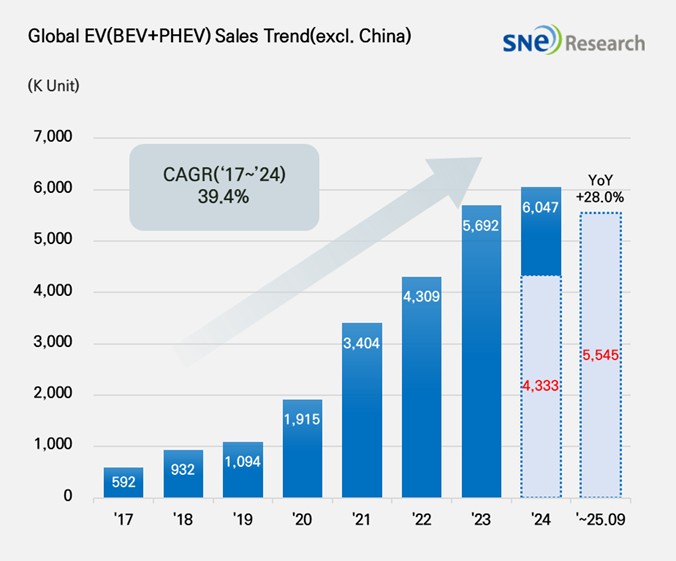

From Jan to Sep in 2025, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded About 5.545 Mil Units, a 28.0% YoY Growth

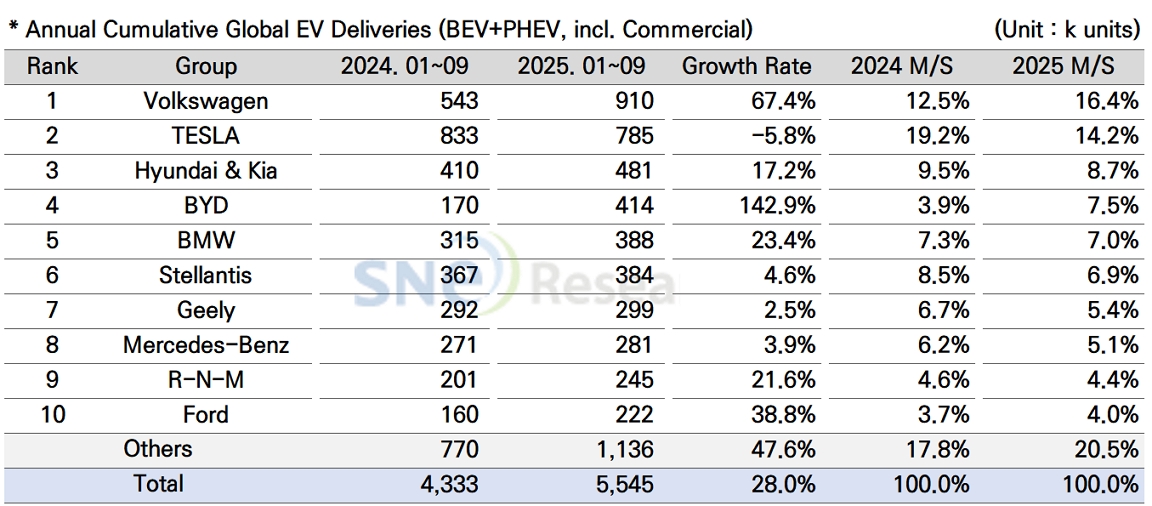

- Tesla ranked 2nd … VW ranked 1st by posting 67.4 growth

From Jan to Aug in 2025, the total number of electric vehicles

registered in countries around the world except China was approx. 5.545 million

units, a 28.0% YoY increase.

(Source: Global EV & Battery Monthly Tracker – Oct 2025, SNE Research)

By group, Volkswagen Group took No. 1 position in the ranking of global electric vehicle deliveries, excluding China, by posting a 67.4% YoY increase with 910k units sold and outperforming Tesla. Major models such as ID.4, ID.7, and ENYAQ, built on the MEB platform, showed strong sales momentum in the European market. Increasing sales of new vehicles, such as A6/Q6 e-Tron and Macan 4 Electric, to which the PPE platform is applied, are regarded as a drive behind such rapid growth of VW Group.

Tesla, ranked 2nd on the list, delivered 785k units and posted a 5.8% YoY degrowth. Deliveries of Model Y and 3 reduced by 0.5% and 8.4% respectively, showing that Tesla has been experiencing a slowdown in demand for its major line-up. Sales of premium sedans, Model S and Model X also decreased by 54.3% and by 34.8% respectively, showing that Tesla’s weakened competitiveness in the premium segment has led to a double-digit decline in sales. Cybertruck also recorded a 27.2% YoY decline in sales with only 19k units delivered to customers. Given the limited supply of Cybertruck, the number of deliveries during the relevant period can be regarded noticeable, but it was not sufficient to make a meaningful contribution to recovery of overall sales.

Hyundai Motor Group in the 3rd place sold approx. 481k units, posting a 17.2% YoY increase. In terms of BEV, IONIQ 5 and EV 3 were leading the growth of sales, while small-sized, strategic models such as Casper (Inster) EV, EV 5, and Creta Electric received positive feedback from the market. On the other hand, some of the existing models such as EV 6, EV 9, and Kona Electric showed a slowdown in sales, failing to maintain their growth momentum. Hyundai delivered a total of 83k units of PHEVs, with Sportage, Tucson, and Sorento maintaining a steady trend of sales, while Niro and Seed experienced a visible slowdown in sales.

Hyundai delivered 64k units in the North American market, ranking 3rd in the market and following Tesla and GM. Despite posting 8.7% YoY decline, Hyundai Motor Group still outperformed its major competitors such as Ford, Stellantis, Toyota, and Volkswagen, which is very meaningful to the group. With the expanded sales of EV 3 in the global market, Hyundai has been diversifying its electrification portfolio by adding new line-ups such as EV 4 and IONIQ 9. Through its strategies to expand the proportion of local procurement and optimize the product line-ups by region, the group is expected to maintain stability in profit structure even amidst current issues related to fluctuating subsidies and tariffs.

(Source: Global EV & Battery Monthly Tracker – Oct 2025, SNE Research)

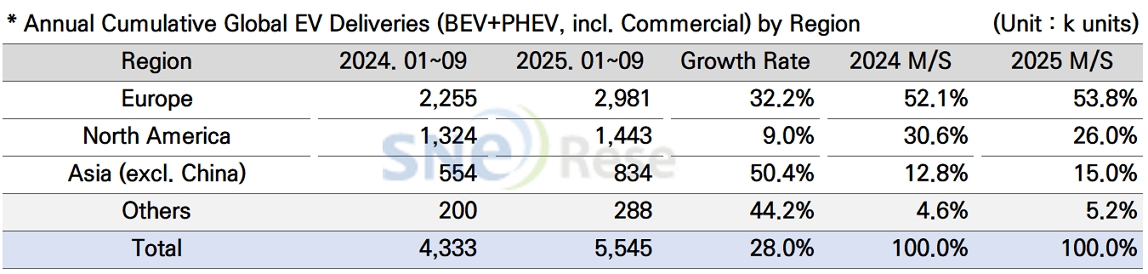

In Europe, a total of 2.981 million units of electric vehicles were sold, posting a 32.2% YoY growth and taking up 53.8% of market share. Recently, the growth of European EV market was led by mid-size SUVs and crossover vehicles such as ID.4, Q4 e-Tron, EV 3, EX 30, and iX1. These models, designed for practical family-oriented demand, combine high efficiency and affordable pricing while leveraging universal electrification platforms such as MEB and PPE, driving rapid market expansion. Moreover, major OEMs including Volkswagen, Volvo, BMW, and Mercedes-Benz are strengthening platform integration strategies to improve production efficiency and simplify their model lineups. This trend is emerging as a key factor reshaping the European EV market structure, shifting its focus toward mid-sized vehicles.

In the North American market, a total of 1.443 million units of electric vehicles were sold, recording a 9.0% YoY growth. The market share of North American market has slightly dropped to 9.6%. At the end of September, the expiration of consumer tax credits under the Inflation Reduction Act (IRA) led major OEMs to launch aggressive promotions aimed at clearing inventory and boosting sales, resulting in a short-term surge in EV deliveries. However, with the expiration of tax credit benefits, a slowdown in demand appears inevitable. GM, Ford, and Hyundai Motor Group are adjusting their strategies by reshaping their lineups around mid- to low-priced segments and expanding hybrid models. In the North American market, short-term volatility is increasing due to changes in tax policy, while local production share and price competitiveness are emerging as the key factors determining future market share.

The Asia market (excluding China) exhibited a 50.4% YoY growth with 834k units of electric vehicles sold, accounting for 15.0% of the global market share. In India, the adoption of small electric vehicles priced between USD 10,000 and 20,000 is expanding rapidly, with Tata Motors and Mahindra leading market growth. In Thailand and Indonesia, Chinese OEMs such as BYD, SAIC, and Chery have begun full-scale operation of local plants, strengthening these countries’ positions as regional production hubs. In contrast, global OEMs are responding by focusing on localized pricing strategies and model customization tailored to local demand structures, prioritizing market adaptability over the speed of electrification. In Japan, Toyota and Honda continue to pursue hybrid-centered strategies while gradually expanding their BEV lineups. Amid these developments, non-Chinese Asian markets are entering a multi-layered growth phase, characterized by the expansion of real demand for affordable models and the coexistence of regionally differentiated strategies.

In other regions—including the Middle East, Latin America, and Oceania—EV sales reached 138k units, a 34.8% increase year-on-year, accounting for 5.2% of the global market. These regions remain in the early stages of EV market development, with significant disparities in government policy support and infrastructure readiness across countries.

While government-led adoption programs and aggressive market entry by Chinese OEMs are driving some progress, limited charging infrastructure and high vehicle prices continue to be the main constraints on broader EV adoption.

(Source: Global EV & Battery Monthly Tracker – Oct 2025, SNE Research)

In 2025, the global EV market excluding China is showing increasingly divergent trends across major regions, driven by policy shifts and differences in demand structure. In Europe, despite supply chain uncertainty and intensifying price competition resulting from the EU’s anti-subsidy tariff measures, the market continues to see moderate growth supported by new model launches. In North America, concerns over a post–September slowdown in demand have grown following the expiration of consumer tax credits, prompting major automakers to reorient their strategies toward hybrids. In emerging Asian markets such as India and Southeast Asia, the base of the EV market is expanding rapidly, led by affordable passenger EVs and light commercial vehicles. Amid these dynamics, global automakers are strengthening their localization and platform integration strategies to cope with policy uncertainty and profitability pressures, while focusing in the medium to long term on balancing production efficiency with technological competitiveness.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period