s Star Wish(星愿) model is gaining popularity and contributing to expansion of line-ups. Its premium brand ZEEKR(极氪), hybrid-dedicated Galaxy(银河), and LYNK & CO(领克), aiming for the global market, are absorbing demands based on its multilayered brand portfolio. In particular, after achieving solid growth based on the Chinese domestic market, Geely Group has been expanding its electric vehicle business by adopting strategies to enhance its global brand awareness and promote electric vehicle models. Geely Group has been very responsive in converting from internal combustion engine vehicles to electric vehicles. The group also accelerated the in-house development of technology for batteries, electrical equipment, and software as well as the increase of production capacities. These vertical integration and in-house technology development strategies have been evaluated as key drives behind the competitiveness of Geely. It seems that the Group is highly likely to expand its presence in the future global market.

Tesla ranked 3rd in terms of global EV sales by selling approx. 1.459 million units and posting an 8.0% YoY decline. A slowdown in sales of Model 3 and Y has made the entire sales drop. In the global market, the sales of Model 3 and Y recorded 1.412 million units, posting a 6.3% decline year-on-year. By region, Tesla saw a 19.9% YoY decline in sales in the European market (234k units), and a 7.4% YoY decrease in the Chinese market (532k units). In addition, even in the North American market, Tesla posted an 7.3% YoY decline (554k units) in sales due to the termination of tax credit benefits offered to customers. Although Tesla continued to implement strategies to sophisticate FSD function and expand the monthly subscription-based software profit model, it seems Tesla would only see limited effects in noticeably improving sales in the short term.

(Source: Global EV and Battery Monthly Tracker – Dec 2025, SNE Research)

Hyundai Motor Group sold approx. 570k units of electric vehicles, recording a 12.1% YoY increase and showing a steady growth in the global EV market. In terms of BEV, IONIQ 5 and EV 3 were leading the growth of sales, while small and strategic models such as Casper (Inster) EV, EV5, and Creta Electric received well in the major global markets. On the other hand, some of the existing models such as EV 6, EV 9, and Kona Electric showed a slowdown in sales, failing to maintain their growth momentum. In terms of plug-in hybrid vehicles (PHEV), Hyundai delivered a total of 96k units, with Sportage, Tucson, and Sorento maintaining a steady trend of sales, while Niro and Seed exhibited an obvious slowdown in sales.

By region, in the North American market, Hyundai delivered approx. 157k units, ranking 3rd in the market and following Tesla and GM. Despite posting 16.8% YoY decline, Hyundai still outperformed its major competitors such as Ford, Stellantis, Toyota, and Volkswagen, which is regarded as a meaningful result given the current market circumstance.

With the expanded sales of EV 3 in the global market, Hyundai has been diversifying its electrification portfolio by adding new line-ups such as EV 4 and IONIQ 9. By expanding the proportion of local production and infrastructure, Hyundai is expected to sustain a stable profit structure amidst market volatility caused by changing tariff and subsidy policies.

(Source: Global EV and Battery Monthly Tracker – Dec 2025, SNE Research)

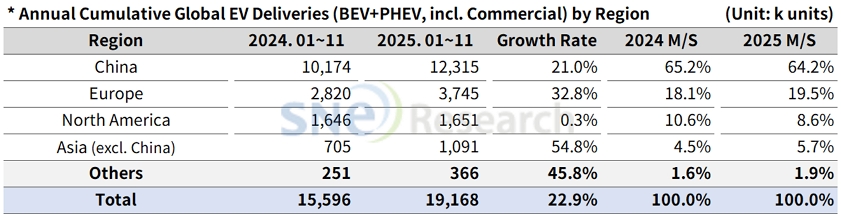

From Jan to Nov 2025, the global electric vehicle market has shown divergent trends across regions, with growth patterns varying significantly depending on each country’s policy environment and demand structure.

In China, accounting for more than 64% of the global EV market share, a total of 12.315 million units of electric vehicles were sold, recording a 21.0% YoY increase. Although the growth of Chinese domestic market has continued, due to concerns over fierce price competition and oversupply in China, the market seems to gradually slowly lose its momentum for strong growth. Given such circumstances, the Chinese EV market has been going through shifts in structure, focusing on mid-to-low price, entry-level electric vehicles and commercial vehicles. Major OEMs have been increasingly strengthening their overseas market strategies to avoid such fierce competition in the Chinese domestic market. In some regions, they have been trying to mitigate risks related to trade tariffs through local production and CKD assembly. The Chinese battery makers have been shifting to profit-focused strategies, while maintaining price competitiveness based on LFP batteries, by developing and commercializing next-generation battery technologies such as LMFP and sodium-ion batteries.

In Europe, a total of 3.745 million units of electric vehicles were sold, posting a 32.8% YoY growth and taking up 19.5% of global market share. However, such recent growth in the European EV market is regarded as something close to a limited growth generated in the midst of changes in policies, rather than policy-led ones. This is because recent moves to adjust timelines for phasing out internal combustion engines or to relax related regulations have brought policy uncertainty surrounding the transition to electric vehicles back into focus. Such changes in the policy environment are directly affecting the electrification strategies of legacy automakers. Major OEMs such as Volkswagen, Mercedes-Benz, and BMW are adjusting the pace of their electrification roadmaps or re-evaluating certain aspects of their strategies.

In the North American market, a total of 1.651 million units of electric vehicles were sold, recording a 0.3% YoY growth. Given such limited growth, the North American market is assessed as entering another stagnated phase similar to that of last year. Ahead of the expiration of consumer tax credits under the Inflation Reduction Act (IRA), demand was front-loaded; however, the risk of demand slowdown is increasing thereafter, particularly in price-sensitive mid- to low-end segments. As a result, legacy OEMs are adjusting their electrification roadmaps and strengthening strategies centered on hybrids and EREVs. Consequently, in the North American market, local production share, price competitiveness, and optimization of the powertrain mix are emerging as key factors that will determine future market share.

The Asia market (excluding China) exhibited a 54.8% YoY growth with 1.091 million units of electric vehicles sold accounting for 5.7% of the global market share. In India, the distribution of entry-level electric vehicles has increased, and competition led by local makers has got fierce. Thailand and Indonesia are growing as a strong base for production and export rather than EV consumer markets. Particularly in the Southeastern major countries, governments have solidified their policy directions to focus on EV assembly business and fostering related industries beyond pursuing growth centered around imported vehicles.

The global electric vehicle market maintained a growth trajectory during January–November 2025; however, the driving forces of the market are rapidly shifting from policy-driven expansion to a focus on profitability, supply chains, and price competitiveness. As the pace of electrification policies moderates in Europe and North America, global OEMs are shifting their strategic emphasis away from the sheer expansion of EVs toward optimizing the electrification mix and improving cost efficiency. In this environment, the core of future competition is expected to converge not on technological superiority alone, but on operational resilience and supply chain control that enable stable profitability amid policy volatility.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period