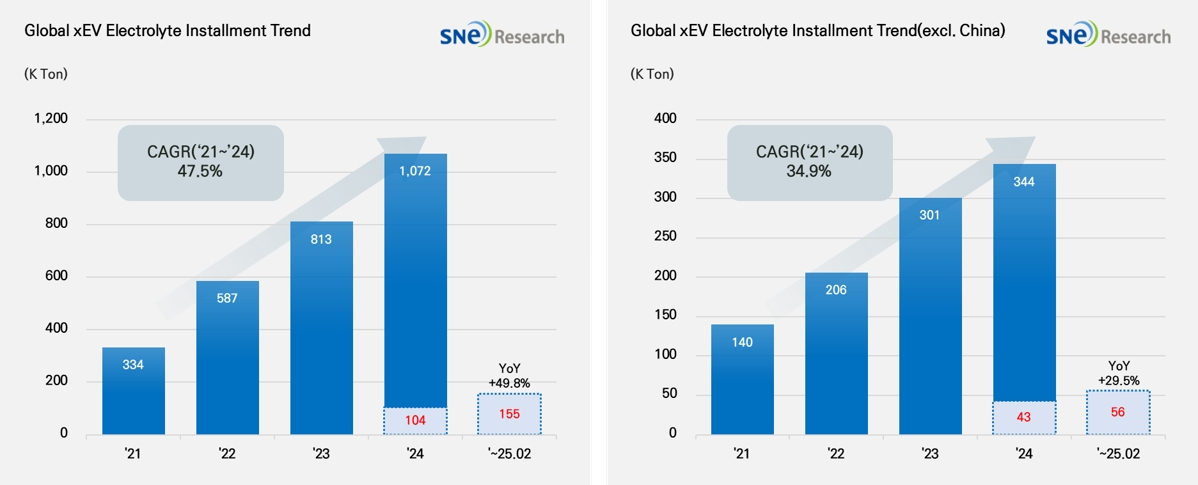

From Jan to Feb in 2025, Global[1] Electric Vehicle Battery Electrolyte Installment[2] Recorded 155K ton, a 50% YoY Growth

- In early 2025, the electrolyte market

posted a double-digit growth, while the non-China market showed a stable

expansion.

(Source: 2025 Mar Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Feb 2025, the total installment of electrolyte used in electric vehicles (EV, PHEV, HEV) registered around the world was approx. 155K ton, showing a 50% YoY growth. Particularly in the non-China market, the total usage of electrolyte grew by 30%, recording 56K ton and showing a stable growth.

Electrolyte is one of key materials and facilitates the transfer of lithium ions inside batteries, directly affecting the battery charging speed, safety, and battery life. With the electric vehicle market expanding and demand for high-performance batteries increasing, the electrolyte market has been rapidly growing.

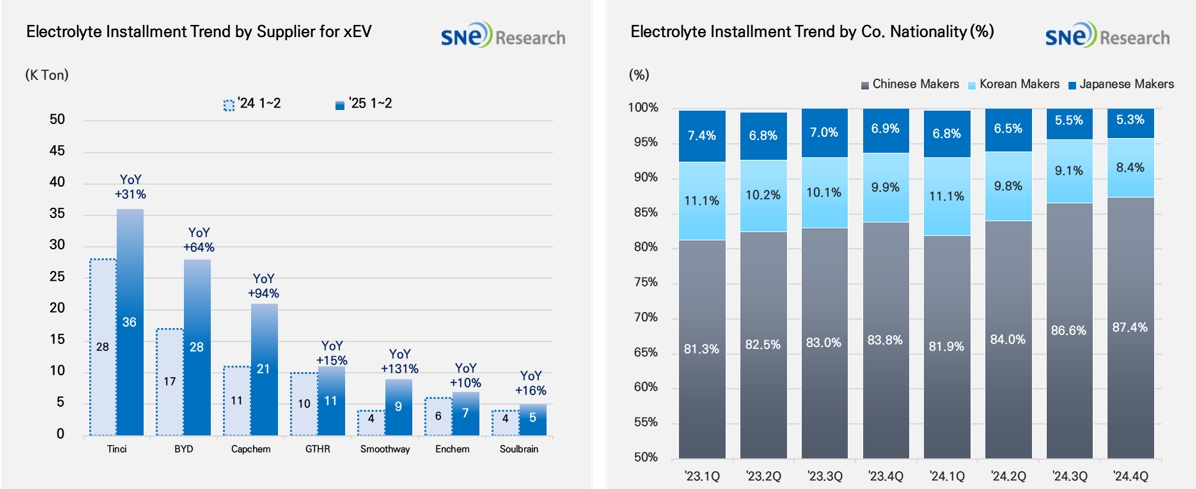

From Jan to Feb in 2025, the global electrolyte market witnessed a high growth of major electrolyte suppliers. Tinci was the world’s No. 1 electrolyte maker, by supplying 36K ton, followed by BYD who supplied 28K ton. Capchem and GTHR also highly ranked with a rapid growth by supplying 21K ton and 11K ton, while Smoothway, Enchem, and Soulbrain also continued to be in a growth trend.

(Source: 2025 Mar Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

Currently, the global electrolyte market is led by the Chinese companies of which market share reached 87.4% as of Q4 2024. The Korean and Japanese companies took up 5.3% and 8.4% of the market shares, and they are trying to expand their market shares by developing technologies and quality that can differentiate them from others. It is expected that competitions for development of next-generation electrolyte would become fierce to accommodate the industry needs for high-power batteries with high safety.

As major battery manufacturers started to adopt next-generation technologies such as all-solid-state batteries in earnest, electrolyte suppliers are expected to focus on technology innovation and product sophistication. The electrolyte market is highly likely to stay in an upward trend, and in the non-China market, increasing demand and diversification of supply chain are expected to act as major factors. Attentions should be paid on whether the Korean and Japanese companies, in cooperation with global OEMs, would enter the future market centered around high-value-added products and expand their presences.

[2] Based on batteries installed to electric vehicles registered during the relevant period.