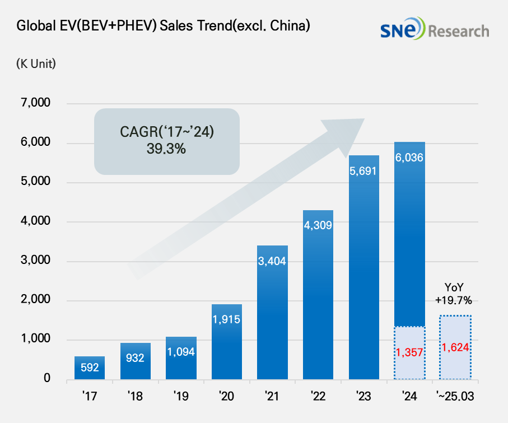

From Jan to Mar 2025, Non-China Global Electric Vehicle Deliveries Reached Approx. 1.624 Mil Units, a 19.7% YoY Growth

-

Tesla falls to second place due to the impact of declining sales in the

European market

From

Jan to Mar 2025, the total number of electric vehicles registered in countries

outside China was approximately 1.624 million units, a 19.7% YoY increase.

(Source: 2025 Apr Global Monthly EV and Battery Monthly Tracker, SNE Research)

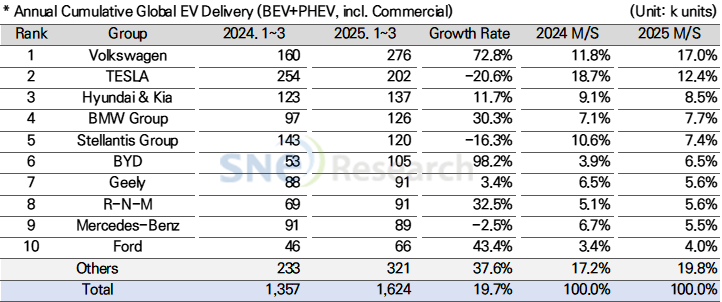

From

Jan to Mar 2025, Volkswagen Group ranked No. 1 in EV sales outside China,

selling approx. 276k units, a 72.8% YoY increase, overtaking Tesla. The strong

performance was driven by solid sales of MEB platform-based models such as the

ID.3, ID.4, ID.7, Q4 e-Tron, and ENYAQ. Tesla fell to second place with approx.

202k units sold, down 20.6% YoY, due to decreased sales of its key models,

Model 3 and Model Y. In Europe, sales dropped 34.2% YoY, and in North America,

8.1% YoY, reflecting weak performance in major markets. The decline in European

sales was mainly due to halted production and low inventory ahead of the launch

of the facelifted Model Y (“Juniper”), which is seen as a temporary issue.

Tesla had planned to release a more affordable model to offset the downturn,

but production has been delayed by at least three months, possibly pushing the

launch to late 2025 or early 2026.

Hyundai Motor Group ranked

3rd, selling approximately 137k units and recording a 11.7% YoY growth. Its

main models, the IONIQ 5 and EV6, have led the recovery in sales thanks to

improved product competitiveness through their 2025 facelifts, while Kia’s EV3

and EV9 are also continuing to expand their global sales. In particular,

Hyundai Motor Group has shown notable performance in the North American market

by surpassing the electric vehicle deliveries of Stellantis, Ford, and GM. Kia

clearly demonstrated its commitment to EV popularization by unveiling the

compact electrified sedan EV4 and the small electric SUV concept car EV2. EV4

offers a maximum range of up to 533 km per charge (based on the WLTP standard)

for its long-range model, which is among the longest in Hyundai Motor Group’s

EV lineup and meets demand for long-distance driving. Along with the EV4, the

EV2 – a small electric SUV targeting the European market – is also being

prepared for launch, as part of Kia’s strategy to further strengthen its EV

competitiveness in Europe.

(Source:

2025 Apr Global Monthly EV and Battery Monthly Tracker, SNE Research)

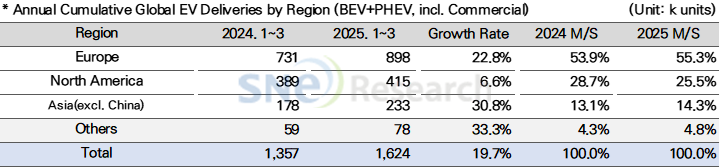

By region, the European

market showed signs of recovery, recording approximately 22.8% YoY growth in

sales. The launch of various new models such as Renault’s small hatchback EV

“R5,” Stellantis’s “e-C3,” Kia’s EV3, and Hyundai’s Casper Electric (Inster)

helped boost market momentum. In particular, BYD is constructing a

Europe-dedicated plant in Szeged, Hungary, with an annual production capacity

of 200k units. The plant, covering an area of 300 hectares, is expected to

become a key hub in BYD’s strategy to expand in the European market. Meanwhile,

considering the burden on automakers, the EU has postponed the application of

CO₂

emission regulations to 2027. As a result, manufacturers will be able to meet

the regulations based on the average emissions between 2025 and 2027. This is

interpreted as a measure to bridge the gap between the pace of EV transition

and practical realities.

The North American market

grew by 6.6%, accounting for 25.5% of the global market share. Due to tax

credit benefits under the U.S. Inflation Reduction Act (IRA), major

manufacturers such as GM, Ford, and Hyundai Motor Group are increasing their

share of local production in North America. However, as the Trump

administration is reportedly considering the repeal of EV sales mandates,

reduction of EV subsidies, and the imposition of tariffs on battery raw

materials, there is a growing possibility of increased market uncertainty in

the future. Accordingly, automakers need to develop flexible strategies to

respond to policy changes and focus on building a well-balanced portfolio

between internal combustion engine vehicles and electric vehicles.

The electric vehicle market

in Asia (excluding China) grew by 30.8% YoY, accounting for 14.3% of the global

market share. While growth continues, the overall upward trend remains moderate

due to varying national policies and the strong presence of internal combustion

engine and hybrid vehicles. Japan has traditionally maintained a hybrid-focused

strategy, but recently, brands like Toyota and Lexus have begun launching new

battery electric vehicle (BEV) models, signaling moves to expand their presence

in the EV market. India is accelerating market expansion through proactive EV

promotion policies. The Indian government aims to increase the EV share to 30%

of total vehicle sales by 2030 and is working to improve subsidy schemes and

expand charging infrastructure to support this goal.

(Source: 2025 Apr Global Monthly EV and

Battery Monthly Tracker, SNE Research)

The global electric vehicle market continues to show gradual growth even outside of China, though the driving forces vary by region. In Europe, price competitiveness and model diversity are key factors supporting market recovery. North America faces a complex landscape where policy benefits and risks coexist amid political uncertainty. Major Asian countries are pursuing EV transitions at their own pace, seeking a balance between protecting domestic industries and expanding adoption. As regional policy directions and demand structures become increasingly distinct, global automakers are refining their market strategies and strengthening their positions in key markets.