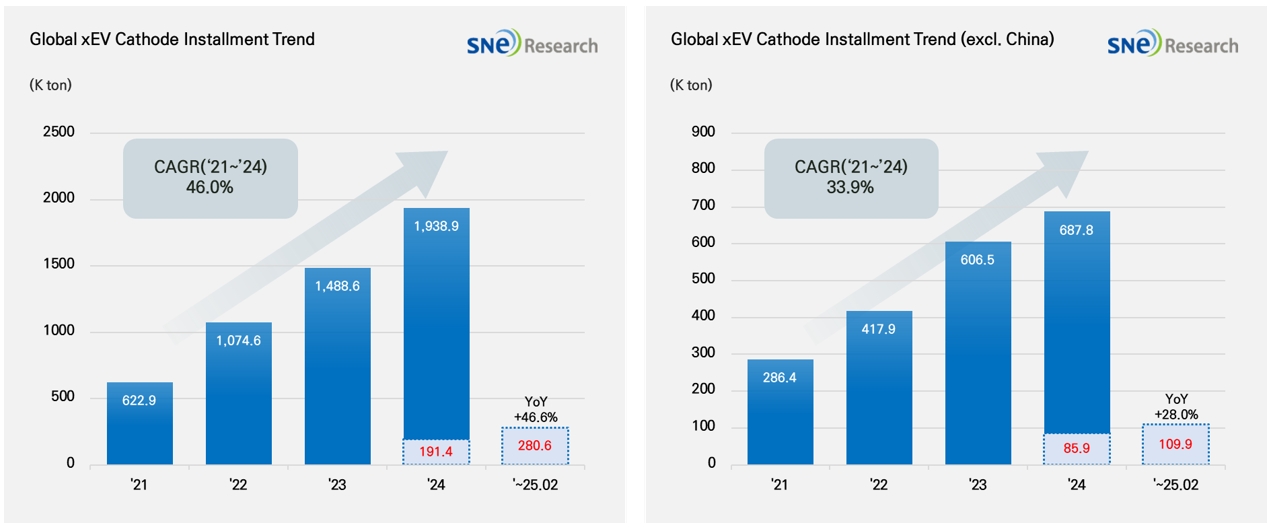

From Jan to Feb in 2025, Global[1] Electric Vehicle Battery Cathode Material Installment[2] Reached 280.6K ton, a 46.6% YoY Growth

-From Jan to Feb in 2025, EV battery cathode material installment in non-China market was 109.9K ton, posting 28.0% growth

(Source: 2025 Mar Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

From Jan to Feb in 2025, the total installment of cathode materials used in electric vehicles (EV, PHEV, HEV) registered worldwide was approximately 280.6K ton, posting a 46.6% YoY growth. In particular, the installment of cathode materials used in electric vehicles in the non-China market recorded a 28.0% growth, reaching 109.9K ton and showing a stable growth. Cathode material is a key material determining the capacity and output value of lithium-ion battery, upon which the performance of battery and driving range of electric vehicles depend. Currently, the battery market can be divided into the one centered around NCx ternary cathode material and the other mainly led by LFP cathode material, and both are driven by technical and economic advantages of each cathode material. Amidst the diversification of global cathode material demand, NCx ternary cathode material and LFP cathode material are positioning themselves as two main axis in the market.

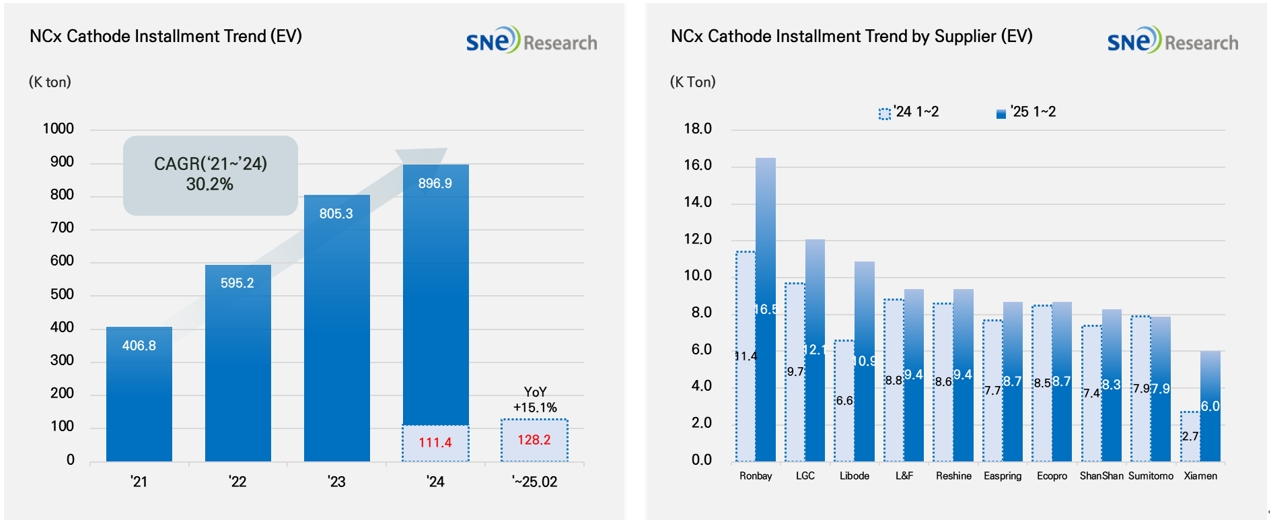

If we look at the market by different cathode materials, the installment of ternary cathode material during the relevant period was 128.2K ton, posting a 15.1% YoY growth and continuously expanding in the market. By company, Ronbay and LG Chem ranked 1st and 2nd, leading the market, while Libode rose to the 3rd place on the list based on the increasing demand for mid-Ni cathode material, posting a 65.9% YoY growth. L&F and EcoPro – other major cathode material suppliers in Korea – posted a 6.5% and 1.8% growth respectively, capturing the 4th and 7th places, but, overall, the growth of Chinese cathode material companies was noticeable. In particular, the Chinese cathode makers have been continuously expanding their global market shares based on high demand from the Chinese domestic market and their aggressive ramp-up strategies as well as cost competitiveness.

(Source: 2025 Mar Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

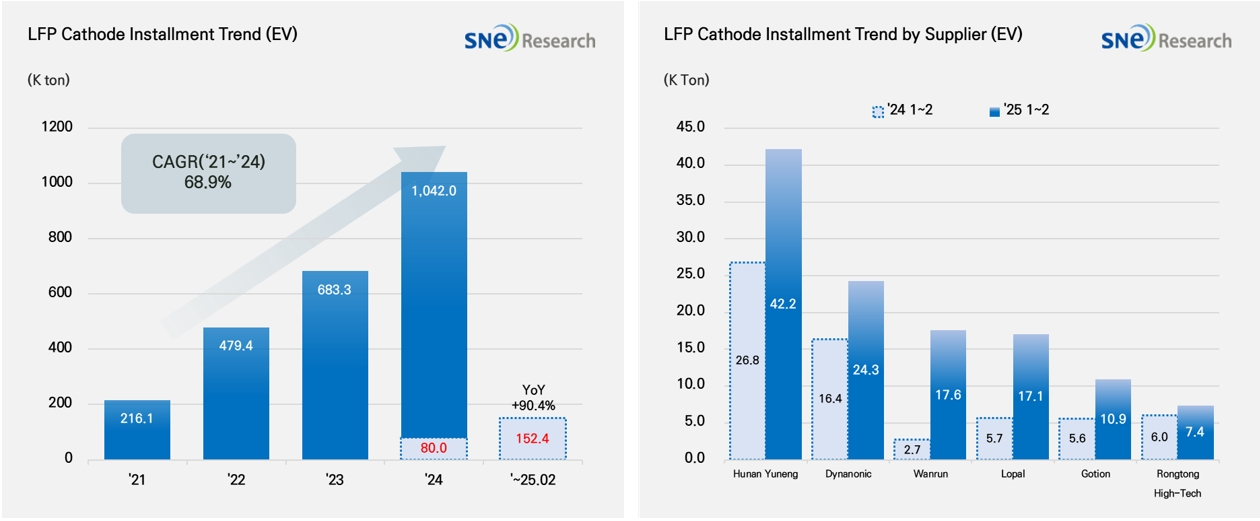

On the other hand, the total installment of LFP cathode material was 152.4K ton, posting a 90.4% YoY growth and showing a rapid growth surpassing that of ternary cathode material. Especially, among the total cathode material installment, the portion taken by LFP cathode material was 54.3%, showing that the LFP cathode material has been further expanding its presence in the market. This growth was interpreted as strongly led by a monopolistic structure of cathode supply chain established by China, the world’s biggest electric vehicle market. Currently, the market of LFP cathode material for electric vehicles was in fact dominated by the Chinese suppliers, and among them, Hunan Yuneng and Dynanonic ranked 1st and 2nd, solidifying their dominance in the market. Following them, Wanrun and Lopal captured the 3rd and 4th places based on their rapid growth, making the competition much fiercer in the market. As a result, the rapid expansion of LFP cathode material market has been acting as a driver behind the market dominance by the Chinese makers. This has led to a trend that the supply chain of global battery material, mainly led by the Chinese suppliers, is further solidified.

(Source: 2025 Mar Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

The global cathode material market has continued a solid growth based on a rapid growth of LFP cathode material and steady expansion of ternary cathode material. However, the tariffs on batteries and materials from China, recently announced by the Trump Administration, are regarded as a major factor reshaping the market landscape. The US high tariffs policy significantly aggravates the cost competitiveness of Chinese and would be a factor to further increase a pressure on battery makers and OEMs in the US to diversify their supply chain. In particular, material companies outside of China, including those in South Korea, are encountering a strategic opportunity to expand their presence in the U.S. market under relatively lower tariff burdens. However, as the Chinese government is considering additional countermeasures such as rare earth export restrictions, the uncertainty surrounding the global battery material supply chain is likely to intensify further. Companies are required to adopt a multifaceted approach in response to the U.S. market, including expanding local production facilities, restructuring global sourcing strategies, and diversifying their portfolios.

[2] Based on batteries installed to electric vehicles registered during the relevant period