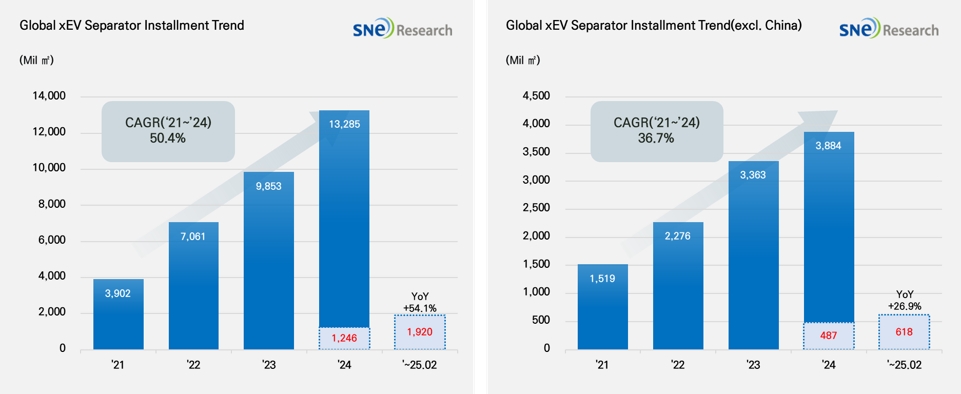

From Jan to Feb in 2025, Global[1] Electric Vehicle Separator Installment[2] Reached 1,920Mil ㎡, a 54% YoY Growth

- In early 2025, the global separator market

posted a double-digit growth; the non-China separator market also saw steady

growth.

(Source: 2025 Mar Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Feb in 2025, the total installment of separator materials used in electric vehicles (EV, PHEV, HEV) registered worldwide was approximately 1,920 Mil ㎡, posting a 54% YoY growth. In the global market excluding China, the total installment of separator increased by 27%, reaching 618Mil ㎡ and demonstrating a stable growth.

Separator is a key material which physically separates cathode and anode inside lithium-ion battery but at the same time enables lithium ions to move freely, playing an important role in determining the safety and performance of battery. With increasing demand for high-performance batteries in accordance with expansion of electric vehicle market, the separator market indeed has been growing rapidly.

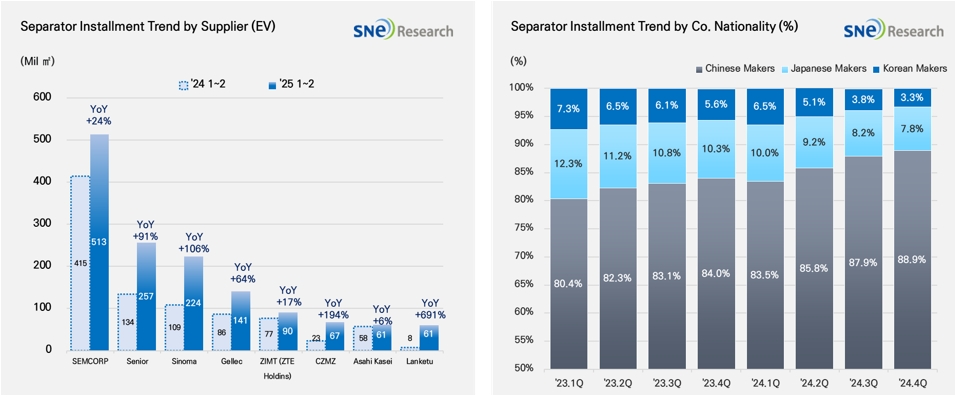

From Jan to Feb 2025, major separator suppliers showed significant growth in the global separator market. In particular, the Chinese companies were all highly ranked, showing an explosive growth based on favorable growth in the Chinese domestic electric vehicle market. Even in the non-China market, the market shares of the Chinese companies are still high, but Asahi Kasei and Toray from Japan and SK IE Technology (SKIET) and WCP from Korea also maintained relatively high market shares.

While the market shares of the Korean and Japanese separator suppliers had been continuously dropping from Q1 2020 to Q4 2024, the Chinese suppliers have been in an upward trend, taking up about 90% of the entire market share.

In 2025, as the diversification of supply chain and changes of production strategies by battery makers have risen as a key issue, competitions in the global separator market are expected to get fiercer.

(Source: 2025 Mar Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

As the OEMs in Europe and North America pushed forward with making their battery supply chain in-house, the separator suppliers have been active in expanding their local production bases. The Korean and Japanese companies are expanding their production bases mainly in Europe and North America, while some of the Chinese companies are considering in earnest whether to establish their production network in the world. In particular, with the US IRA and European regulations on supply chain intensified, the establishment of non-China separator supply chain has become a key strategic task.

As batteries for electric vehicles have become bigger with higher power output, demand for separators has been increasing, as well. To be specific, as the size of battery cell and energy density increase, there have been increasing demand for high-quality and highly durable separators. This may lead to an expansion of the premium separator market. In addition, since battery manufacturers, together with OEMs, have been carrying out strategies befitting different requirements in different regions, it is expected that the separator companies would accelerate their technology innovation and changes in production strategies.

As the electric vehicle market has maintained high growth, the separator market has been expanding at a rapid pace. The market expansion in the non-China regions has drawn attention from the industry, as well. Depending on changes in battery technologies and OEMs’ future strategies, the competition landscape in the separator market is expected to continuously reshape. The global separator suppliers are likely to make a strategic investment to expand their market shares as well as to secure their competitive edge in quality and safety.

[1] The xEV

sales of 80 countries are aggregated.

[2] Based on batteries installed to electric vehicles registered during the relevant period.