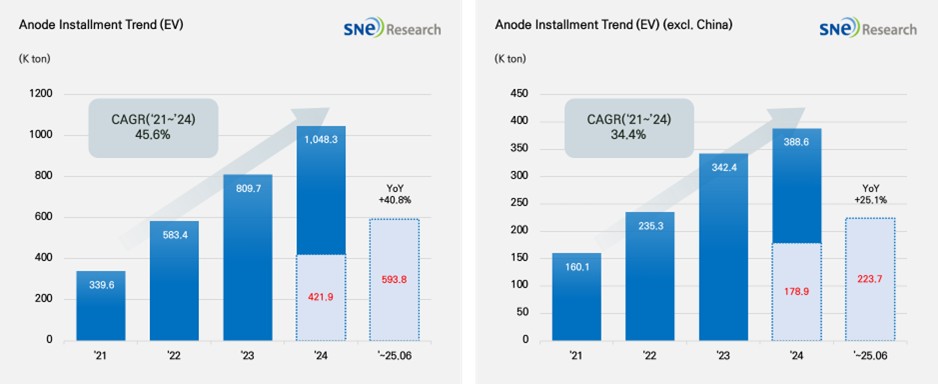

From Jan to June in 2025, Global[1] Electric Vehicle Battery Anode Material Installment[2] Reached 593.8K ton, a 40.8% YoY Growth

- The non-China market recorded 223.7K ton, posting a 25.1% growth

(Source: 2025 July Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to June in 2025, the total installment of anode materials used in electric vehicles (EV, PHEV, HEV) registered worldwide was approx. 593.8K ton, posting a 40.8% YoY increase and maintaining steady growth. In the non-China market, the total installment of anode materials was 223.7K ton, recording a 25.1% growth. Despite relatively moderate growth, the overall trend of steady growth was maintained.

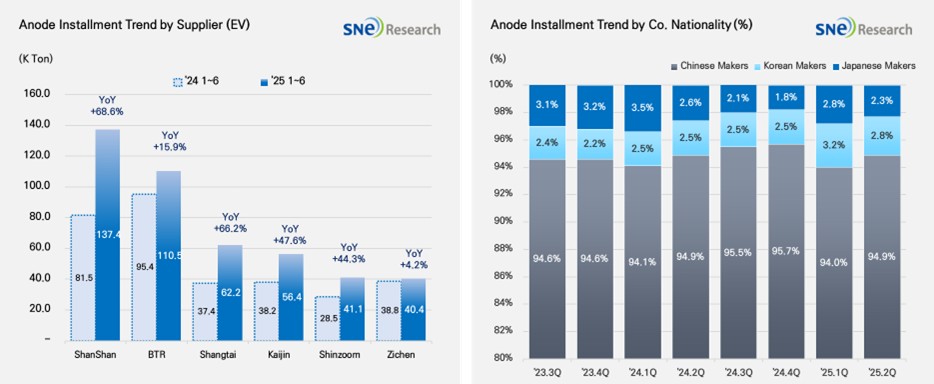

If we look at the market shares held by companies, ShanShan (137.4K ton) and BTR (110.5K ton) ranked 1st and 2nd on the list, leading the global anode market. These two companies have successfully secured a stable customer base and mass production capabilities, by supplying anode materials to major battery makers such as CATL, BYD, and LG Energy Solution. Shangtai (62.2K ton), Kaijin (56.4K ton), Shinzoom (41.1K ton), and Zichen (40.4K ton) were all ranked high, exhibiting a high growth of 40~70% compared to the previous year.

(Source: 2025 July Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

If we look at the market shares of companies by their nationality, the Chinese anode makers accounted for about 95% of the entire market share, keeping their absolute dominance in the market. Based on expansion of production capacity and sophistication of technology, they have been solidifying their market dominance. With the electric vehicle market expanded, more Si-anode has been adopted, leading them to further intensify cooperation with major battery makers. Although the market shares taken by the Korean anode makers were only around 2.8%, cooperation with major cell makers has been expanded mainly by POSCO and Daejoo. This means that the Korean anode suppliers are trying in earnest to enter the market. On the other hand, the Japanese anode manufacturers accounted for only 2.3% of the market share, showing a relatively insignificant presence in the market. Hitachi and Mitsubishi maintained their conservative business management system relying on the existing customers, which seemed to gradually weaken their competitiveness in the market.

In 2025, the global anode materials market entered a full-fledged technological transition phase, as the commercialization of silicon-composite anodes gains momentum alongside stable demand for conventional graphite-based products. Major Chinese companies are establishing mass-production systems for silicon anodes, securing a dominant position in the market, while the United States and Europe are actively promoting supply chain restructuring and materials self-sufficiency policies to reduce dependence on Chinese graphite. The current anode materials market is evolving into a dual-structured landscape—where traditional graphite demand remains solid, but commercialization of next-generation materials such as silicon and lithium metal anodes is progressing in parallel. The pace of technological transition and the ability to secure raw materials are emerging as key determinants of corporate competitiveness. At the same time, the strategic importance of silicon anodes is growing rapidly, as they are expected to become a core material for high-performance EVs and the era of solid-state batteries.

[2] Based on batteries installed to electric vehicles registered during the relevant period.