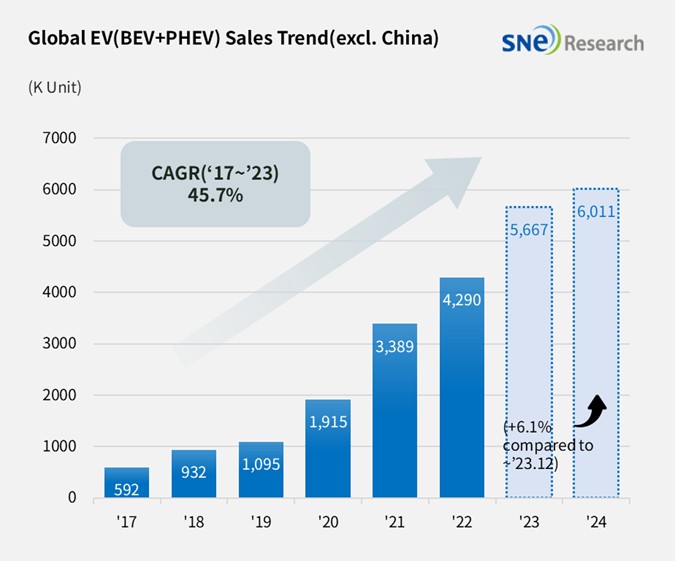

From Jan to Dec 2024, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded About 6.01 Mil Units, a 6.1% YoY Growth

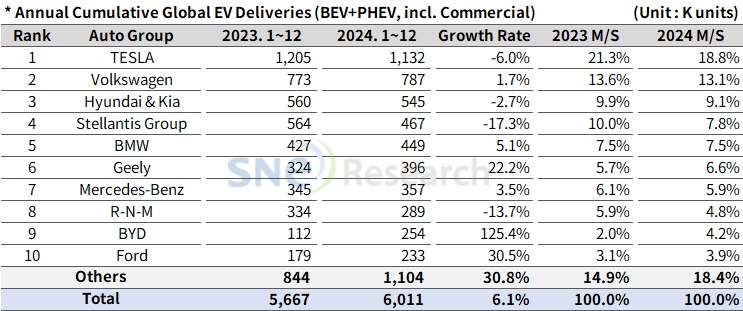

- In 2024, Tesla ranked No. 1 in non-China EV market in terms of EV deliveries

From Jan to Dec 2024, the total number of

electric vehicles registered in countries around the world except China was approx.

6.01 million units, a 6.1% YoY increase.

(Source: Global EV & Battery Monthly Tracker – Jan 2025, SNE Research)

If we look at the number of electric vehicles sold in the world except the China market from Jan to Dec 2024, despite recording a 6.0% degrowth, Tesla stayed No. 1 on the list. Tesla currently aims to produce a new model at entry-level in the first half of 2025 and also improve the FSD technology this year, leading to an expectation for increased sales in 2025.

The Volkswagen Group, where Audi, Porsche, and Skoda belong to, posted a 1.7% YoY growth and ranked 2nd on the list. While Q4/8 e-tron and PHEV models showed a steady increase in sales, sales of VW’s main models, ID.3/4/5, have been sluggish. This seemed to be caused by a continuous slowdown in EV demand in the European market.

The 3rd place was taken by Hyundai Motor Group, selling approx. 545k units and posting a 2.7% YoY degrowth. Sales of IONIQ 5 and EV6 experienced a slowdown compared to the same period of last year, but global sales of EV3 and EV9 have been expanding. In particular, Hyundai Motor Group outperformed Stellantis, Ford, and GM in terms of EV deliveries in North America. Hyundai Motor Group commenced full-scale operation of HMGMA, which enabled it to produce at least 5 different types of electric vehicles on the US soil. This makes it quality for tax credits of max. US$ 7,500 under the US IRA. However, the Trump administration publicly announced that it would revoke the IRA and reduce tax credits accordingly, the Group is expected to respond to changes in business environment and relevant policies so that it can solidify its presence in the US market.

(Source: Global EV & Battery Monthly Tracker – Jan 2025, SNE Research)

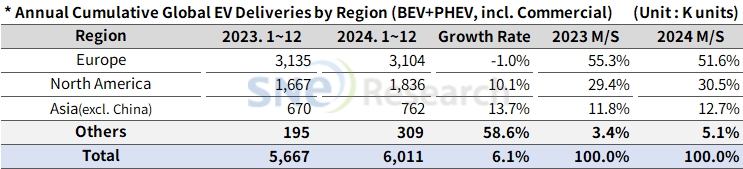

The European EV market accounted for more than half of market share in the non-China market, but it seems that the market has reached a plateau, posting a 1.0% YoY degrowth. On the other hand, with sales of HEV increasing by 22.1%, there seems to be a tendency in Europe to choose HEV rather than BEV. This was caused by a combination of different factors including shortage of EV charging infrastructure and weakened competitiveness in vehicle price.

In the US, there are challenges to tackle; revocation of the EV mandate and high tariffs. The US President Donald Trump announced to implement a 25% additional tariff on electric vehicles imported from Mexico and Canada and a 10% additional tariff on those imported from China, which prevents the Chinese electric vehicles from entering the US market by taking a detour. The approval of full self-driving (FSD) may act as a factor to increase the penetration rate of electric vehicles. commercialization of self-driving technology may lead to expansion of demand for electric vehicles, possibly reignite the growth of EV market in the US.

In Asia (excl. China) and other regions, the EV markets have been rapidly expanding and recording a two-digit growth despite the so-called chasm phase. In particular, the Chinese EV makers are dominating the late-comer markets, accelerating the distribution rate of electric vehicles in emerging countries.

(Source: Global EV & Battery Monthly Tracker – Jan 2025, SNE Research)

In the non-China market, the US and Europe are trying to strengthen protectionism scheme, making the EV market difficult to grow. On the other hand, the hybrid vehicle market has regained a growth momentum, instead. Emerging EV markets have been noticeably growing fast. In 2025, the growth rate of EV market is expected to be highly dependent on changes of policies in different countries. It is time for OEMs to establish response measures in consideration of short-term policy risks and focus on technology innovation efforts as well as establishment of production system in order to prepare for possible market rebound from 2026.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period