From Jan to Sep 2025, Global[1] Electric Vehicle Battery Separator Installment[2] Reached 12,487Mil ㎡, a 43.3% YoY Growth

- With the increasing installment of

batteries in electric vehicles in 2025, the global separator market maintained

steady growth

(Source: 2025 Oct Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Sep 2025, the total installment of separators used in electric vehicles (EV, PHEV, HEV) registered worldwide was approx. 12,487 Mil ㎡, posting a 43.3% YoY growth. During the same period, the total installment of separators in the non-China market was 3,708Mil ㎡, posting a 33.6% YoY growth and continuing to be in a stable growth trend.

Separator is a key material which physically separates cathode and anode inside lithium-ion battery but at the same time enables lithium ions to move freely, playing an important role in determining the safety and performance of battery. With increasing demand for high-performance batteries in accordance with expansion of electric vehicle market, the separator market indeed has been growing rapidly.

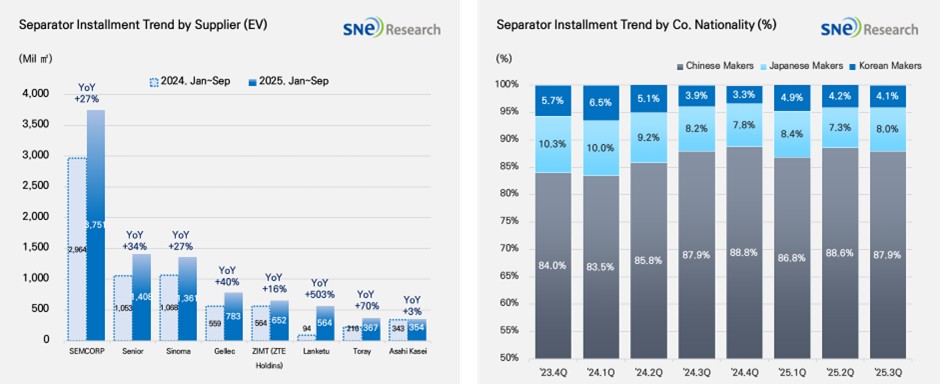

From Jan to Sep 2025, major separator suppliers showed notable growth in the global separator market. In particular, the installment of SEMCORP’s separator was increased by 27% from the same period last year, reaching 3,751Mil ㎡ and leading the market. Other major Chinese companies such as Senior (+34%), Sinoma (+27%), and Gellec (+40%) also continued to show strong growth in the market. On the other hand, SK IE Technology from Korea also showed a 54% YoY growth, having 337Mil ㎡ of separator installed in EV batteries and exhibiting a steady growth.

In terms of market shares of companies by nationality, the Chinese separator makers accounted for almost 90% of the entire market share, boasting their dominance in the market. Since the 4th quarter of 2023, the market shares of Japanese and Korean separator suppliers have been continuously declining. In the 3rd quarter of 2025, the Japanese separator makers took up 8.0%, and the Korean companies accounted for 4.1% of the market share. As the market dominance by the Chinese suppliers have strengthened, the competition landscape has been further polarized between the Chinese makers and non-China companies in the global separator market.

(Source: 2025 Oct Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

The separator market has recently entered a phase where technological advancement and diversification of production systems are required simultaneously, driven by the spread of high-performance battery technologies and shifting regional sourcing strategies. With growing demand for high-power and high–energy-density cells, key technical priorities for separators now include achieving an optimal balance between thermal stability, precise thickness control, and ionic conductivity. In response, global separator manufacturers are steadily increasing the share of high value-added products, such as ceramic-coated separators, to enhance performance and reliability.

Meanwhile, the U.S. government has repeatedly signaled the possibility of raising tariffs on battery materials and components, heightening the need for production stability and localization of separator manufacturing in North America. This is no longer a matter of short-term adjustment but one that requires structural realignment. The EU Battery Regulation mandates environmental, social, and governance (ESG) due diligence across the entire supply chain, underscoring that transparent sourcing and eco-friendly process management are now as crucial to corporate competitiveness as product performance itself. However, with enforcement postponed until 2027, companies have gained time to prepare proactive compliance strategies. In this evolving landscape, the separator market is shifting beyond simple capacity expansion toward competition based on product quality, technological sophistication, and supply chain design capabilities, reflecting the convergence of advanced technical requirements, regional production localization, and sustainability standards.

[2] Based on batteries installed to electric vehicles registered during the relevant period.