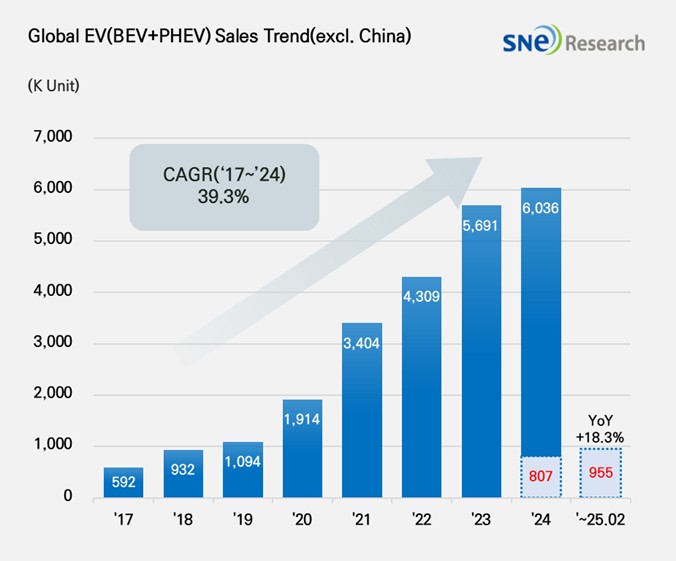

From Jan to Feb in 2025, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded About 955k units, a 18.3% YoY Growth

- Tesla ranked 2nd due to the impact of declining sales in Europe

From Jan to Feb in 2025, the total number of electric vehicles

registered in countries around the world except China was approx. 955k units, a 18.3% YoY increase.

(Source: Global EV & Battery Monthly Tracker – Mar 2025, SNE Research)

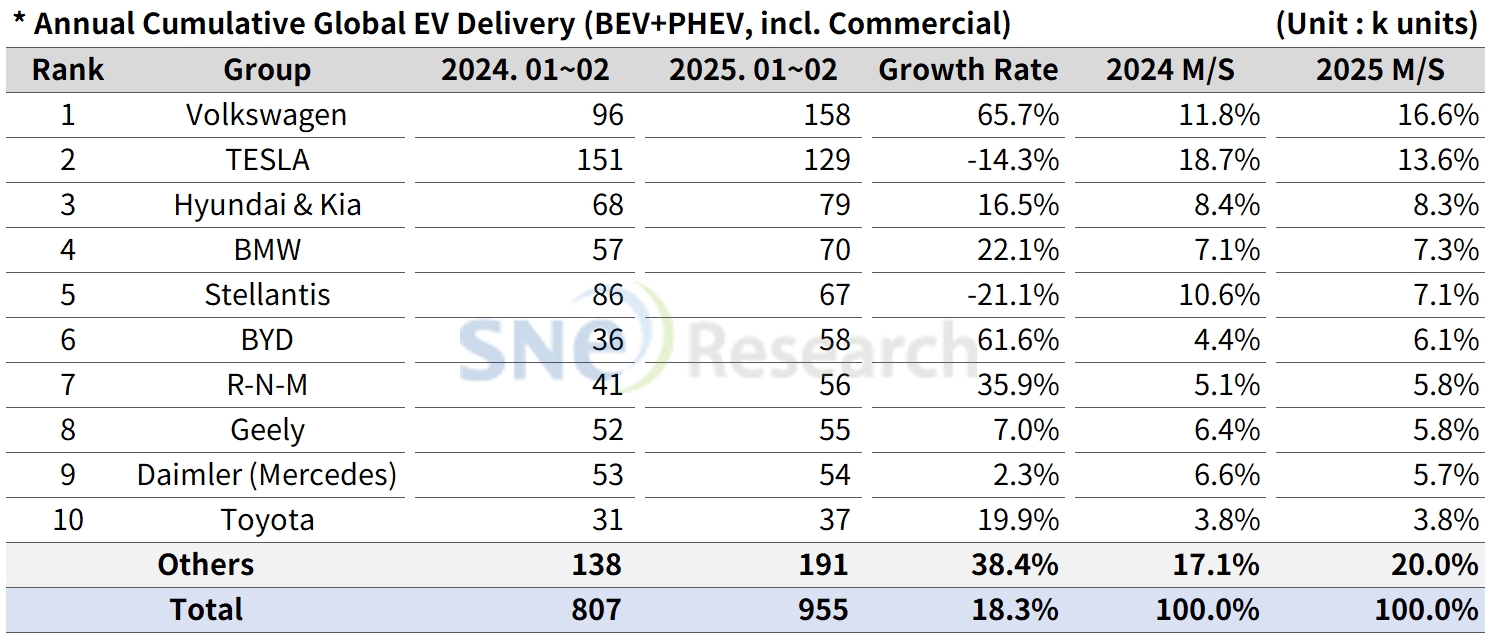

If we look at the number of electric vehicles sold in the world except China market from Jan to Feb 2025, Volkswagen Group outperformed Tesla and captured the 1st place in the ranking by selling 158k units, a 65.7% increase compared to the previous year. The growth of VW Group was mainly led by favorable sales of VW’s main models such as ID series, Q4 e-Tron, and ENYAQ to which MEB platform are installed. In particular, VW Group posted a high growth of 65% in Europe and 72% in North America.

Tesla ranked 2nd with declines in sales of Model 3 and Y, selling 129k units and posting a 14.3% YoY decrease. In particular, Tesla saw a slowdown in sales in Europe (38% YoY decrease). In this regard, Tesla is positioning 2025 as a turning point and aims to rebound in sales by launching a new entry-level model in the first half of 2025. In addition, it has been working on sophisticating its FSD software and expanding subscription services to strengthen a software-based revenue model. Meanwhile, Tesla tries to improve the efficiency in the Texas Gigafactory and newly build a factory in Mexico in an effort to improve cost competitiveness. Admist intensifying price competition in the EV market, Tesla is focusing on securing long-term profitability.

The 3rd place was taken by Hyundai Motor Group, selling about 79k units and recording a 16.5% YoY growth. Hyundai improved product competitiveness of IONIQ 5 and EV 6 by releasing the facelifted version in 2025. Kia also saw an expansion in global sales led by EV3. In particular, Hyundai Motor Group is showing strong performance by surpassing the electric vehicle deliveries of Stellantis, Ford, and GM in the North American market. At <2025 Kia EV Day> taking place in Spain, Kia announced a new electrification strategy. At the event, Kia unveiled its compact electrified EV 4 and small-size electric SUV concept car EV 2 for the first in the world, demonstrating its commitment to the popularization of electric vehicles.

(Source: Global EV & Battery Monthly Tracker – Mar 2025, SNE Research)

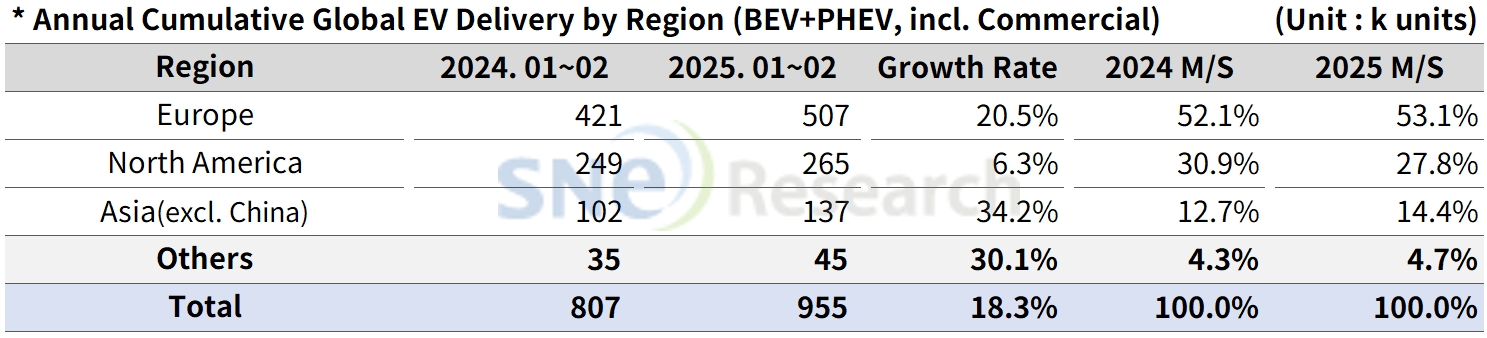

Meanwhile, Europe saw a recovery even during the chasm period, recording a 20.5% increase in sales compared to the same period of last year. A key factor driving this growth is the tightening of environment regulations in Europe and electrification roadmaps laid out by different European countries. However, as the regulation which requires automakers to sell at least 20% electric vehicles has postponed till 2027, it is expected that the resilience of the European EV market would decrease in the mid to long term. The postponement of regulation is interpreted as a policy decision to reflect the necessity for structural stabilization of the regional EV ecosystem which encompasses the restoration of independence in raw material supply, the establishment of battery-related regulations, and the reallocation of production bases.

The North American market posted a 6.3% of growth, accounting for 10.6% of the global market share. Due to the tax credit benefits under the US Inflation Reduction Act(IRA), major manufacturers such as GM, Ford, and Hyundai Motor Group are increasing their local production share in North America. However, since the embarkment of Trump Administration, there have been growing uncertainties in the market due to the abolition of mandatory electric vehicle sales targets, a reduction in electric vehicle subsidies, and the imposition of tariffs on battery raw materials. In addition, the recently announced policies on baseline tariffs, reciprocal tariffs, and tariffs on electric vehicles have further increased uncertainties in the industry. In this regard, major OEMs are necessary to establish a strategy to have a balanced portfolio between ICE vehicles and electric vehicles as well as to establish response measures against policy changes.

The Asia market (excluding China) exhibited a 34.2% YoY growth and accounted for 5.5% of the global market share. The region saw an overall expansion of electric vehicle market, but the growth seems to be limited due to differences between national policies upheld by difference countries and popularity of ICE vehicles and hybrid cars. In particular, India, Vietnam and Thailand recorded a higher sale of electric vehicles than Korea and Japan. The strong sales of electric vehicles in those countries are thanks to government subsidies for EV purchase, the establishment of charging infrastructure, and standardization of related policies. The Southeast Asian region is highly likely to face risks in production and export due to high tariffs imposed by the US government. India, on the other hand, seems to benefit from the current circumstance in the short term thanks to India’s relatively lower tariff exposure compared to other markets.

(Source: Global EV & Battery Monthly Tracker – Mar 2025, SNE Research)

Based on the global electric vehicle market from January to February 2025, while the market as a whole continues its growth trend, different regional market structures and policy changes are determining the industry's direction. In Europe, the shift toward an electric vehicle–centered market is accelerating as carbon emission regulations become more stringent. In North America, electric vehicle adoption continues to expand under the influence of the IRA (Inflation Reduction Act), but the policies of the Trump administration, which took office in 2025, are adding uncertainty to the market. Meanwhile, in the Asian market excluding China, electric vehicle policies vary significantly by country. The response strategies of major nations such as Japan and India are expected to become key variables in the future growth of the market. Overall, regions outside of China are experiencing rapid changes in regulatory environments, subsidy systems, and supply chain structures. As a result, securing price competitiveness and proactively responding to country-specific regulations are emerging as key strategic priorities for automakers.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period