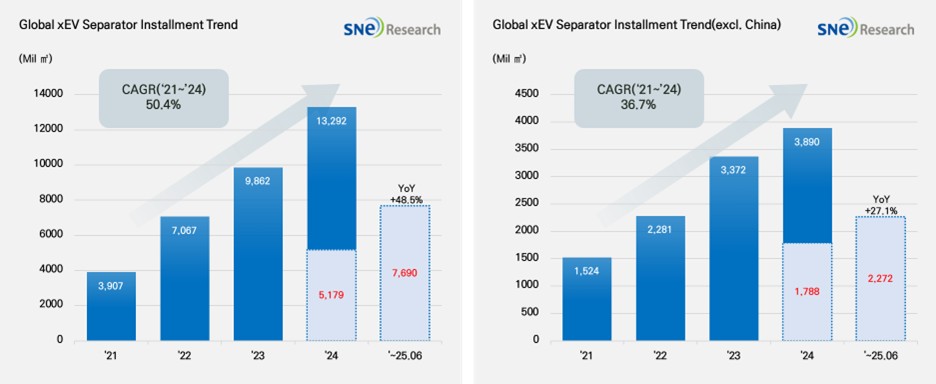

From Jan to June in 2025, Global[1] Electric Vehicle Separator Installment[2] Reached 7,690Mil ㎡, a 48.5% YoY Growth

- With the increasing installment of batteries in electric vehicles, the global separator market posted steady growth.

(Source: 2025 July Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to June in 2025, the total installment of separators used in electric vehicle (EV, PHEV, HEV) registered worldwide was approx. 7,690 Mil ㎡, posting a 48.5% YoY growth. During the same period, the total installment of separators in the non-China market increased by 27.1%, reaching 2,272Mil ㎡ and showing a relatively stable growth.

Separator is a key material which physically separates cathode and anode inside lithium-ion battery but at the same time enables lithium ions to move freely, playing an important role in determining the safety and performance of battery. With increasing demand for high-performance batteries in accordance with expansion of electric vehicle market, the separator market indeed has been growing rapidly.

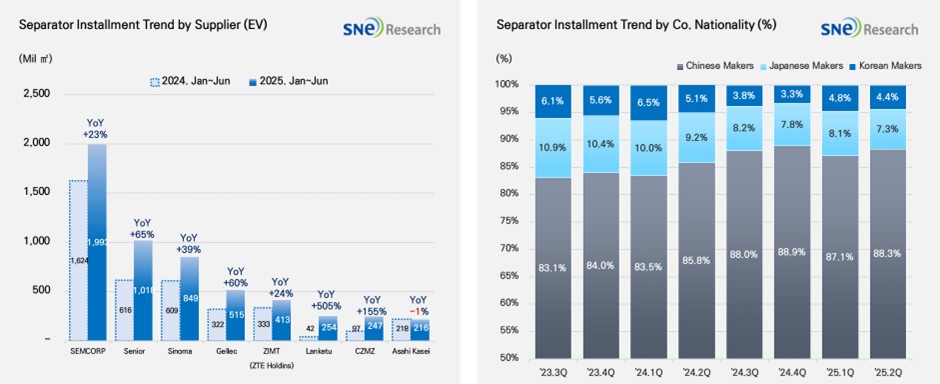

From Jan to June in 2025, major separator suppliers showed noticeable growth in the global separator market. In particular, the installment of SEMCORP’s separator was increased by 22.7% from the same period last year, reaching 1,993Mil ㎡ and leading the market. Other major Chinese companies such as Senior (+65.3%), Sinoma (+39.4%), and Gellec (+59.9%) continued to exhibit a strong growth. Other than them, both ZIMT and CMZF also recorded more than double-digit growth, expanding their shares in the market. On the other hand, SK IE Technology from Korea showed a noteworthy growth, reaching 210Mil ㎡ and posting a 51.1% YoY growth.

In terms of market shares of companies by their nationality, the Chinse separator makers accounted for approx. 90% of the entire market share, almost dominating the market. Since the 2nd quarter of 2023, the market shares of Japanese and Korean separator companies have been continuously dropping. In the 2nd quarter of 2025, the Japanese separator makers took up 7.3%, and the Korean companies accounted for 4.4% of the market share. As the market dominance by the Chinese suppliers have strengthened, the competition landscape has been further polarized between the Chinese makers and non-China companies in the global separator market.

(Source: 2025 July Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

The separator market has recently entered a structural transition period centered around three key pillars: technological advancement, supply chain reinforcement, and sustainability initiatives. With the global expansion of battery demand, the separator coating market is also experiencing significant growth. In particular, there is rising demand for high heat-resistant separators that utilize high-performance coating materials such as ceramics and alumina. These materials are emerging as core technologies that simultaneously enhance battery safety and lifespan. As a result, global separator companies are strengthening their high-value-added coating product portfolios and actively pursuing product differentiation strategies.

Moreover, as the production of PE and PP resins – the primary raw materials for separators – is concentrated in specific regions, concerns over geopolitical risks and supply imbalances are increasingly coming to the forefront. In particular, the heavily localized supply structure in areas such as Shandong Province, China, is a key driver behind global automakers and battery companies ramping up efforts to diversify procurement sources and secure locally sourced materials.

In addition, as Europe begins to enforce mandatory recycling ratios for battery materials, the separator industry as a whole is being called upon to adopt circular economy strategies. Product strategies that align with environmental regulations, such as structural improvements to separator products and the establishment of material recovery systems, are emerging as new standards of competitiveness in the market.

As such, the separator market is undergoing a transition into a highly advanced competitive landscape that demands technological sophistication, supply chain stability, and sustainability. Companies that proactively adapt to these changes are expected to secure long-term leadership in the industry.

[2] Based on batteries installed to electric vehicles registered during the relevant period