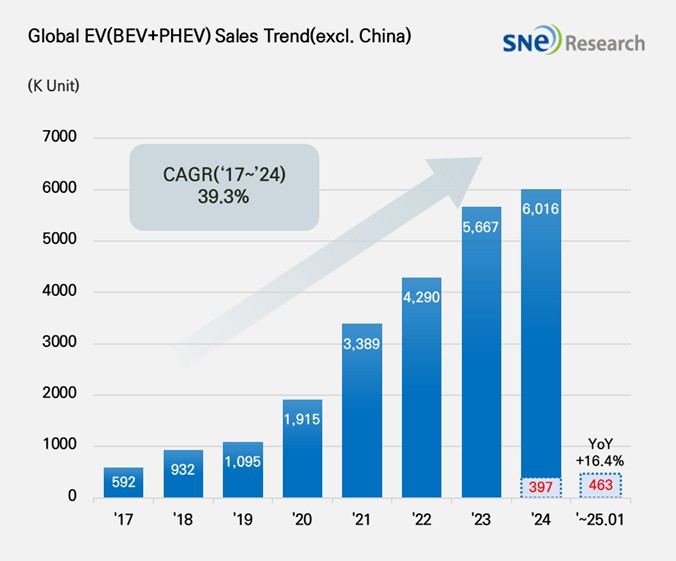

In Jan 2025, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded About 463k Units, a 16.4% YoY Growth

- Tesla falls to second place due to the impact of declining sales in the European market

In Jan 2025, the total number of electric vehicles

registered in countries around the world except China was approx. 463k units, a

16.4% YoY increase.

(Source: Global EV & Battery Monthly Tracker – Feb 2025, SNE Research)

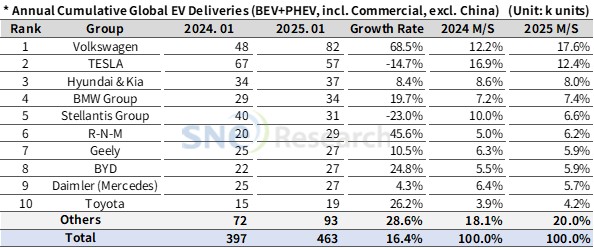

If we look at the number of electric vehicles sold in the world except China market in Jan 2025, Volkswagen Group outran Tesla and captured the 1st place in the ranking by selling 82k units, a 68.5% increase compared to the previous year. The growth of VW Group was mainly led by favorable sales of VW’s main models – ID.3, ID.4, ID.7, Q4 e-Tron, and ENYAQ – to which MEB platform are installed. Tesla ranked 2nd with declines in sales of Model 3 and Y, selling 57k units and posting a 14.7% YoY decrease.In particular, Tesla saw a slowdown in sales in Europe (45.9% YoY decrease) and North America (2.1% YoY decrease) In this regard, Tesla Tesla is positioning 2025 as a turning point and aims to rebound in sales by launching a new affordable electric vehicle in the first half of 2025. In addition, it has been working on sophisticating its FSD software and expanding subscription services to strengthen a software-based revenue model. Meanwhile, Tesla tries to improve the efficiency in the Texas Gigafactory and newly build a factory in Mexico in an effort to improve cost competitiveness. Admist intensifying price competition in the EV market, Tesla is focusing on securing long-term profitability.

The 3rd place was taken by Hyundai Motor Group, selling about 37k units and recording a 8.4% YoY growth. Hyundai’s main models – IONIQ 5 and EV 6 – have been leading a recovery in sales based on improved product competitiveness of their facelifted version released in 2025. Kia also saw an expansion in global sales led by EV 3 and EV 9. In particular, Hyundai Motor Group is showing strong performance by surpassing the electric vehicle deliveries of Stellantis, Ford, and GM in the North American market. At <2025 Kia EV Day> taking place in Spain, Kia announced a new electrification strategy. At the event, Kia unveiled its compact electrified EV 4 and small-size electric SUV concept car EV 2 for the first in the world, demonstrating its commitment to the popularization of electric vehicles. Particularly, EV 2 is a small-size electric SUV targeting the European market, and Kia is aiming to launch EV 2 in 2026. This can be analyzed as one of Kia’s strategies to reinforce its competitive edge in the European market.

(Source: Global EV & Battery Monthly Tracker – Feb 2025, SNE Research)

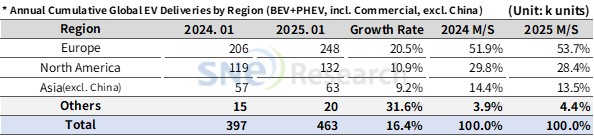

Meanwhile, Europe, which posted a degrowth due to chasm last year, showed a recovery with 20.5% YoY growth. The growth seemed to be led by reinforced environmental regulations in Europe. Against this backdrop, more electric vehicle line-ups have been released, centered around small-size electric vehicles, and OEMs have been launching new vehicles in accordance with the trend. Renault introduced small-size, hatchback ‘R5,’ while other OEMs such as Stellantis (e-C3), Kis (EV3) and Hyundai (Inster) have been active in targeting the European market.

The North American market grew by 10.9% and accounted for 10.5% of the global electric vehicle market. Thanks to tax credits offered under the US Inflation Reduction Act (IRA), major OEMs such as GM, Ford, and Hyundai have been increasing their local production in North America. However, with the Trump Administration embarked on in 2025, uncertainties are growing in future market as the Administration is currently contemplating on imposing tariffs on battery raw materials, reducing EV subsidies, and abolition of mandatory EV sales targets. In this regard, it is important for OEMs to establish flexible strategies to address policy changes and to build a balanced portfolio between internal combustion engine vehicles and electric vehicles.

The Asian market (excluding China) grew by 9.2%, recording a global market share of 13.5%. Major countries such as South Korea, Japan, and India are working to expand the electric vehicle market, but growth has relatively slowed. This slowdown is attributed to differences in each country's EV adoption policies and the strong performance of internal combustion engine and hybrid vehicles. Japan's Toyota and Honda have maintained a strategy centered on hybrid vehicles. However, they have recently begun actively launching pure electric vehicle (BEV) models in an effort to expand their market presence. In India, Tata Motors and Mahindra are increasing EV production, and government subsidies are being strengthened. However, demand for internal combustion engine vehicles remains high, and the development of EV charging infrastructure is still in progress.

(Source: Global EV & Battery Monthly Tracker – Feb 2025, SNE Research)

In Jan 2025, the global EV market has been still in an upward trend, but region-specific market structures and policy changes are shaping the direction of the industry. In Europe, the EV market has been going through restructuring in accordance with strengthened regulations on carbon emission. In North America, the distribution of EV has been continuously expanding due to the implementation of IRA, while possible policy changes made by the Trump Administration increase uncertainties in the market. In the Asian market (excluding China), differentiated EV adoption policies by country are shaping the landscape. The response strategies of key markets such as Japan and India are expected to be crucial factors in determining future market growth rates.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period