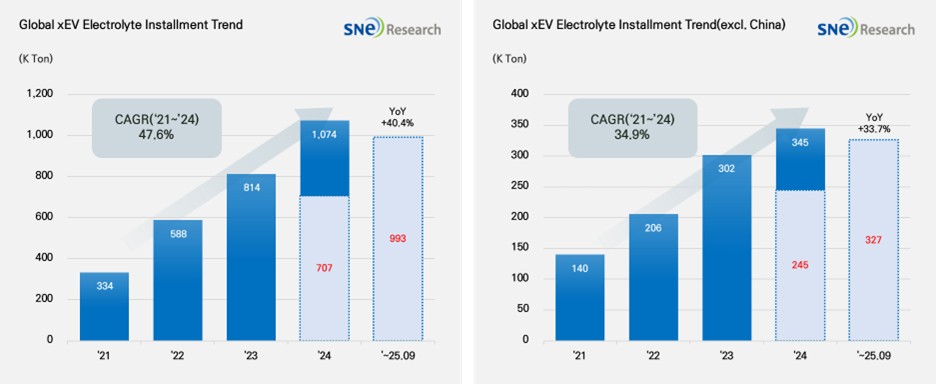

From Jan to Sep 2025, Global[1] Electric Vehicle Battery Electrolyte Installment[2] Reached 993K ton, a 40.4% YoY Growth

- In 2025, the electrolyte market continued to post a

double-digit growth, while the non-China market showed a stable expansion in

demand.

(Source: 2025 Oct Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Sep 2025, the total installment of electrolyte used in electric vehicles (EV, PHEV, HEV) registered around the world was approx. 993K ton, posting a 40.4% YoY growth. Particularly in the global market outside China, the total usage of electrolyte for electric vehicles recorded 327K ton and 33.7% YoY growth, continuously exhibiting a stable expansion in demand.

Electrolyte is one of the key materials and facilitates the transfer of lithium ions inside batteries, directly affecting the battery charging speed, safety, and battery life. With the electric vehicle market expanding and demand for high-performance batteries increasing, the electrolyte market is expected to continue steady growth in the mid to long run.

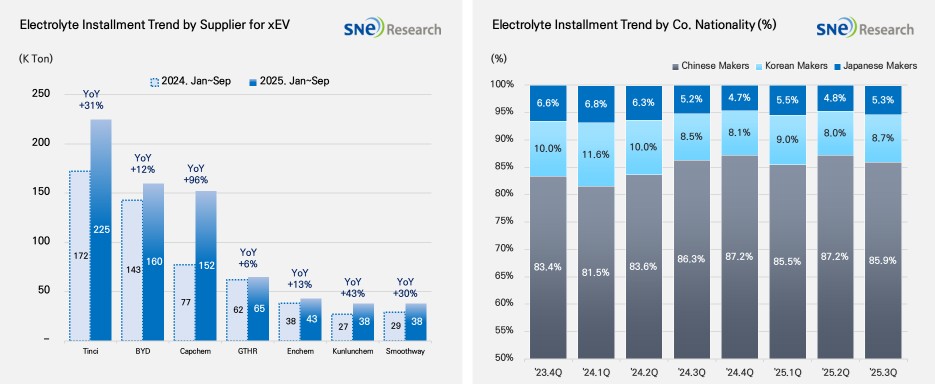

From Jan to Sep 2025, the global electrolyte market showed remarkable growth among major electrolyte suppliers. Tinci ranked 1st on the list, posting a 31% YoY growth by supplying 225K tons of electrolyte. BYD followed Tinci in the ranking with 160K ton, a 12% increase. Capchem showed a 96% growth with 152K ton, while GTHR had 65K tons of its electrolyte installed in batteries for electric vehicles. Smoothway showed a remarkable growth of 30% with 38K ton. Korean electrolyte suppliers such as Enchem (43K ton, +13%) and Soulbrain (38K ton, +30%) also maintained steady growth.

(Source: 2025 Oct Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

In terms of market shares of companies by nationality, the Chinese electrolyte suppliers are still leading the market. As of Q3 2025, the market shares taken by the Chinese electrolyte companies were 85.9%, while the Korean and Japanese companies took up 8.7% and 5.3%, respectively. The market shares held by the Korean and Japanese electrolyte makers were slightly lower than the same period of last year. While the Chinese companies are solidifying their market dominance, it becomes more important for the non-China companies to secure their own competitive edge.

The electrolyte market has reached a turning point, driven by the rapid expansion of high-performance battery demand and geopolitical pressures, which together are forcing both technological advancement and supply chain redesign. The policy landscape is adding further strain: with the U.S. tightening tariffs on battery materials and Europe enforcing supply chain due diligence, electrolyte producers are prioritizing resilient raw material sourcing and the establishment of North American production bases. On the technological front, performance capable of withstanding high-temperature and high-voltage environments has become the new baseline. Premium materials—such as high-fluorine solvents and heat- and oxidation-resistant additives—are being rapidly adopted, shifting product portfolios from standardized commodity lines toward high-value, performance-oriented solutions. This shift represents not just incremental improvement, but a fundamental redesign aligned with next-generation high-power, high–energy-density cells. Looking ahead, the electrolyte market is expected to be reshaped by material technology localization, regional supply chain stability, and ESG-based procurement frameworks. Companies that proactively develop customized technical capabilities and strategic partnerships are likely to secure market leadership in this evolving competitive landscape.

[2] Based on batteries installed to electric vehicles registered during the relevant period.