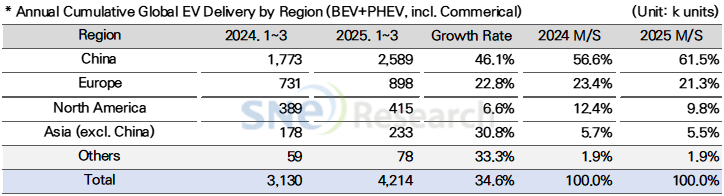

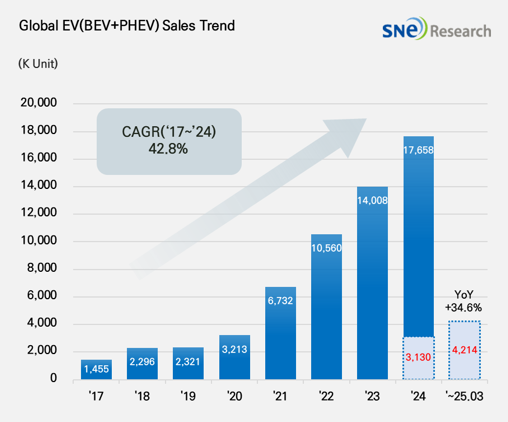

From Jan to Mar 2025, Global[1] Electric Vehicle Deliveries[2] Recorded Approx. 4.214 Mil Units, a 34.6% YoY Growth

-

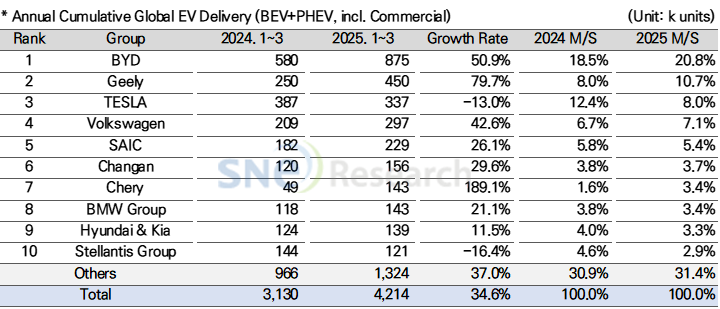

From Jan to Mar 2025, BYD ranked No. 1 in the ranking of global EV sales,

selling approx. 875k units

From January to March 2025, the number of electric vehicles registered

in countries around the world was approximately 4.214 million units, about

34.6% YoY increase.

(Source: 2025 Apr Global Monthly EV and

Battery Monthly Tracker, SNE Research)

From

January to March 2025, BYD sold approximately 875k units of of electric

vehicles, a 50.9% YoY increase, ranking first in global EV sales. Aiming to

sell around 6 million units this year, BYD is actively responding to changes in

tariffs and subsidies by establishing or expanding local plants in Europe

(Hungary, Turkey) and Southeast Asia (Thailand, Indonesia, Cambodia).

Leveraging its strong price competitiveness and technological capabilities, the

company is enhancing brand recognition while strengthening its overall

competitiveness across the EV ecosystem.

Geely

Group ranked 2nd on the list by selling approximately 450k units, a 79.7% YoY

increase, continuing its double-digit growth trend. The recently released ‘Star

Wish (星愿)’ model has been well received in the market, supporting

the expansion of Geely’s EV lineup. In addition, Geely Group operates a diverse

range of brands—including the premium brand ZEEKR (极氪), the hybrid-exclusive brand

Galaxy (银河), and LYNK & CO (领克), which targets the global market—allowing the company to

appeal to a broad consumer base. Geely is also accelerating its transition from

internal combustion engine vehicles to EVs, while simultaneously strengthening

its technology development and production capacity, which is expected to drive

continued high growth in 2025.

Tesla ranked 3rd on the list,

selling approximately 337k units, a 13.0% YoY decrease. The decline was mainly

driven by weaker sales of its key models, Model 3 and Model Y. In particular,

sales in Europe dropped by 34.2% YoY, while sales in North America declined by

8.1%, reflecting sluggish performance in major markets. The sales decline in

Europe was largely due to halted production and inventory shortages ahead of

the launch of the facelifted Model Y “Juniper,” and is considered a temporary

issue. Tesla had planned to offset the downturn with the launch of a

lower-priced model, but the production timeline has recently been delayed by at

least three months, pushing the expected release to the second half of 2025 or

early 2026. In parallel, the company is strengthening its software-driven

revenue model by enhancing its Full Self-Driving (FSD) software and expanding

subscription-based services. However, growing concerns over brand

reputation—partly due to politically controversial statements by CEO Elon Musk—are

raising questions about consumer trust, drawing attention to whether Tesla can

regain its brand credibility.

(Source: 2025 Apr Global Monthly EV and Battery Monthly Tracker, SNE Research)

(Source: 2025 Apr Global Monthly EV and Battery Monthly Tracker, SNE Research)

Europe showed signs of

recovery, with EV sales increasing by approximately 22.8% YoY. The launch of

new models such as Renault’s small hatchback EV “R5,” Stellantis’ “e-C3,” Kia’s

EV3, and Hyundai’s Casper Electric (Inster) helped revitalize the market. Notably,

BYD is constructing a Europe-dedicated plant in Szeged, Hungary, with an annual

capacity of 200,000 units. Spanning 300 hectares, the facility is expected to

become a key hub for BYD’s expansion strategy in the European market.

Meanwhile, the EU has postponed the implementation of stricter CO₂

emission regulations to 2027, taking into account the burden on automakers. As

a result, manufacturers will be allowed to meet the target based on the average

emissions between 2025 and 2027—a move seen as an effort to balance the pace of

EV transition with market realities.

The North American market

grew by 6.6%, accounting for 9.8% of global EV market share. Thanks to tax

credit incentives under the U.S. Inflation Reduction Act (IRA), major

automakers such as GM, Ford, and Hyundai Motor Group have been increasing their

local production in the region. However, growing uncertainty looms over the

market as the Trump administration is reviewing potential rollbacks, including

the elimination of EV sales mandates, reduction of subsidies, and the

imposition of tariffs on battery raw materials. In response, automakers will

need to adopt flexible strategies to cope with policy shifts, and building a

well-balanced portfolio between internal combustion engine vehicles and EVs is

likely to become increasingly important.

The

Asia market (excluding China) grew by 30.8% YoY, accounting for 5.5% of the

global market share. Although the growth trend continues, the rise has been

relatively moderate due to differences in national policies and the strong

presence of internal combustion engine and hybrid vehicles. Japan has

traditionally focused on hybrid vehicles, but recently, new BEV models from

Toyota and Lexus have been launched, indicating moves to expand the market.

India is accelerating market growth with the government's aggressive EV

promotion policies. The Indian government aims to increase the EV sales ratio

to 30% of total vehicle sales by 2030 and is working to improve subsidy

programs and expand charging infrastructure.

The global EV market is

showing signs of overall recovery and growth, with varying trends across

regions. In China, the transition toward an EV-centered market is accelerating,

driven by strong government support and enhanced technological capabilities of

local brands. Europe is experiencing a structural rebound, supported by the

gradual tightening of environmental regulations and the growing presence of

Chinese brands. North America has entered a transitional phase, marked by

expanded production under the IRA alongside rising policy risks. In Asia

(excluding China), the pace of EV adoption varies depending on differences in

national policies and infrastructure readiness. Amid these conditions,

automakers are intensifying efforts to secure an advantage in the global EV

market through flexible, market-specific strategies, strengthened technological

competitiveness, localized production, and diversified branding approaches.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period