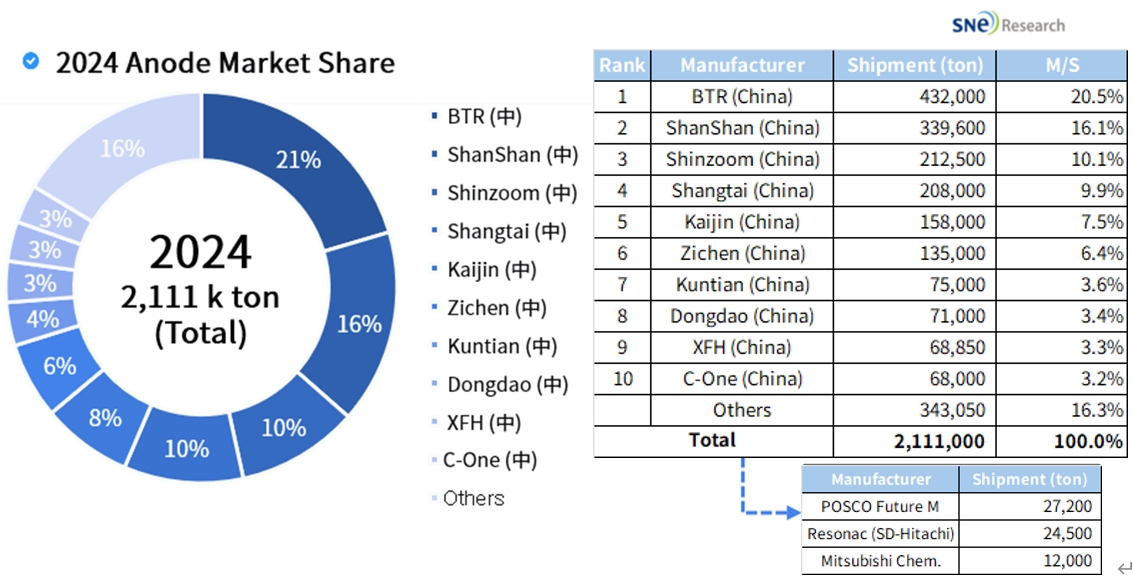

In 2024, the shipment of anode material reached 2.11 Mil ton dominantly supplied by the Chinese manufacturers;

POSCO Future M from Korea failed to enter top 10

l In 2024, total

shipment of anode material for LIB was approx. 2.111 million tons. Among them,

AG accounted for 1.756 million tons (83.2%), NG accounted for 294k tons (13.9%),

and Si took up 41k tons (1.9%).

l Major graphite

companies in China such as BTR and ShanShan continuously showed a growth in

their production capacity and shipment.

l POSCO Future M in

Korea dropped to No. 11 in 2024 from No. 10 both in 2022 and 2023. In 2020,

POSCO Future M ranked 6th and 8th in 2021.

l Resonac in Japan

also ranked below 12th dropping from 9th in 2021 and 5th

in 2020 due to fierce competitions with the Chinese makers, leading Resonac to

downsize its production lines.

l Variables due to

tariffs imposed by the Trump administration, competitions to secure non-China

graphite, and increasing use of new graphite technology for low-cost,

low-expansion material

l In future, it is

expected that the use of new Si anode material will expand and the development

of hard carbon for Sodium-ion battery will accelerate.

(Source: <2025.1H> LIB 4 Materials SCM Analysis and Mid/Long-term Market Outlook, SNE Research)

According to the report <2025.1H> LIB 4 Major Materials SCM Analysis and Mid/Long-term Market Outlook published by SNE Research in early May 2025, the total demand (usage) of anode material for lithium-ion batteries in 2024 was 1.97 million tons, and the shipment of anode materials reached 2.11 million tons. Compared to 2023, the demand increased by 26%, and the shipment increased by 25%.

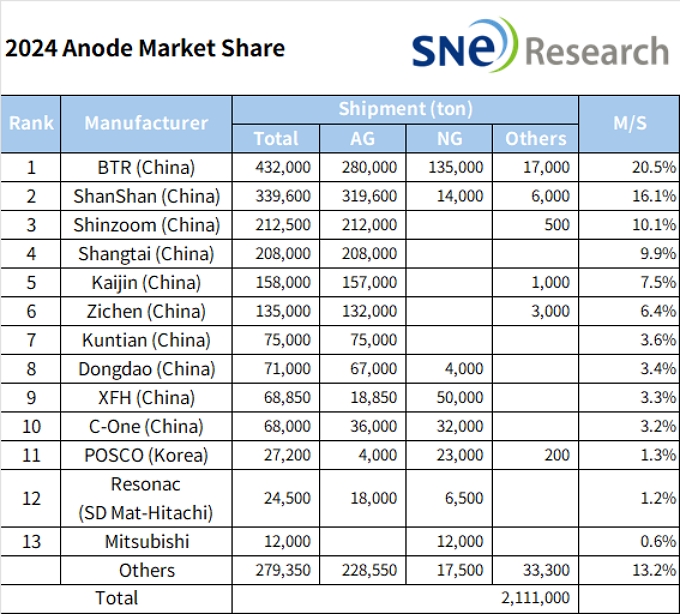

Among the total shipment of anode materials in 2024, artificial graphite accounted for approx. 83% with 1.76 million tons, natural graphite took up 14% with 290k tons, and silicon anode material accounted for 1.9% with 41k tons.

Chinese companies are showing strong dominance, with all of the top 10 companies by shipment volume being Chinese. BTR ranked No. 1 on the list with total shipment of over 432k tons, while ShanShan took the 2nd place with 340k tons. Shinzoom ranked 3rd with 213k tons, followed by Shangtai with 208k tons, Kaijin with 158k tons, and Zichen with 135k tons.

Last year, the anode material manufacturers in Korea and Japan had a difficult time outperformed by the Chinese counterparts based on excess production and underpriced contracts.

POSCO Future M in Korea, who is supplying natural graphite to the K-battery trio and recently started its artificial graphite business to expand their production capacity, was hit hard by a slowdown in demand for electric vehicles during the chasm phase in 2024, the U.S. government's postponement of restrictions on Chinese graphite anode supply, and price competition with Chinese graphite products. In response, POSCO Future M is planning to implement a strategy to reduce manufacturing costs by 30% by 2027. It is hoping for subsidy support following the government’s designation of the item as an economic security priority.

Resonac in Japan also suspended the production of graphite electrodes for steelmakers in China and Malaysia and downsized the production lines. In terms of graphite for LIBs, Resonac is supplying AG to Panasonic and PPES and NG to AESC, but it is taking a rather cautious approach toward future business expansion.

(Source: <2025.1H> LIB 4 Materials SCM Analysis and Mid/Long-term Market Outlook, SNE Research)

In the second half of 2024, shipments showed an upward trend compared to the first half. The artificial graphite market grew by 37% compared to the first half and by 30% year-over-year, while the natural graphite market increased by 23% compared to the first half and by 7% year-over-year. In particular, the second half of 2024 saw a sharp increase in artificial graphite shipments by Chinese companies, likely driven by rising battery demand from EVs and ESS in China, which led to increased purchases by battery manufacturers. Although sales volumes in the Si anode and other markets remain modest, the installed capacity is growing, especially in models suited for rapid charging. PHEV and HEV markets, which are experiencing renewed growth due to the electric vehicle chasm, are increasingly using premium graphite with higher C-rates and better performance compared to EVs. Major Chinese companies are actively developing 6C fast-charging technologies.

In 2025, amid the continued strength of Chinese synthetic graphite, the usage by the top six anode material companies—BTR, ShanShan, Shinzoom, Shangtai, Kaijin, and Zichen—is expected to be sustained or further strengthened. Si-based anode materials are expected to increase, targeting high-efficiency EV batteries, next-generation batteries, and some small device markets. Additionally, there is anticipated demand for hard carbon used in Na-ion batteries (NIB) and high-power LTO products.