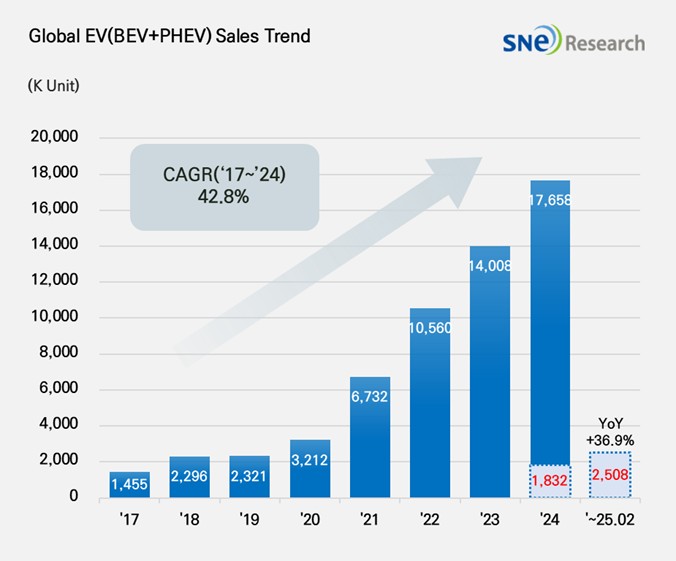

From Jan to Feb 2025, Global[1] Electric Vehicle Deliveries[2] Recorded Approx. 2.508 Mil Units, a 36.9% YoY Growth

-

From Jan to Feb 2025, BYD ranked No. 1 in the ranking of global EV sales,

selling approx. 540k units

From

Jan to Feb 2025, the number of electric vehicles registered in countries around

the world was approximately 2.508 million units, about 36.9% YoY increase.

(Source: Global EV and Battery Monthly Tracker – Mar 2025, SNE Research)

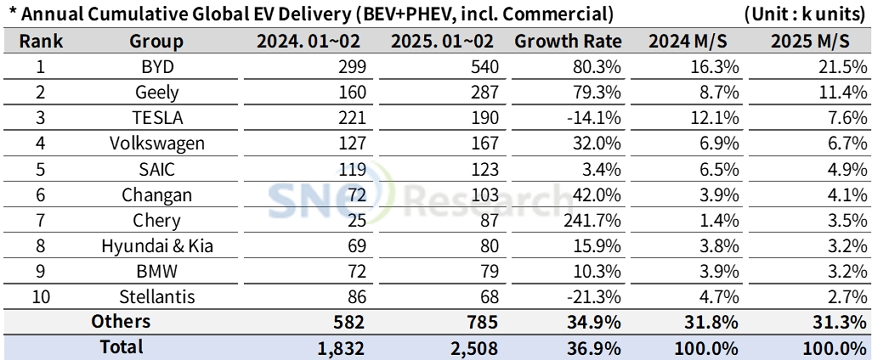

If we look at the global EV sales by major OEMs from Jan to Feb 2025, BYD remained top on the list by selling 540k units of electric vehicles and posting a 80.3% YoY growth. BYD keeps pushing ahead with its aggressive growth strategy in 2025, accelerating its global expansion. This year, BYD has set a goal of selling 6 million units. In particular, BYD is intensifying its local production capacity in areas like Europe and Southeast Asia, trying to achieve growth two times higher than the previous year. BYD’s strategy is analyzed as an intention to enhance brand awareness not only by leveraging cost competitiveness but also by promptly responding to local policy changes and implementing the localization strategies.

Geely Group, ranked 2nd on the list, stayed in an upward trend by selling 287k units, a 79.3% YoY growth. The recently-released ‘Star Wish(星愿)’ model was well received in the market, contributing to Geely’s expansion of EV portfolio. Additionally, Geely Group operates a diverse range of brands, including the premium brand ZEEKR (极氪), the hybrid-exclusive brand Galaxy (银河), and LYNK & CO (领克), which targets the global market, allowing it to reach a wide consumer base. In particular, Geely is rapidly transitioning from internal combustion engine vehicles to electric vehicles while simultaneously strengthening its technological development and production capabilities. As a result, continued high growth is expected in 2025.

Tesla, which ranked 3rd, saw a 14.1% decrease in sales compared to the same period of last year, selling 190k units. Sales of Model 3 and Y have noticeably slowed down. In particular, in Europe, sales dropped by 38%, and in North America, they decreased by 2%. In this regard, Tesla is aiming for 2025 to be a turning point, planning to launch a new affordable electric vehicle ‘Model Q’ in the first half of 2025 to drive a rebound in sales. Additionally, Tesla is working on enhancing the performance of its Full Self-Driving (FSD) software and expanding its subscription-based services to strengthen its software-driven revenue model. Meanwhile, Tesla is improving cost competitiveness through enhanced production efficiency at its Texas Gigafactory and plans to establish a new plant in Mexico. Despite the intensifying price competition in the electric vehicle market, Tesla is focusing on securing long-term profitability.

Hyundai Motor Group sold approximately 80k electric vehicles, recording a 15.9% YoY growth and showing a gradual recovery in sales. The main models, IONIQ 5 and EV6, are driving the recovery in sales through improvements in product appeal via a facelift. Kia’s EV3 are continuing to see expanded sales in the global market. In particular, Hyundai Motor Group is boasting a strong presence in the North American market, outperforming Stellantis, Ford, and GM. At the recent '2025 Kia EV Day' held in Spain, Kia announced its new electrification strategy. At this event, Kia unveiled the compact electric sedan EV4 and the small electric SUV concept car EV2 for the first time in the world, showcasing its commitment to the popularization of electric vehicles.

(Source: Global EV and Battery Monthly Tracker – Mar 2025, SNE Research)

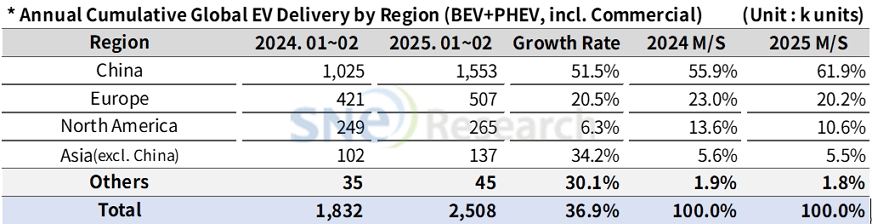

From Jan to Feb 2025, the Chinse market reaffirmed its position as a key region for electric vehicle adoption, with the regional EV sales recording a 51.5% YoY growth and the global market share of 61.9%. This growth was thanks to the strong support policies for New Energy Vehicles of the Chinese government, as well as the increased production and strengthened technological competitiveness of local OEMs such as BYD, NIO, and Xpeng. Additionally, the Chinese government's decision to maintain tax incentives for new energy vehicles and expand public and commercial electric vehicle charging infrastructure, even after the termination of electric vehicle subsidies, is playing a key role in sustaining growth.

Meanwhile, Europe saw a recovery even during the chasm period, recording a 20.5% increase in sales compared to the same period of last year. A key factor driving this growth is the tightening of environmental regulations in Europe and electrification roadmaps laid out by different European countries. However, as the regulation which requires automakers to sell at least 20% electric vehicles has postponed till 2027, it is expected that the resilience of the European EV market would decrease in the mid to long term. The postponement of regulation is interpreted as a policy decision to reflect the necessity for structural stabilization of the regional EV ecosystem which encompasses the restoration of independence in raw material supply, the establishment of battery-related regulations, and the reallocation of production bases.

The North American market posted a 6.3% of growth, accounting for 10.6% of the global market share. Due to the tax credit benefits under the US Inflation Reduction Act(IRA), major manufacturers such as GM, Ford, and Hyundai Motor Group are increasing their local production share in North America. However, since the embarkment of Trump Administration, there have been growing uncertainties in the market due to the abolition of mandatory electric vehicle sales targets, a reduction in electric vehicle subsidies, and the imposition of tariffs on battery raw materials. In addition, the recently announced policies on baseline tariffs, reciprocal tariffs, and tariffs on electric vehicles have further increased uncertainties in the industry. In this regard, major OEMs are necessary to establish a strategy to have a balanced portfolio between ICE vehicles and electric vehicles as well as to establish response measures against policy changes.

The Asia market (excluding China) exhibited a 34.2% YoY growth and accounted for 5.5% of the global market share. The region saw an overall expansion of electric vehicle market, but the growth seems to be limited due to differences between national policies upheld by difference countries and popularity of ICE vehicles and hybrid cars. In particular, India, Vietnam and Thailand recorded a higher sale of electric vehicles than Korea and Japan. The strong sales of electric vehicles in those countries are thanks to government subsidies for EV purchase, the establishment of charging infrastructure, and standardization of related policies. The Southeast Asian region is highly likely to face risks in production and export due to high tariffs imposed by the US government. India, on the other hand, seems to benefit from the current circumstance in the short term thanks to India’s relatively lower tariff exposure compared to other markets.

(Source: Global EV and Battery Monthly Tracker – Mar 2025, SNE Research)

The electric vehicle (EV) market in 2025 is characterized by China's dominance, industrial restructuring in advanced economies, and the growing potential of emerging markets. China is leading the global market by expanding domestic production backed by government support, while Europe and North America are restructuring their industries amid policy uncertainties such as regulatory easing and increased tariffs. Between 2026 and 2027, the market is expected to enter a new phase of growth, driven by declining battery costs, an increase in new vehicle models, and the expansion of charging infrastructure. Accordingly, automakers will need to not only strengthen their price competitiveness but also proactively respond to region-specific regulations and subsidy frameworks. Diversification strategies such as autonomous driving, Full Self-Driving (FSD), and subscription-based software are also emerging as key priorities. Meanwhile, the U.S. tariff policy may lead to short-term increases in EV prices and a decline in demand, but in the medium to long term, it could create a favorable environment for K-trio with local production bases in the U.S. and Europe. China is dominating the market by leveraging its supply chain, while the United States is strongly pushing forward with policies centered around domestic interests. In this situation, South Korea needs a strategy that maintains a balanced position between the two countries.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period