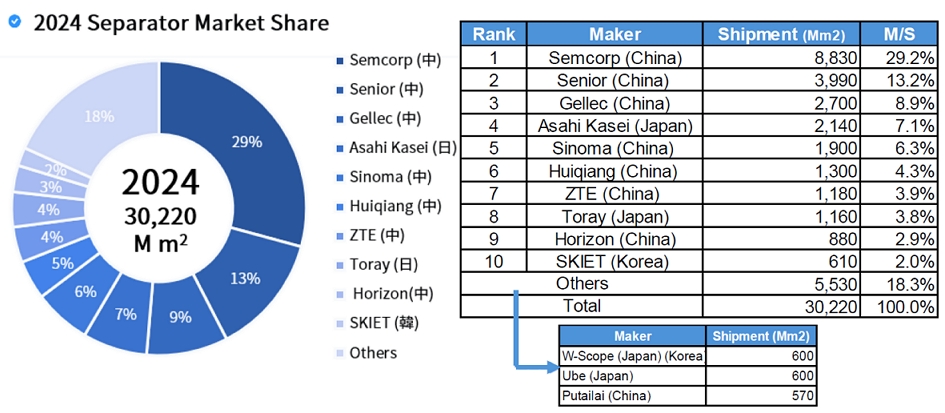

In 2024, Global Separator Shipment Exceeding 30.2 Bil ㎡;

Korean and Japanese Separator Makers in Stagnation While Top 3 Chinese Makers Leading the Market

l In 2024, the demand for LIB separator was 23.2 billion m2; the separator shipment recorded 30.2 billion m2.

l The top 3 Chinese separator makers accounted for over 90% of the entire shipment while Gellec’s growth in the market drew attention.

l The Korean and Japanese makers were in stagnation due to a slowdown in demand, but there is a possibility of rebound in 2025.

l Toray

indicated a possibility in downsizing its LIB separator business, leading to an

expectation for benefits to the Korean companies.

According to the report <2025.1H> LIB 4 Major Materials SCM Analysis and Mid/Long-term Market Outlook published by SNE Research in early May 2025, the total demand of separator for lithium-ion batteries in 2024 was 23.2 billion m2, and the shipment of separator recorded 30.2 billion m2. Compared to 2023, the demand increased by 30%, and the shipment increased by 22%. Such excessive shipment compared to the demand was led by different factors such as clients’ pre-emptive securement of stock, excessive production, and competition for strategic expansion of market shares. All of these factors combined with slack demand at the end, leading to a failure in making actual sales and profitability aggravation of several separator makers.

By application, the shipment of separator for electric vehicles was 20.8 billion ㎡(69%), those for ESS were 7.7 billion ㎡(25%), and those for CE were 1.8 billion ㎡(6%). More than 80% of the entire shipment was delivered by the Chinse companies. Among them, major Chinese makers such as SEMCORP, Senior, and Gellec highly ranked, firmly securing their leading positions in the market. SEMCORP remained top on the list with about 29% of market share by delivering approx. 8.8 billion ㎡ per year. Senior secured the 2nd place in the ranking by increasing their supply contracts with global major battery makers. What’s noteworthy here is the growth of Gellec who entered the global top 3 based on a sharp increase in shipment together with the announcement on acquisition by FSPG(佛塑科技) after Gellec failed to pursue an IPO(Initial Public Offering).

On the other hand, the Korean and Japanese Separator makers such as Asahi Kasei, SKIET, and WCP showed a stagnation in shipment due to reduced demand from clients for the European market and clients’ stock rebalancing. Therefore, those Korean and Japanese separator makers have been losing their market shares and dropping in the ranking. Against this backdrop, it is highly likely that the Korean and Japanese makers would have to go through difficult times even after the year of 2025 when the recovery of EV demand and the full-scale growth of ESS market are expected.

However, as Japan's chemical giant Toray officially mentioned the possibility of withdrawing from the lithium-ion battery separator (BSF) business due to the downturn in the EV market, new opportunities are emerging for related Korean companies

At a press conference on the 26th, Toray President Mitsuo Ohya stated, “Due to stagnation in the EV market and rising costs, we are keeping all options open, including downsizing or exiting the lithium-ion battery separator business.” Alongside this, Toray also announced its plan to sell its 20% stake in the separator joint venture in Hungary, which was co-invested with LG Chem, indicating a gradual retreat from the separator business.

SKIET, one of the front runners in the separator industry, is regarded as being ready to fill the gap created by Toray’s withdrawal from the business. To be specific, SKIET does not only have its production bases in Poland and China, it also offers products which satisfy the high-power, high-safety requirements for separators used in electric vehicles by utilizing high-performance, ceramic coating separator (CCS) technology. In addition, SKIET also has a reliable history of transactions with global, top-tier customers.

Recently, the U.S. Department of Commerce issued a preliminary decision to impose countervailing duties on Chinese-made separators, easing SKIET’s pricing pressure from Chinese competitors and paving the way for expansion in the North American market. With Toray mentioning the possibility of exiting from the separator business, the strategic significance of the Korean separator products is expected to be more highlighted in terms of finding suitable suppliers in accordance with the US IRA.

Toray’s exit from the business signifies more than a mere cutback in supply. This is being interpreted as a signal of a global restructuring of the battery materials supply chain and could instead serve as an opportunity for Korean materials companies to expand their market presence based on technological competitiveness. Especially for SKIET and W-SCOPE, which are actively pursuing global customer diversification, this will create an environment conducive to strengthening strategic partnerships with other OEMs.