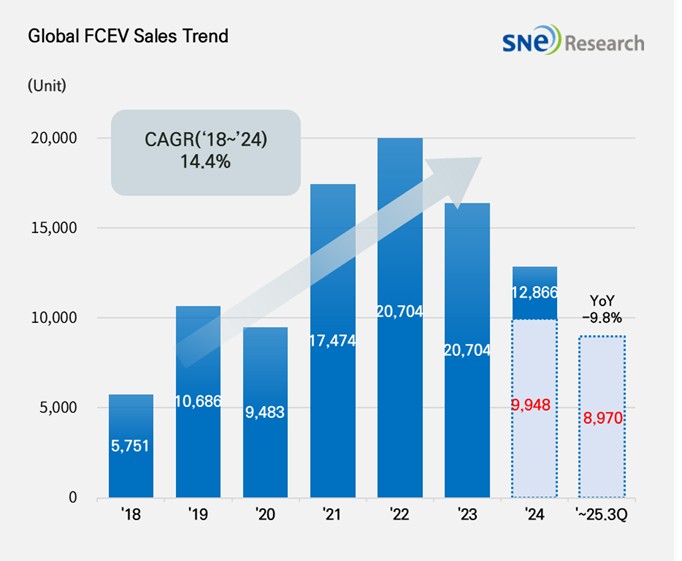

From Jan to Sep in 2025, Global FCEV Market Posted 9.8% YoY Degrowth

- Hyundai Motor Group ranked No. 1 in global FCEV market from Jan to Sep in 2025.

The total number of globally registered FCEVs sold from Jan to Sep in 2025 was 8,970 units, recording a 9.8% YoY decline and showing a visible downturn.

(Source: Global FCEV Monthly Tracker – Oct 2025, SNE Research)

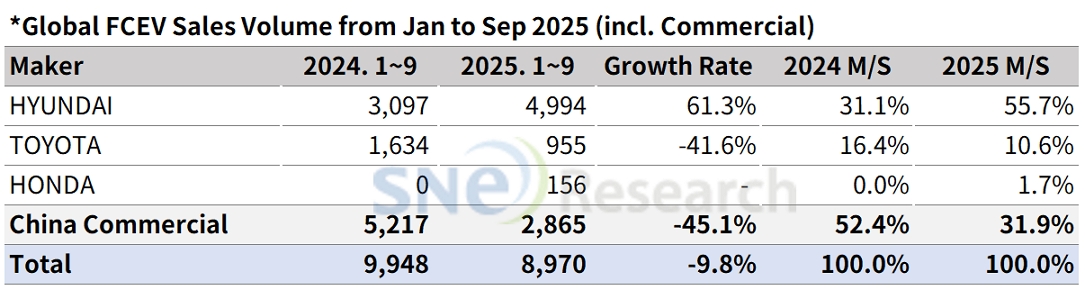

By company, Hyundai Motor Group sold 4,994 units of FCEVs, mostly NEXO, and remained No. 1 in the market. In April 2025, Hyundai launched the second-generation NEXO, achieving a strong 61.3% growth rate. In contrast, Toyota sold 955 units of its Mirai and Crown fuel cell models combined, marking a 41.6% year-on-year decline, including a 53.6% drop in domestic Japanese sales. Nevertheless, Toyota continues to invest steadily in hydrogen vehicle technology and infrastructure development. Meanwhile, Chinese manufacturers are maintaining stable sales by focusing on the commercial vehicle segment rather than passenger cars. Honda introduced the 2025 Honda CR-V e:FCEV in the U.S. and Japan, but sales reached only 156 units. The CR-V e:FCEV is the world’s first SUV combining a hydrogen fuel cell with plug-in hybrid functionality, featuring a 4.3 kg hydrogen tank and a 17.7 kWh battery, providing an EPA-rated range of 435 km.

(Source: Global FCEV Monthly Tracker – Oct 2025, SNE Research)

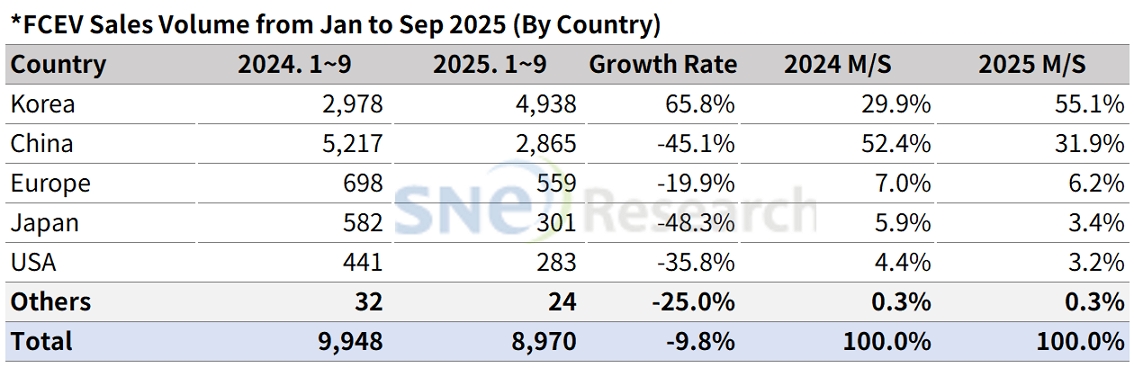

By country, South Korea captured a majority market share of 55.1% in the global hydrogen vehicle market, driven by strong sales of Hyundai’s NEXO. In contrast, China, which has focused its hydrogen vehicle strategy on commercial vehicles, ranked second behind Korea. Meanwhile, Europe, the U.S., and Japan—the major developed markets—are showing a notable decline. In Europe, combined sales of the Mirai and NEXO totaled 559 units, representing a 19.9% year-on-year decrease. In the U.S., Mirai sales plunged by 59.0%, and in Japan, weak sales of the Mirai and Crown models resulted in a 35.8% drop.

(Source: Global FCEV Monthly Tracker – Oct 2025, SNE Research)

With the launch of the second-generation NEXO, Hyundai Motor is accelerating the expansion of real demand by organizing sales and service networks for its XCIENT hydrogen trucks in North America. Toyota, meanwhile, has introduced its third-generation fuel cell system, designed to meet not only passenger car needs but also those of trucks and buses. In China, the hydrogen commercial vehicle market has grown rapidly through local subsidies and joint ventures with logistics companies, expanding long-haul hydrogen truck routes and hub charging infrastructure. However, as the subsidy system transitions, delivery delays and higher total cost of ownership (TCO) have led to weakened demand. Overall, the hydrogen vehicle market is slowing down, and its future momentum will largely depend on the pace of refueling infrastructure expansion and the long-term stability of government subsidy policies.