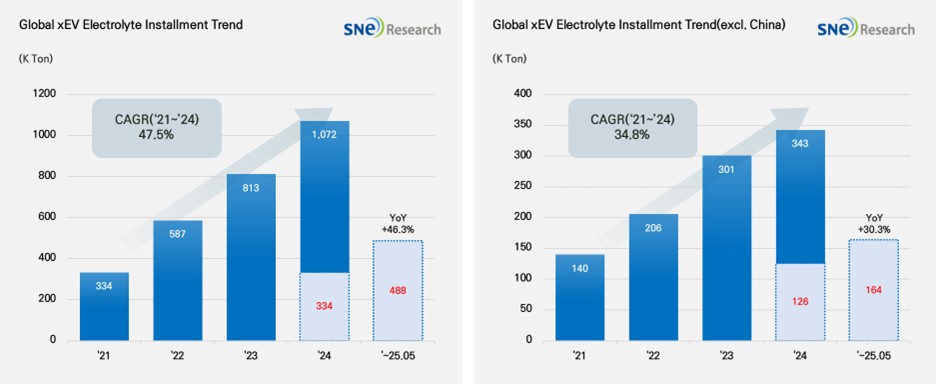

From Jan to May in 2025, Global[1] Electric Vehicle Battery Electrolyte Installment[2] Reached 488K ton, a 46.3% YoY Growth

From Jan to May in

2025, the electrolyte market continued to post a double-digit growth, while the

non-China market showed a stable expansion in demand

(Source: 2025 June Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to May in 2025, the total installment of electrolyte used in electric vehicles (EV, PHEV, HEV) registered around the world was approx. 488K ton, showing a 46.3% YoY growth. Particularly in the non-China market, the total usage of electrolyte reached 164K ton, a 30.3% YoY growth, showing that demand for electrolyte has already entered the phase of stable expansion.

Electrolyte is one of the key materials and facilitates the transfer of lithium ions inside batteries, directly affecting the battery charging speed, safety, and battery life. With the electric vehicle market expanding and demand for high-performance batteries increasing, the electrolyte market is expected to continue steady growth in the mid to long run.

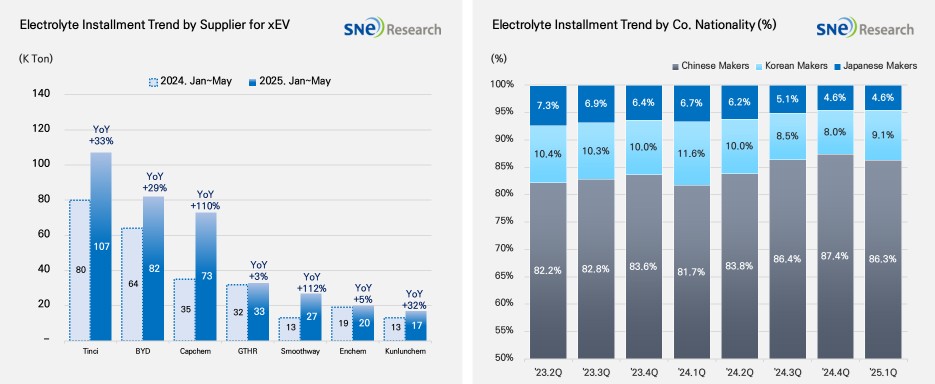

From Jan to May in 2025, the global electrolyte market witnessed noticeable growth among major electrolyte suppliers. Tinci was the world No.1 electrolyte supplier, whose electrolyte installment reached 107K ton, a 33% YoY growth. BYD followed Tinci on the list with 82K ton (+29%). Capchem showed a high YoY growth of 110% with 73K ton, while GTHR’s electrolyte of 33K ton were used in batteries installed to electric vehicles. Smoothway boasted an explosive growth of 112%, recording 27K ton. The Korean electrolyte suppliers such as Enchem and Soulbrain posted 20K ton(+5%) and 15K ton(+22%) respectively, maintaining steady growth.

(Source: 2025 June Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

In terms of market shares of companies by their nationality, the Chinse electrolyte suppliers are solidifying their dominant positions in the market. As of Q1 in 2025, the Chinese companies accounted for 86.3% of the entire market share, while the Korean and Japanese companies took up 9.1% and 4.6% respectively. The market shares held by the Korean and Japanese electrolyte suppliers were slightly lower than the same period of last year, showing that the Chinese companies have been expanding their presences in the market.

The US government is tightening regulations on materials and components from China, thus leading to an increasing demand for electrolyte locally produced in North America or products made from non-China raw materials. In other words, OEMs mainly in the US have been increasingly showing more interest in material and component suppliers who can meet the requirements for tax credit. These changes in the North American market are regarded as a challenge and at the same time a chance to the Korean electrolyte suppliers. Enchem captured an advantageous position to secure the US customers based on the AMPC tax credits. Soulbrain is also accelerating to enter the US market based on technology sophistication and overseas cooperation.

However, most of the Korean electrolyte suppliers have yet to secure mass production bases in the US. In order for electrolyte makers to secure competitiveness in future, a key would be whether dependence on the Chinese raw materials is reduced, and the local material supply system is established. In particular, to qualify for tax credits, it is an important condition to meet not to use materials from China, which means it is necessary to build a whole system from material management and local production to certification. To grow in the US market, an electrolyte company should be equipped with policy-adapting abilities, technical competitiveness, and localization strategies. One who is able to have all three of the above is highly likely to become a major electrolyte supplier in the US electric vehicle market.

[2] Based on batteries installed to electric vehicles registered during the relevant period.