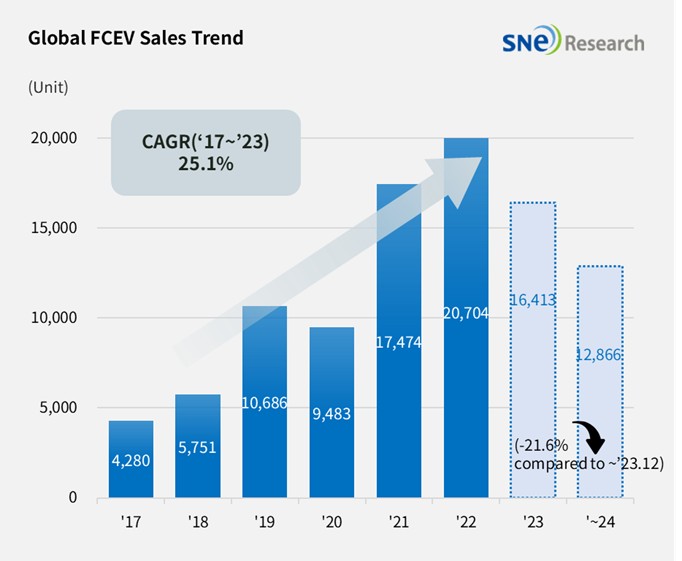

From Jan to Dec 2024, Global FCEV Market with a 21.6% YoY Degrowth

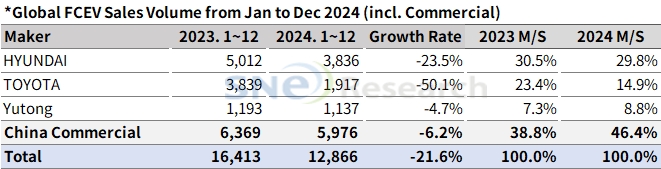

- Hyundai Motor Group ranked No. 1 in global FCEV market from Jan to Dec 2024

A total number of globally registered FCEVs sold from Jan to Dec 2024 was 12,866 units, recording a 21.6% YoY decline.

(Source: Global FCEV Monthly Tracker – Jan 2025,

SNE Research)

By company, Hyundai Motor sold a total of 3,836 units of NEXO

and ELEC CITY, posting a 23.5% YoY degrowth but still capturing the top

position on the list. This sales drop was mainly caused by a declining sale of

NEXO in the Korean domestic market. Hyundai Motor Company has been planning to

launch a follow-up model of NEXO in 2025, together with commercial vehicle

line-ups in an effort to lead the FCEV market. Toyota, selling 1,917 units of

Mirai and Crown, recorded a 50.1% YoY decline, as well. On the other hand, the

Chinese FCEV makers have enjoyed a steady sale of vehicles mainly focusing on

commercial ones.

(Source: Global FCEV Monthly Tracker – Jan 2025, SNE

Research)

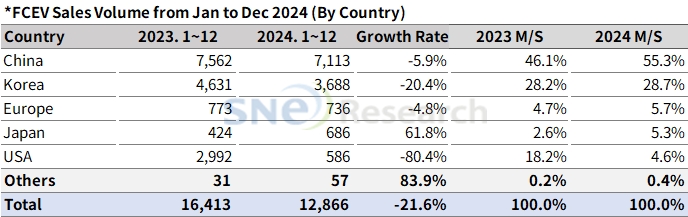

By country, due to a sluggish sale of NEXO, Korea experienced a 23.5% YoY degrowth, accounting for 29.8% of market share, declined by 0.7%p. China recorded a continuous growth centered around hydrogen commercial vehicles, capturing No. 1 position not only in the global EV market but also in the FCEV market. In Europe, 716 units of Toyota Mirai was sold, posting a 4.8% YoY decrease. On the other hand, sales of Mirai in the US have dropped, posting an 80.4% YoY degrowth. In Japan, although the sale of Toyota Mirai plummeted, 565 units of Crown, released last year, were sold. Among the major regions, Japan was the only nation exhibiting a high growth rate of 61.8%.

(Source: Global FCEV Monthly Tracker – Jan 2025, SNE

Research)

Since reaching the pinnacle in 2022, the FCEV market

recorded a 20.7% YoY degrowth in 2023 and 21.6% YoY degrowth in 2024. A

sluggish sale of hydrogen fuel cell vehicles in the Korean market has acted as

a major cause of declines in the global FCEV market. In this regard, the Korean

government has been revising the FCEV distribution expansion strategies to

place more focus on commercial vehicles than on passenger ones. However, there

are still challenges to overcome such as shortage of charging infrastructure,

cost of hydrogen production and storage, and difficulties in securing economic feasibility.

In order to achieve the expansion of global FCEV market in the long term, it is

necessary to implement various strategies to expand charging infrastructure,

extend the commercial vehicle market, and reduce the hydrogen production cost. In

addition, it seems that public-private cooperation would be essential for

further development in the FCEV industry. If all these substantial issues are

cleared up, FCEVs are highly likely to position as one of key mobility

technologies leading the carbon-neutrality era.