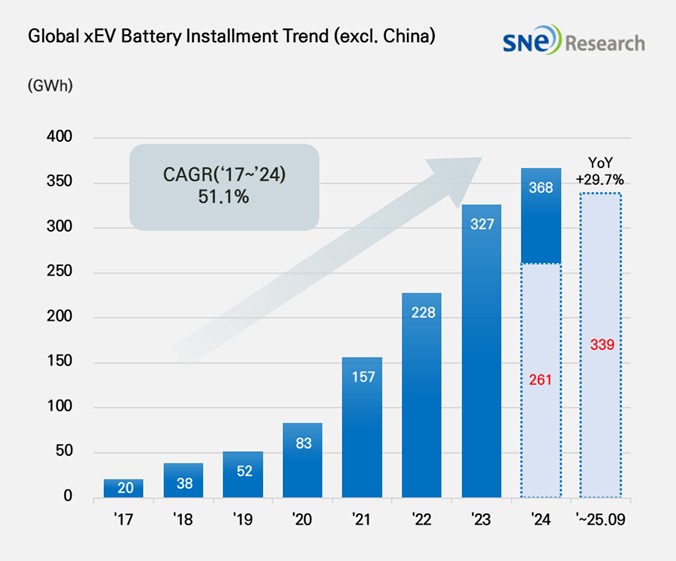

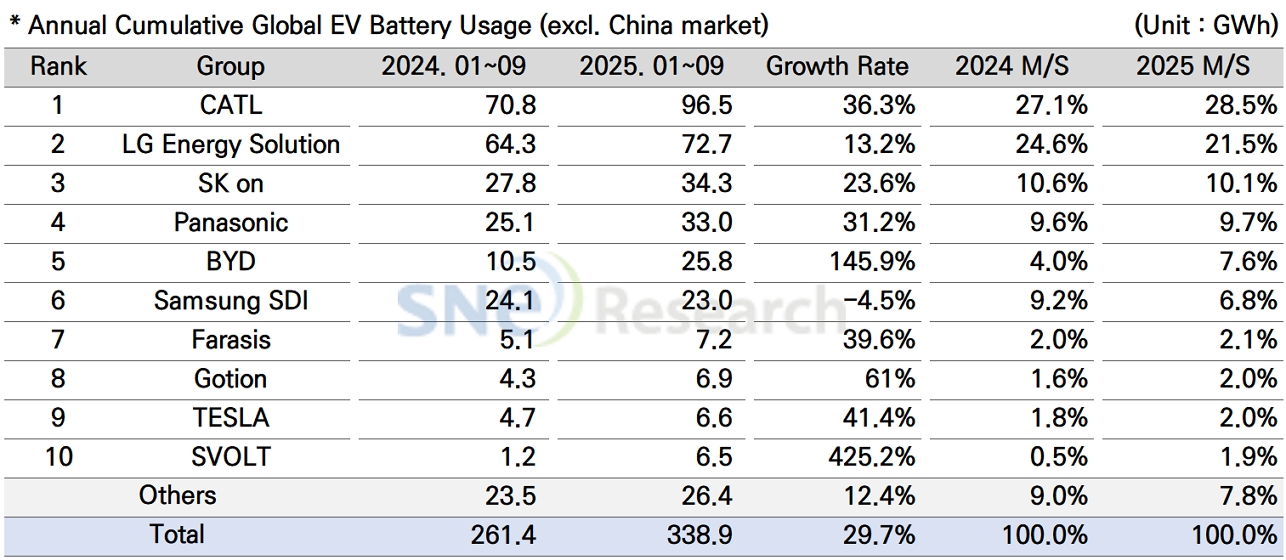

From Jan to Sep in 2025, Non-Chinese Global[1] EV Battery Usage[2] Posted 338.9GWh, a 29.7% YoY Growt

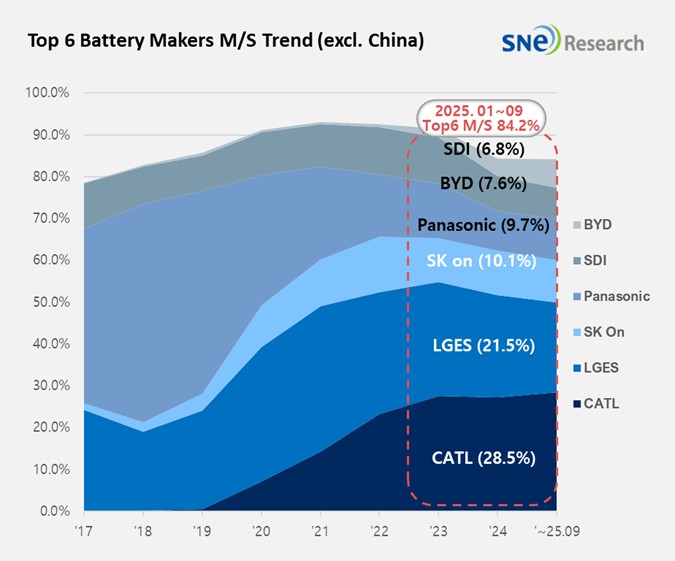

- From Jan to Sep in 2025, K-trio’s combined M/S recorded 38.0% (except China market)

Battery installation for global

electric vehicles (EV, PHEV, HEV) excluding the Chinese market sold from Jan to

Sep in 2025 was approximately 338.9GWh, posting a 29.7% YoY growth.

(Source: Global EV and Battery Monthly Tracker – October 2025, SNE Research)

The combined market shares of LG Energy Solution, SK On, and Samsung SDI in global electric vehicle battery usage from Jan to Sep in 2025 reached 38.0%, a 5.4%p decline from the same period last year. LG Energy Solution ranked 2nd on the list with 13.2% (72.7GWh), while SK On took the 3rd position with 23.6% (34.3GWh) growth. On the other hand, Samsung SDI posted 4.5%(23.0GWh) degrowth.

(Source: Global EV and Battery Monthly Tracker – October 2025, SNE Research)

If we look at the usage of battery made by the K-trio in terms of the sales volume of EVs, Samsung SDI’s battery was mainly supplied to BMW, Audi, and Rivian. BMW has Samsung SDI’s batteries in its major electrified models such as i4, i5, i7, and iX. In case of Rivian, although they recorded stable sales of R1S and R1T in the US, the newly launched standard range trim, to which Gotion’s LFP batteries are installed, has had a negative impact on the share of batteries supplied by Samsung SDI to Rivian. On the other hand, as Audi started selling Q6 e-Tron, built on the PPE platform, the usage of batteries recorded a 33.6% YoY growth.

SK On’s battery was installed to electric vehicles made by Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen. Hyundai Motor Group has SK On’s battery in IONIQ 5 and EV 6 most, and the steady sales of VW ID.4 and ID.7 also contributed to an increase in the usage of batteries made by SK On. On the other hand, Ford F-150 Lighting, to which large-capacity batteries are installed, saw a slowdown in sales. Although there are expectations that SK On may see a recovery in plant operation by mass producing LFP batteries and batteries for ESS in the 2nd half of 2026 and possibly receive benefits from the AMPC, it is analyzed that the recovery of demand from key clients such as Ford and Hyundai will be crucial to improving the operating rate of U.S. manufacturing plants.

LG Energy Solution’s battery was mainly used by Tesla, Chevrolet, Kia, and Volkswagen. Due to a slowdown in sales of Tesla models, to which LG Energy Solution’s batteries are installed, the usage of LGES’ batteries by Tesla saw a 25.3% YoY decrease. On the other hand, thanks to favorable sales of Kia EV 3 in the global market and expanded sales of Chevrolet Equinox, Blazer, and Silverado EV, to which the Ultium platform was applied, in the North American market were regarded as a major drive behind the increasing usage of batteries made by LG Energy Solution

Panasonic, which mainly supplies its batteries to Tesla, ranked 4th on the list with the battery usage of 33.0GWh. Panasonic has been speeding up the reshuffling of supply chain to focus on the North American market, in response to the recently fortified US tariffs on the Chinese batteries and raw materials. To be specific, Panasonic is working on lowering its dependency on the Chinese materials, expanding the procurement of local materials, and securing new material sources in order to increase the stability in battery production. These efforts are expected to lay a significant foundation for recovery in the usage of batteries made by Panasonic and maintaining its market share in the North American market.

CATL remained top in the ranking of global battery usage, posting a 36.3%(96.5GWh) YoY growth. Major OEMs in China as well as those in the global market have chosen CATL’s batteries for their EVs.

BYD took the 5th position on the list with 145.9%(25.8GWh) growth rate. . BYD, which manufactures both batteries and electric vehicles (BEV+PHEV) in-house, has been expanding sales of various models based on its strong price competitiveness. Although the 2025 sales target was revised downward by 16% to 4.6 million units, BYD is maintaining its export expansion strategy. In particular, its growth in the European market is notable. Between Jan and Sep 2025, BYD’s battery usage in Europe reached 10.3 GWh, representing a 246.2% increase year-on-year.

(Source: Global EV and Battery Monthly Tracker – October 2025, SNE Research)

In non-Chinese markets, changes in policy regulations, technology, and supply strategies are simultaneously accelerating, prompting OEMs and battery makers to restructure their procurement and product strategies. In North America, the tightening of the IRA and discussions around expanding FEOC (Foreign Entity of Concern) rules are accelerating the shift toward local sourcing. In Europe, growing expectations for PHEV regulation flexibility are driving efforts to moderate the BEV-heavy product mix. The three major Korean battery manufacturers, which remain highly dependent on the European and U.S. markets, are facing declining market share in Europe amid aggressive localization and price competition from Chinese firms. In the U.S., following OBBBA and the early phase-out of IRA benefits, front-loaded purchases in Q3 were observed, but demand is expected to decline after October. In response, battery companies are striving to strengthen mid- to long-term competitiveness by maintaining their lead in premium, high-energy NCM products, while accelerating mass production of LFP and LMFP batteries to address the affordable segment.

[2] Based on battery installation for xEV registered during the relevant period.