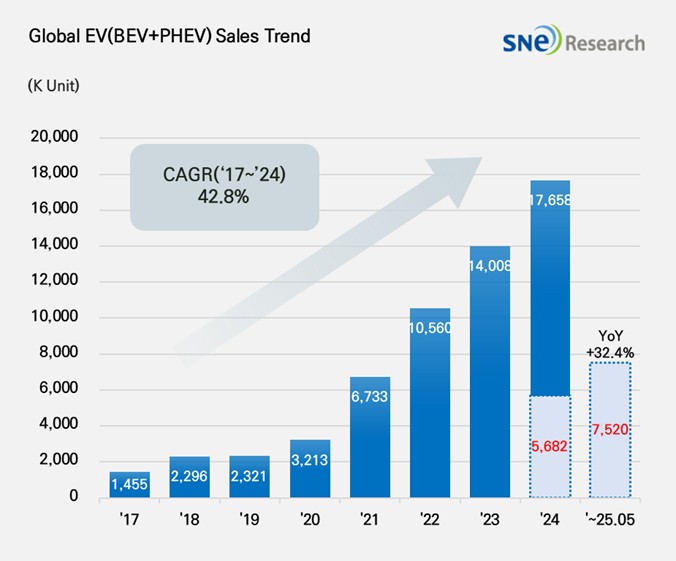

From Jan to May in 2025, Global[1] Electric Vehicle Deliveries[2] Recorded Approx. 7.520 Mil Units, a 32.4% YoY Growth

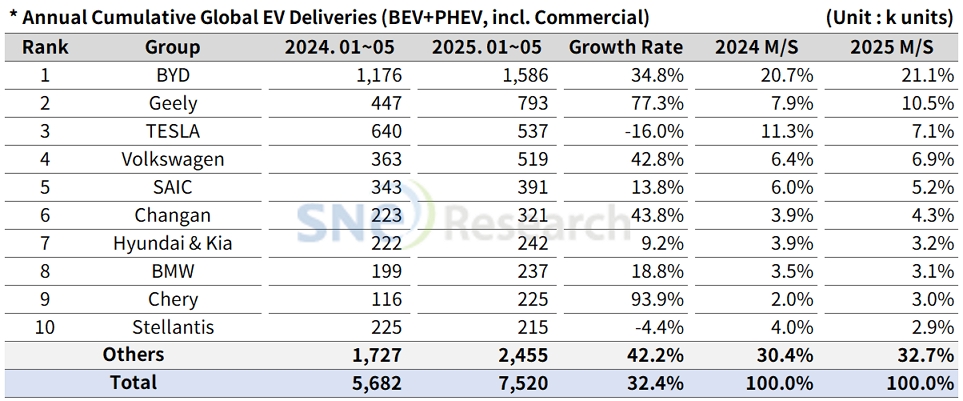

- From Jan to May in 2025, BYD sold 1.586 mil units, capturing No. 1 position …Geely ranked 2nd with 77.3% growth

From Jan to May in 2025, the number of electric vehicles registered in

countries around the world was approximately 7.520 million units, about 32.4%

increase from the same period last year (5.682 mil units).

(Source: Global EV and Battery Monthly Tracker – June 2025, SNE Research)

From Jan to May in 2025, BYD ranked No.1 in the global ranking of electric vehicle sales by selling approx. 1.586 million units, a 34.8% YoY increase. BYD, aiming to sell about 6 million units of its electric vehicles this year, has been actively responding to changes in tariffs and subsidies policy by building local production lines or expanding them in Europe (Hungary and Turkey) and the Southeast Asia (Thailand, Indonesia, and Cambodia). Based on its competitive price and technology, BYD has continued to enhance brand awareness and diversify its product portfolio in various segments ranging from micro EVs to commercial vehicles to fortify its competitiveness in the overall ecosystem of electric vehicles. However, there has been concerns about its financial solvency as BYD recently expanded a bit too rapidly and thus the amount of liabilities increased. Against this backdrop, the industry is paying attention to how BYD’s aggressive movement and bold investment would affect its future profitability and market share onwards.

Geely Group, ranked 2nd on the list, continued to be in an upward trend, recording a more than double digit growth (77.3% YoY) and selling approx. 793k units. Geely’s Star Wish(星愿) model is gaining a huge popularity and contributing to expansion of line-ups. Its premium brand ZEEKR(极氪), hybrid-dedicated Galaxy(银河), and LYNK & CO(领克) aiming for the global market are targeting different classes of customers. In particular, Geely is actively working to convert from ICE vehicles to electric vehicles by developing its own technology in battery, electronic system, and software, as well as strengthening its production capabilities. These strategies for vertical integration and in-house development of technology are regarded as key factors to promote the competitiveness of Geely, leading to an expectation that Geely is highly likely to expand its presence in the global market.

Tesla, in the 3rd place, saw a 16.0% YoY decrease in sales, selling approx. 537k units. A drop in sales of Model Y and 3 is pointed out as a main reason for a decline in the entire sales. In particular, sales of Model Y reduced by 22.8% (421k units → 325k units) in the global market, aggravating burden on the entire brand. By region, in Europe, sales dropped by 34.3%, recording 79k units, while in North America, sales dropped by 13.8%, posting 218k units. In China, Tesla sold 202k units, a 7.8% decline from the same period last year. In Europe, sales of Model Y (-38.1%) and Model 3 (-25.4%) exhibited a double-digit decline, and in North America, sales of Model Y dropped by 16.6%, showing a visible slowdown in sales. In China, sales of Model 3 increased by 43.8%, but Model Y experienced a 24.0% decline in sales, recording an overall degrowth in the region. Especially, the global sales of flagship segment models such as Model S and X both dropped by 66.1% and 43.4% respectively, showing that Tesla seems to lose its competitive edge in the premium segment, as well. Meanwhile, Tesla has continued to implement strategies to sophisticate the Full Self-Driving (FSD) function and expand the monthly subscription-based software service model, but the effect on tangible performance improvement seems to be limited. In addition to this, CEO Elon Musk’s political statements and personal comments posted on his social media are still controversial, bringing about possible negative impacts on the brand and its reliability. In order for Tesla to expect a recovery in sales in future, it will be necessary to come up with measures to mitigate the risks from the tarnished brand image.

(Source: Global EV and Battery Monthly Tracker – June 2025, SNE Research)

Hyundai Motor Group sold approx. 242k units of electric vehicles, recording a 9.2% YoY growth and showing steady growth in the global market. In terms of BEV, IONIQ 5 and EV 3 mainly contributed to sales, and small-size and strategic models including newly launched Casper (Inster) EV, EV 5, and Creta Electric received positive reviews from the market. On the other hand, some of the existing models such as EV 6, EV 9, and Kona Electric showed a slowdown in sales. In terms of PHEV, Hyundai sold a total of 44k units during the relevant period. While Sportage, Sorento, and Santafe continued to be sold well, Niro and Ceed experienced a visible drop in sales. In the North American market, Hyundai delivered 64k units, capturing the 3rd place in the ranking next to GM and Tesla. It is noteworthy that, even though Hyundai saw a 23.3% YoY decrease in sales in the North American market, it still outperformed its major competitors such as Ford, Stellantis, and Toyota. Along with the expansion of EV 3’s presence in the global market, Hyundai Motor Group gradually diversified its electrification strategies by adding new models, such as EV 4 and IONIQ 9, to the electric vehicle portfolio. Based on this, Hyundai Motor Group is expected to take up more shares in the market in the mid to long run.

(Source: Global EV and Battery Monthly Tracker – June 2025, SNE Research)

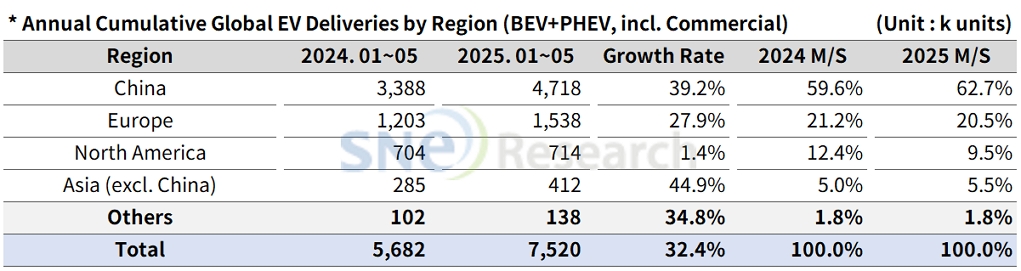

From Jan to May in 2025, the global electric vehicle market showed different trends in regions where the growth patterns have clearly diverged depending on related policies and demand structures in each country.

In China, taking up the biggest portion (62.7%) in the global market, a total of 4.718 million units of electric vehicles were sold, a 39.2% YoY increase. Centered around big cities in China, demand for entry-level electric vehicles expanded and the electrification of commercial EVs increased. Autonomous subsidy policies introduced by local Chinese governments and expansion of charging infrastructure were effective in driving demand in the market. In particular, low-cost LFP technology developed by battery suppliers like CATL and BYD was commercialized, leading to a rapid expansion of market for mid to low-priced electric vehicle models.

In Europe, a total of 1.538 million electric vehicles were sold, a 27.9% YoY growth, and the market share of European EV market slightly dropped to 20.5%. Although the numerical indicators show continued recovery, the overall rise in price sensitivity has notably accelerated the market share gains of Chinese electric vehicles at the expense of incumbent brands. The Chinese OEMs such as BYD, NIO, and Xpeng are working in earnest to invest in local production plants in countries like Hungary and Spain. In this regard, conflicts have become visible between the EU policy to promote local production and measures to curb Chinese electric vehicles. The landscape in the European EV market is expected to be determined later depending on which OEMs in Europe will be able to leverage their price competitiveness.

In the North American market, a total of 714k units were sold, recording only a 1.4% YoY increase. The share of North America in the global EV market also dropped to 9.5%. GM, Due to the tax credit benefits under the US Inflation Reduction Act (IRA), major manufacturers such as GM, Ford, and Hyundai Motor Group are increasing their local production share in North America, but demand for electric vehicles was below expectation. Since the inauguration of Trump administration, As the policy stance shifts toward greater tax cuts and easing of environmental regulations, discussions are gaining momentum at the federal level to reduce EV subsidies. Consequently, the outlook for electric vehicle demand is being revised downward, and automakers are beginning to realign their strategies, such as returning to internal combustion engine-focused portfolios.

The Asia market (excluding China) exhibited a 44.9% YoY growth with 412k units sold, accounting for 5.5% of the global EV market share. In emerging markets, mainly led by India, demand for electric vehicles, of which price range is from US$ 10k to 20k, has been rising. Japan is also signaling a full-fledged shift toward battery electric vehicles (BEVs), led by Toyota and Honda. However, disparities in charging infrastructure and consumer subsidies across countries continue to result in significant differences in the pace of growth by region.

The global electric vehicle market in 2025 is still in an upward trend, but regional disparities are becoming increasingly pronounced, shaped by varying demand structures and policy environments. In China, growth is being driven by continued expansion of the domestic market centered on low- to mid-priced models, with additional momentum from rising demand for commercial EVs. Europe is showing signs of recovery, supported by new model launches and the validity of subsidy programs, although intensified price competition among OEMs is placing downward pressure on profitability. In North America, a policy shift toward tax cuts is accelerating a slowdown in demand, while emerging Asian markets are broadening their base through the promotion of affordable models and government-led deployment programs. Against this backdrop of policy uncertainty and profitability pressures, global automakers are increasingly focusing on technological internalization and localization strategies to secure long-term competitiveness

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period