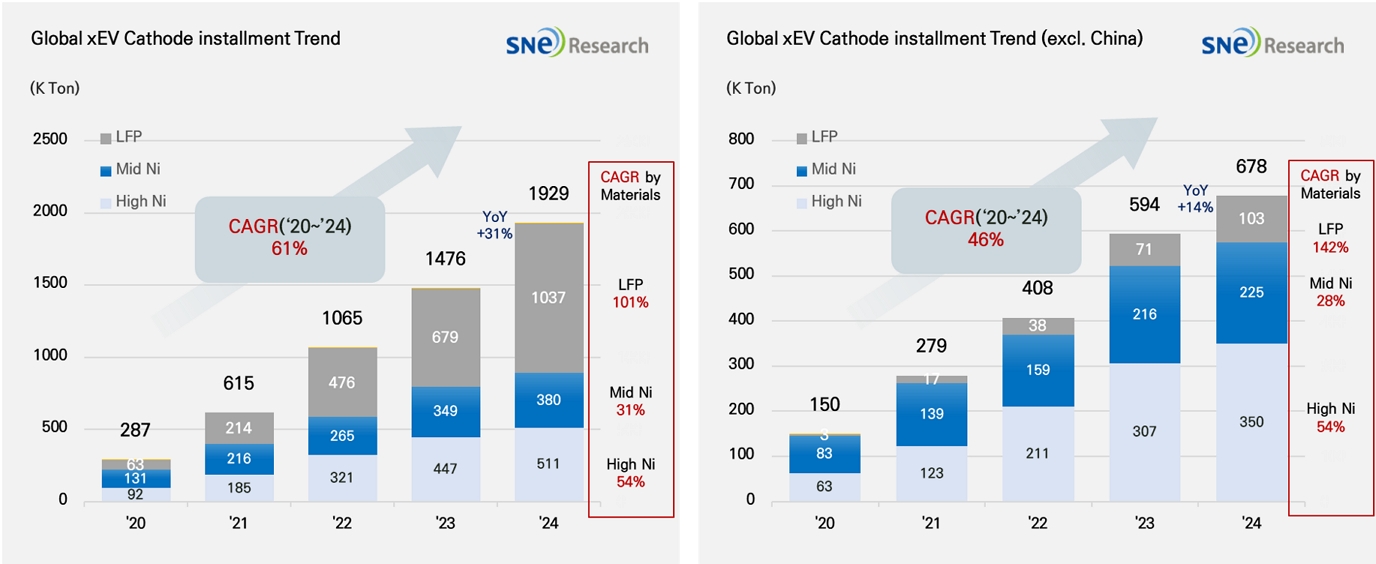

In 2024, Global[1] Electric Vehicle Battery Cathode Material Installment[2] Reached 1,929K Ton, a 31% YoY Growth

- In 2024, EV battery cathode material installment in non-China market was 678K ton, posting 14% growth

(Source: 2025 Feb Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

In 2024, total installment of cathode materials used in electric vehicles (EV, PHEV, HEV) registered worldwide was approximately 1,929K ton, posting a 31% YoY growth. In particular, the installment of cathode materials used in electric vehicles in the non-China market recorded 678K ton, posting 14% growth and showing a stable growth.

Cathode material is a key material determining the capacity and output value of lithium-ion battery, upon which the performance of battery and driving range of electric vehicles depend. Currently in the battery market, NCx ternary cathode material, with relatively high capacity, and LFP cathode material, with low capacity but high safety, are competing. Ternary battery has been showing a high growth in both the global and non-China markets. However, LFP has been also rapidly expanding its market share, growing at a CAGR of 101% in the global market and at a CAGR of 142% in the non-China market.

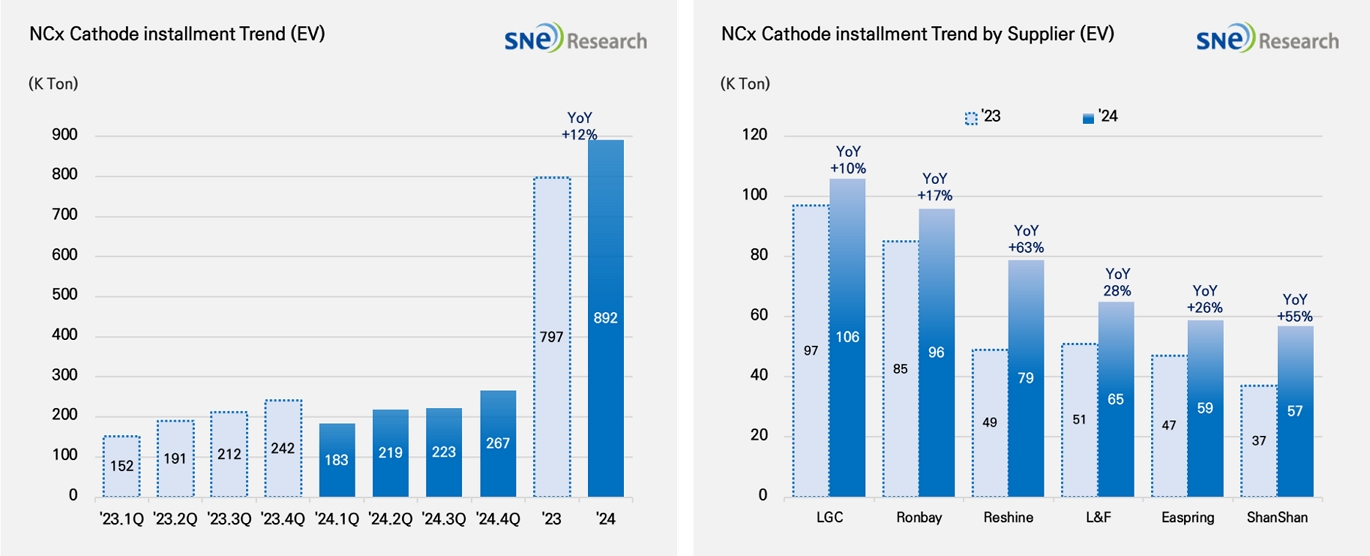

Below graph shows a comparison between the NCx and LFP markets.

(Source: 2025 Feb Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

In 2024, total installment of ternary cathode materials in the global market was 892K tons, showing a 12% growth and a continuous expansion. By company, LG Chem ranked No. 1, followed by Ronbay, while Reshine rose to the 3rd place on the list with a 63% YoY growth. L&F and EcoPro, major cathode suppliers in Korea together with LG Chem, ranked 4th and 7th with a 28% and 6% growth respectively, but overall, the growth of Chinese cathode suppliers was remarkable. The Chinese cathode manufacturers have been expanding their global market shares by aggressively ramping up their production capacity and based on price competitiveness.

(Source: 2025 Feb Global EV & Battery Monthly Tracker (Incl. LiB 4 Major Materials), SNE Research)

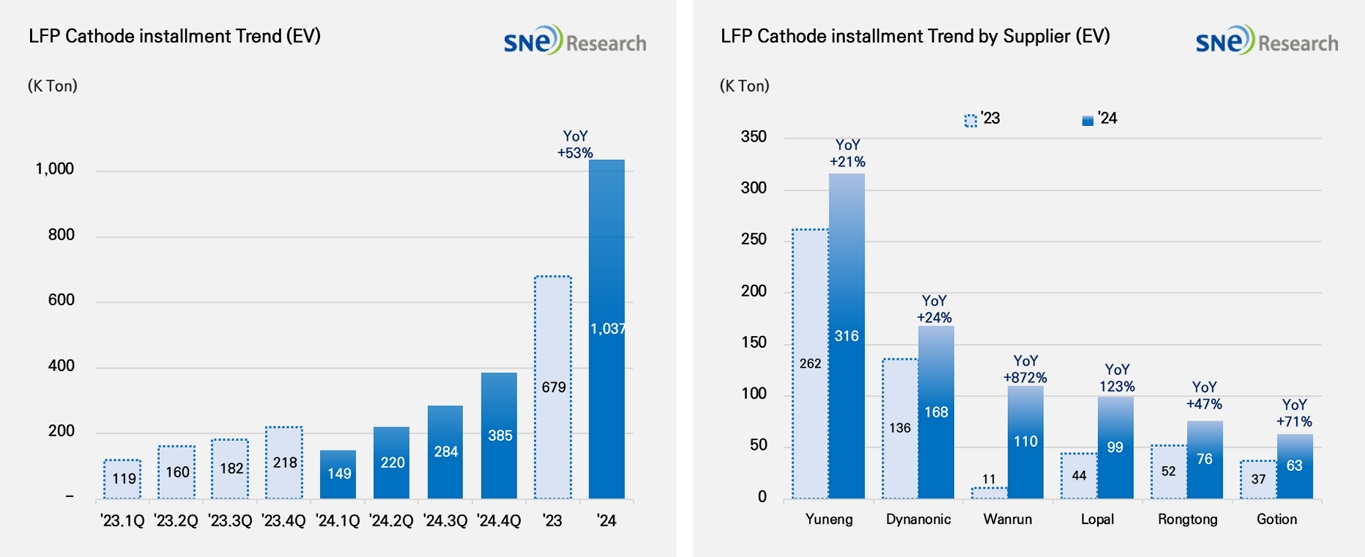

Meanwhile, the LFP cathode material market showed an explosive growth of 53% YoY, reaching 1,037K ton. This is 39%p higher than that of ternary cathode material market, meaning that the market share of LFP cathode material reached 54%, surpassing half. Behind this growth of LFP cathode material market, the monopolized structure of supply by Chinese companies is a key drive. Currently, LFP cathode materials are all supplied by Chinese companies, and among them, Yuneng and Dynanonic captured 1st and 2nd places on the list. Following them, Wanrun and Lopal captured 3rd and 4th places with a rapid growth, intensifying competitions in the market. As a result, such an explosive expansion of LFP cathode material market serves as a factor that further reinforces the market dominance of Chinese companies, leading to a rapid change in the landscape of the global battery material market.

In future, competitions between high-Ni NCM and LFP are expected to get fiercer in the EV cathode material market. Particularly in regions other than China, major OEMs area increasingly adopting LFP cathode materials, and as part of their response measures, cathode suppliers are trying to diversify their product portfolios by ramping up their LFP production facilities in collaboration with battery makers. In 2024, the cathode material market maintained a high growth trend overall, with LFP rapidly expanding its market share. In future, technology and cost competitions between high-Ni NCM and LFP, centered on electric vehicles, are projected to accelerate. It is also expected that the market dynamics would continuously change in accordance with strategic shifts of OEMs.

[2] Based on batteries installed to electric vehicles registered during the relevant period