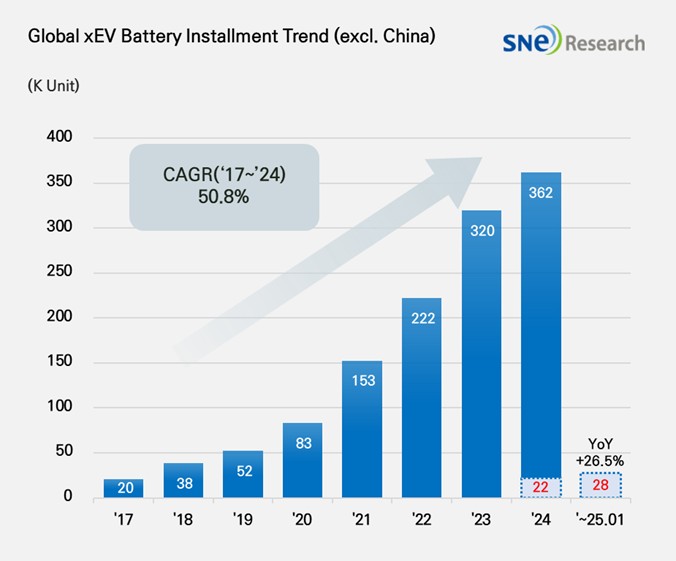

In Jan 2025, Non-Chinese Global[1] EV Battery Usage[2] Posted 28.0GWh, a 26.5% YoY Growth

- In Jan 2025, K-trio’s combined M/S recorded 37.9%.

Battery installation for

global electric vehicles (EV, PHEV, HEV) excluding the Chinese market sold in

January 2025 was approximately

28.0GWh, a 26.5% YoY

growth.

(Source: Global EV and Battery Monthly Tracker – Feb 2025, SNE Research)

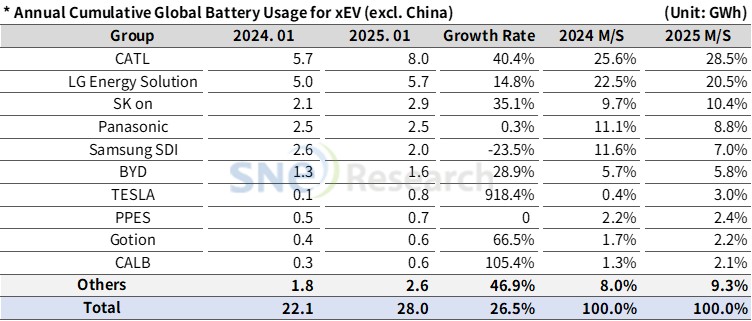

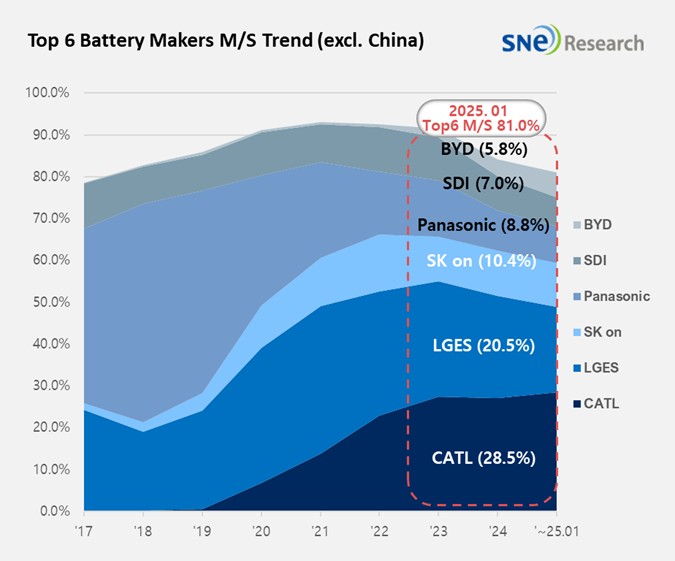

The combined market shares of LG Energy Solution, SK on, and Samsung SDI in global electric vehicle battery usage in Jan 2025 posted 37.9%, a 6.0%p decline from the same period of last year. LG Energy Solution kept the 2nd position in the ranking with 14.8%(5.7GWh) YoY growth, while SK On ranked 3rd with 35.1%(2.9GWh). On the other hand, Samsung SDI posted a 23.5%(2.0GWh) degrowth. The downward trend in Samsung SDI’s battery usage was mainly caused by a decline in demand for batteries from major car OEMs in Europe and North America.

(Source: Global EV and Battery Monthly Tracker – Feb 2025, SNE Research)

If we look at the usage of battery made by the K-trio in terms of the sales volume of models, Samsung SDI’s battery was mainly used in BMW, followed by Audi and Rivian. BMW has Samsung SDI’s battery in its models such as i4, i5, i7, and iX, and among these, i5 released in 2023 sold well in the market. On the other hand, even though Rivian posted a steady sale of R1S and R1T in the US, the release of standard-range trim with LFP battery, made by a battery maker other than Samsung SDI, had a negative impact on the installment volume of battery made by Samsung SDI. AUDI saw a decrease in sales of Q8 e-Tron, leading to a 23.4% decline in the usage of Samsung SDI’s battery compared to the previous year.

SK On’s battery was mainly installed in EV models made by Hyundai Motor Group, followed by Mercedes-Benz and Volkswagen. Hyundai Motor Group saw a recovery in sales after the facelifted version of IONIQ 5 and EV 6 were released. Mercedes-Benz saw favorable sales of compact SUV EQA and EQB, to which SK On’s battery are installed, which was similar to the same period of last year. Along with this, solid sales of VW ID.7 and ID.4 also brought about a positive impact on growth of battery usage made by SK On.

LG Energy Solution’s battery was mainly used by Tesla, followed by VW, Chevrolet, and Kia. In the case of Tesla, the sales decline of models equipped with LG Energy Solution batteries led to a 35.0% decrease in Tesla’s usage of LG Energy Solution batteries. Meanwhile, the total usage grew by 14.8% due to strong sales of Volkswagen’s ID series, Kia’s EV3 and the expanded sales of Chevrolet Equinox, Blazer, and Silverado EVs, which are built on the Ultium platform.

Panasonic, which primarily supplies batteries to Tesla, remained in 4th place with a battery usage of 2.5GWh. The decline in sales of the Model 3, which was temporarily halted at the beginning of the year due to a facelift, combined with Tesla's overall sales decline this year, is analyzed as the main reason. Panasonic is expected to quickly recover its battery usage in North America, primarily for Tesla, by releasing improved 2170 and 4680 cells.

China’s CATL boasted the biggest market shares in the global market (excl. China), growing by 40.4%(8.0GWh) compared to the same period last year. Currently, many major OEMs around the world such as VW, BMW, Mercedes, and Hyundai Motor adopted CATL’s batteries. In particular, CATL is expected to rapidly expand its global market share by addressing the issue of oversupply in the Chinese domestic market through exports to countries such as Brazil, Thailand, Israel, and Australia.

(Source: Global EV and Battery Monthly Tracker – Feb 2025, SNE Research)

The global electric vehicle market continues to grow in 2024, but trends vary across different regions. In markets outside of China, some regions are experiencing a slowdown or stagnation in EV adoption, while certain emerging markets continue to show solid growth. India and Southeast Asia are key markets where EV adoption is expected to expand rapidly. Korean companies are building diverse product portfolios, including cost-competitive LFP batteries, to capture these opportunities. Additionally, expanding collaboration models with local automakers and optimizing the battery supply chain will be crucial tasks for securing a competitive edge in these markets. To gain a competitive edge in the global battery market, it is essential to go beyond simply increasing production capacity and focus on region-specific strategies and next-generation technological innovations. Building a sustainable supply chain and strengthening close collaboration with automakers will be key factors in securing long-term competitiveness.

[2] Based on battery installation for xEV registered during the relevant period