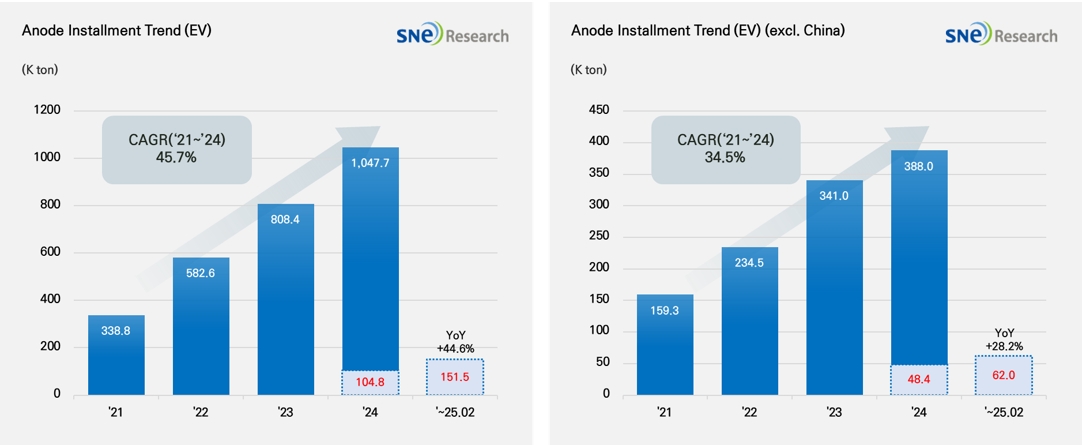

From Jan to Feb in 2025, Global[1] Electric Vehicle Battery Anode Material Installment[2] Reached 151.5K ton, a 44.6% YoY Growth

- From Jan to Feb in 2025, the non-China

market recorded 62.0K ton, posting a 28.2% growth

(Source: 2025 Mar Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Feb in 2025, the total installment of anode materials used in electric vehicles (EV, PHEV, HEV) registered worldwide was approximately 151.5K ton, posting a 44.6% YoY growth and sustaining steady growth. On the other hand, in the market excluding China, the total installment of anode materials used in electric vehicles was 62.0K ton, recording only a 28.2% growth. The anode installment in the non-China market showed a relatively moderate growth, but the trend of stable growth was maintained.

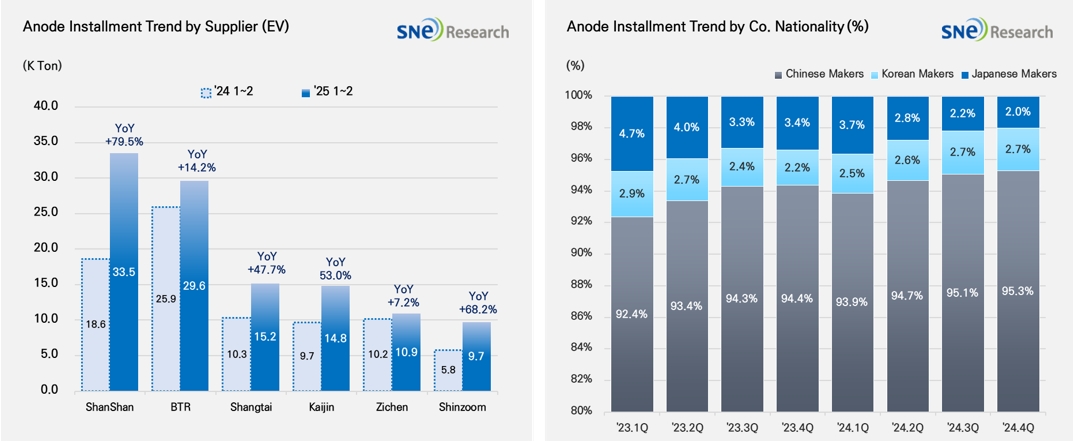

If we look at the market shares of companies, ShanShan and BTR ranked 1st and 2nd on the list, leading the global anode market. The two companies secure a broad range of customers by supplying to major battery makers such as CATL, BYD, and LGES. Shangtai, Kaijin, and Zichen also recorded over 10k ton of installment, while Shinzoom showed a rapid growth of 68.2% compared to the same period of last year.

(Source: 2025 Mar Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

If we look at the market shares of companies by their nationality, the Chinese anode companies boast an overwhelming dominance in the market, taking up approx. 95% of the entire market. They have been strengthening their market dominance by continuously expanding their production and developing technologies. In particular, along with the growth of the electric vehicle market, more Si-anode has been adopted, leading to further consolidation of cooperation between anode material suppliers and major battery companies. The Korean anode companies’ market shares are only 2.7%, but, mostly by POSCO and Daejoo, they have been looking for opportunities to expand their market shares through cooperation with major battery makers. The Japanese anode suppliers also take up only 2.0% of the market share, showing a relatively unnoticeable presence int the market. The Japanese anode companies such as Hitachi and Mitsubishi maintained their conservative business management system focusing on the existing customers, which seemed to weaken their competitiveness compared to other suppliers in the world.

Recently, due to fluctuations in raw material price and tariff-related issues between the US and China, higher risks have been posed in the global anode supply chain. In particular, the imposition of tariffs on China by the US has weaken the cost competitiveness of Chinese materials, leading to a rise of raw material diversification and expansion of local production as key issues and imminent tasks. In this current trend, it is necessary for the Korean and Japanese companies to come up with strategies to diversify their production sites and reinforce their technical prowess to make high-performance anode material. While the Korean companies may find their breakthrough by localizing their production in the US and expanding their premium product line-ups, the Japanese companies seem to be necessary to reshape their low-key position by actively involving in investment and diversifying their product portfolios.

[2] Based on batteries installed to electric vehicles registered during the relevant period.