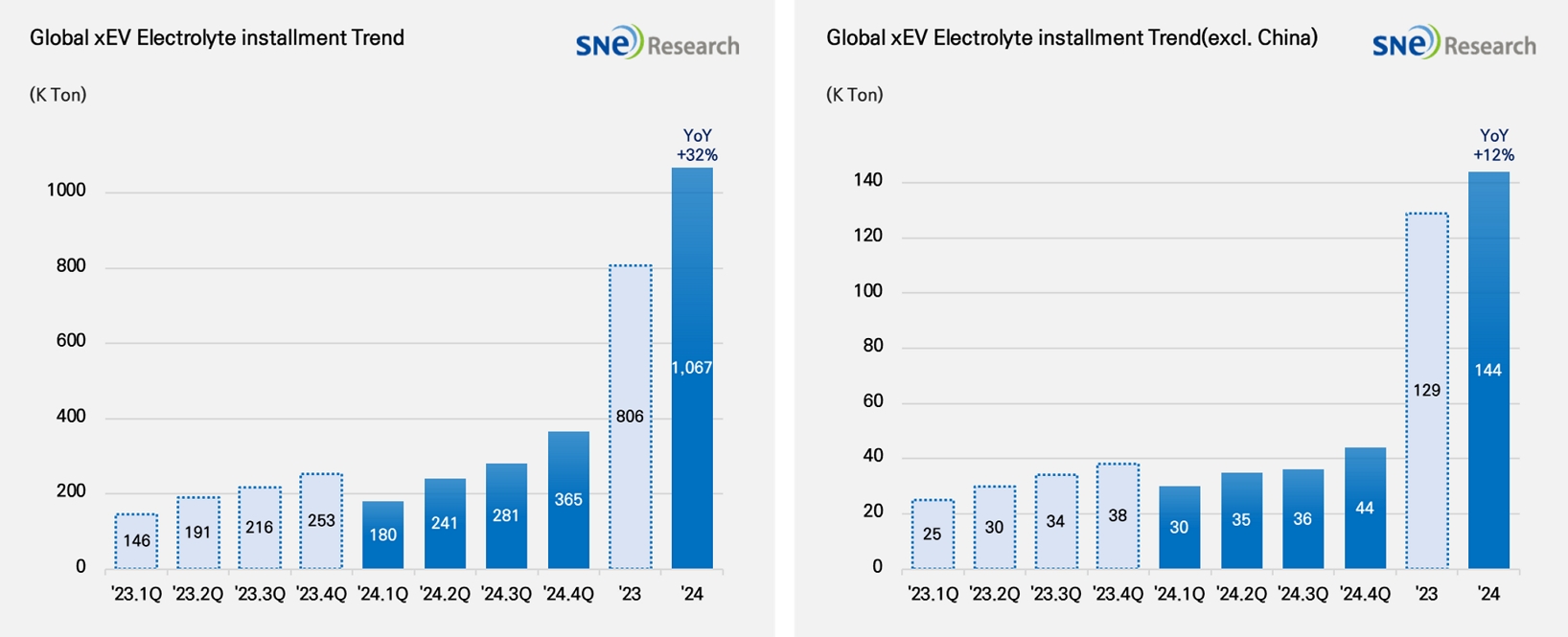

In 2024, Global[1] Electric Vehicle Battery Electrolyte Installment[2] Recorded 1,067K ton, a 32% YoY Growth

- In 2024, the non-China EV electrolyte market grew by 12%, reaching 144K.

(Source: 2025 Feb Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

In 2024, total installment of electrolyte used in electric vehicles (EV, PHEV, HEV) registered around the world was approx. 1,067K ton, showing a 32% YoY growth. Particularly in the non-China market, a total usage of electrolyte grew by 12%, recording 144K ton and showing a stable growth.

Electrolyte is one of key materials and facilitates the transfer of lithium ions inside batteries, directly affecting the battery charging speed, safety, and battery life. With the electric vehicle market expanding and demand for high-performance batteries increasing, the electrolyte market has been rapidly growing.

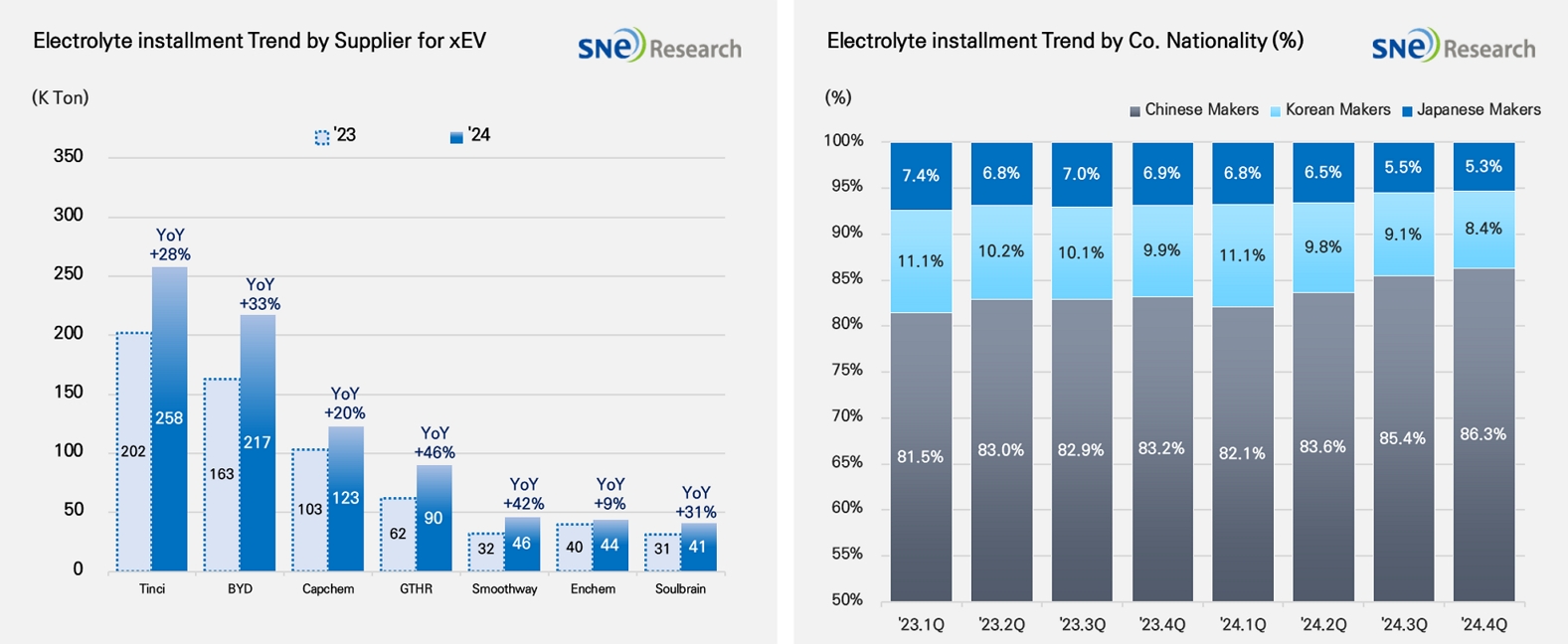

In the global electrolyte market in 2024, a high growth of major electrolyte suppliers was noteworthy. Tinci ranked 1st on the list with 258K ton, followed by BYD with 217K ton. Capchem and GTHR recorded 123K ton and 90K ton respectively, which was huge increases in the usage of their electrolyte products. Smoothway, Enchem, and Soulbrain also continued to be in a growth trend.

(Source: 2025 Feb Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

Amidst the global electrolyte market mainly led by the Chinese companies, the Korean and Japanese electrolyte manufacturers are also proactive in expanding their market shares. As of 2024, the market shares held by the Chinese companies were 84.8%, while the Korean and Japanese suppliers accounted for 5.9% and 9.3%, respectively. In the electrolyte market, the Chinese companies have been continuously expanding their influences, while the Korean and Japanese makers have been strengthening their strategies based on differentiated technologies and product quality.

In future, the electrolyte for EV market is projected to experience intensified competitions centered on development of next-generation electrolyte suitable for batteries with high power output and high safety. In addition, as major battery makers have adopted next-gen battery technologies, the electrolyte companies are expected to continue their effort for technological innovation as one of their response measures. The global electrolyte market is projected to continue a high growth trend in years to come, and a growth in the non-China market would particularly draw attention from market players.

[2] Based on batteries installed to electric vehicles registered during the relevant period.