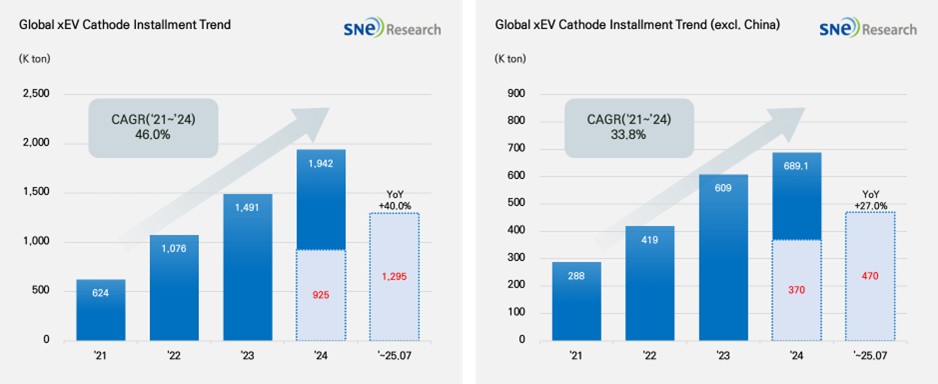

From Jan to July 2025, Global[1] Electric Vehicle Battery Cathode Material Installment[2] 1,942K ton, a 40.0% YoY Growth

- From Jan to July 2025, EV battery cathode material

installment in non-China market was 470K ton, posting a 27.0% growth

(Source: 2025 Aug Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to July 2025, the total installment of cathode materials used in electric vehicles (EV, PHEV, HEV) registered worldwide was approx. 1,942K ton, posting a 40.0% YoY growth. In particular, the installment of cathode materials used in electric vehicles in the non-China market recorded 470.0K ton, showing a stable growth of 27.0%.

Cathode material is a key material determining the capacity and output value of lithium-ion battery, upon which the performance of battery and driving range of electric vehicles depend. Currently, the battery market can be divided into the one centered around NCx ternary cathode material and the other mainly led by LFP cathode material, and both are driven by technical and economic advantages of each cathode material. Amidst the diversification of global cathode material demand, NCx ternary cathode material and LFP cathode material are positioning themselves as two main axes in the market.

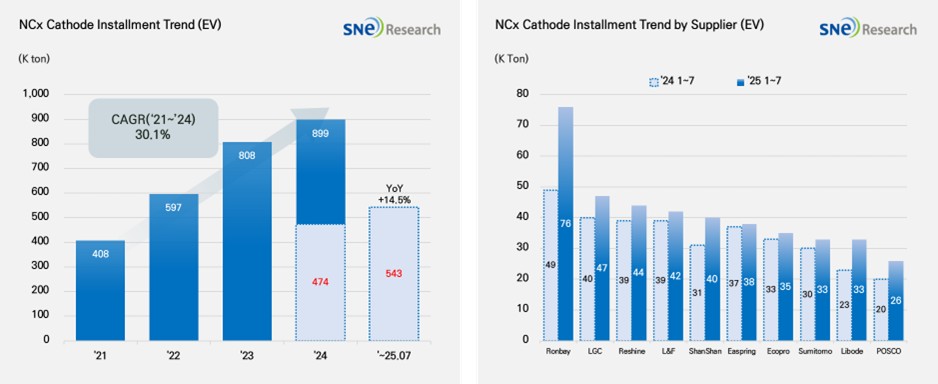

If we look at the market by different cathode materials, the installment of ternary cathode material during the relevant period was 543K tons, posting a 14.5% YoY growth and continuing a gradual increase. By company, Ronbay and LG Chem ranked 1st and 2nd on the list, leading the market, while L&F (42K ton), Ecopro(35K ton), and POSCO (26K ton) entered the upper rank, maintaining their presence in the market. Overall, however, the growth of Chinese cathode material makers showed a noticeable growth. Major cathode suppliers such as Reshine, Easpring, and ShanShan are competing fiercely, and the Chinse cathode makers are gradually expanding their global market shares based on demand from the Chinese domestic market, price competitiveness, and their massive ramp-up plans.

(Source: 2025 Aug Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

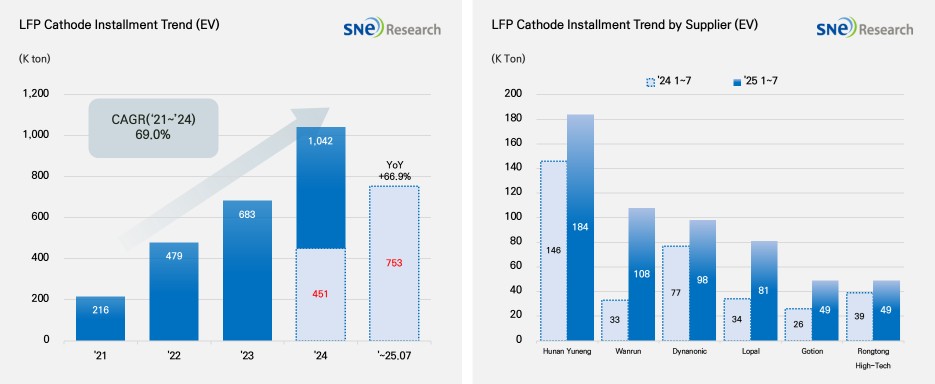

During the same period of time, the total installment of LFP cathode material was 753K tons, showing a massive 66.9% YoY growth even greater than that of ternary cathode material. Among the total cathode material installment, the proportion taken by LFP was about 58% (based on weight), which was over half the entire market share. It is interpreted as being affected by the expansion of entry-level EV market in China, increasing preference to LFP chemistry with price competitiveness, and increasing adoption of LFP batteries by global OEMs. By cathode suppliers, Hunan Yuneng (184K ton) and Wanrun (108K ton) ranked 1st and 2nd on the list, solidifying their dominance in the market. Dynanonic (98K ton) and Lopal (81K ton) settled in the 3rd and 4th places based on their growth which was higher than that of last year. Other than this, Gotion and Rongtong High-Tech are expanding their market shares by supplying 49K ton per each. Those suppliers in the upper rank are all Chinese cathode makers, clearly showing that the LFP cathode market is practically dominated by China. In turn, the growth of LFP cathode material market is directly connected to the reinforcement of global dominance by the Chinese material companies, which ultimately leads to solidify the China-centered structure in the global supply chain for battery materials.

(Source: 2025 Aug Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

The cathode materials market is entering a complex phase of transformation amid intensifying competition for technological leadership and mounting pressure to restructure global supply chains. Recently, the Chinese government has added key technologies related to cathode material production to its export control list, reinforcing the regulatory framework governing overseas technology transfers. This moves underscore the growing importance of technological self-sufficiency and internalization strategies for material companies outside of China.

Meanwhile, the European Union has introduced stricter regulations on the recycling efficiency and recovery rates of critical battery elements such as lithium, nickel, and cobalt. These measures are driving a shift in the supply structure of cathode materials and making the development of a circular economy-based materials strategy an essential task for the industry.

In addition, some Chinese suppliers are actively pursuing overseas manufacturing bases in Southeast Asia and other regions in line with the “China Plus One” strategy. This trend signals both an impending global oversupply and intensifying price competition.

Overall, the cathode materials market is navigating a multifaceted environment shaped by intersecting forces such as export controls, mandatory recycling regulations, and the diversification of supply chains. Going forward, market leadership is likely to concentrate among companies that can establish early capabilities in technology localization, secure supply stability through recycling, and implement regionally distributed production strategies.

[2] Based on batteries installed to electric vehicles registered during the relevant period.