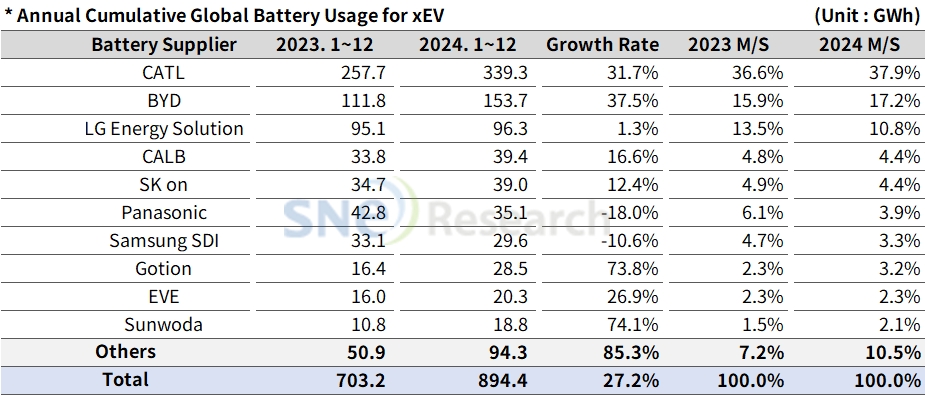

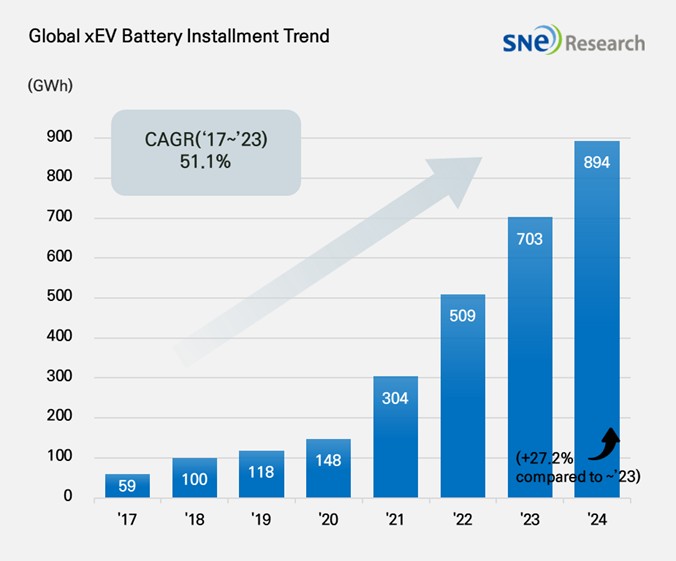

From Jan to Dec 2024, Global[1] EV Battery Usage[2] Posted 894.4GWh, a 27.2% YoY Growth

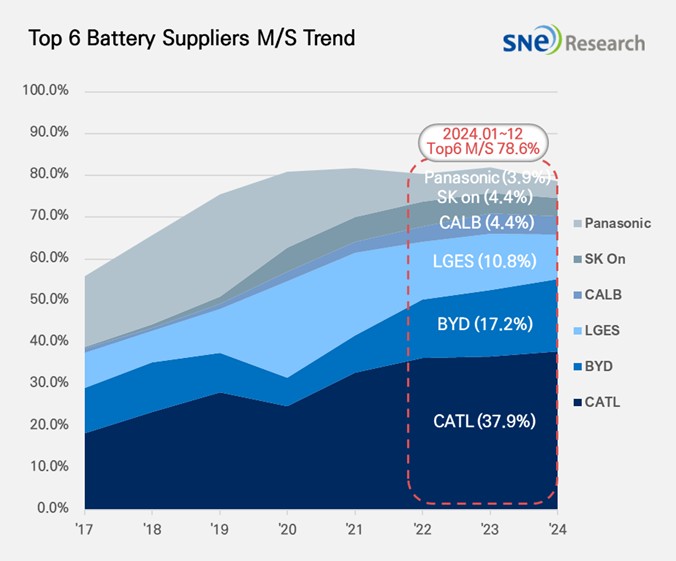

- From Jan to Dec 2024, K-trio’s M/S recorded 18.4%

From January to December 2024, the amount of energy held

by batteries for electric vehicles (EV, PHEV, HEV) registered worldwide was approximately

894.4GWh, a 27.2% YoY growth.

(Source: 2025 Jan Global Monthly EV and Battery Monthly Tracker, SNE Research)

The combined market shares of LG Energy Solution, SK On, and Samsung SDI

in global electric vehicle battery usage from Jan to Dec 2024 posted 18.4%, a

4.7% decline from the same period of last year. LG Energy Solution remained 3rd

on the list with a 1.3%(96.3GWh) YoY growth. SK On ranked 5th with a

12.4%(39.0GWh) growth. On the other hand, Samsung SDI exhibited a 10.6%(29.6GWh)

degrowth. The downward trend in Samsung SDI’s battery

usage was mainly caused by a decline in demand for battery from major car OEMSs

in Europe and North America.

(Source: 2025 Jan Global Monthly EV and Battery Monthly Tracker, SNE Research)

If we look at the usage of battery made by the K-trio in terms of the sales volume of models, Samsung SDI’s battery was mainly used in BMW, followed by Rivian and AUDI. BMW has Samsung SDI’s battery in its models such as i4, i5, i7, and iX, and among these, i5, released at the end of 2023, sold well in the market. On the other hand, even though Rivian posted a steady sale of R1S and R1T in the US, the release of standard-range trim with LFP battery installed had a negative impact on the installment volume of battery made by Samsung SDI. AUDI saw a decrease in sales of Q8 e-Tron, leading to a 30.9% decline in the usage of Samsung SDI’s battery compared to the previous year.

SK On’s battery was mainly installed in EV models made by Hyundai Motor Group, followed by Mercedes-Benz, Ford, and Volkswagen. Hyundai Motor Group saw 60.3% and 59.2% declines in sales of Bongo 3 EV and Porter 2 EV respectively compared to last year. On the other hand, its electric passenger car models – IONIQ 5 and EV6 – experienced a slowdown in sales at the beginning of 2024, but they saw a gradual recovery in sales after the facelifted versions were released. In addition, Kia’s EV9 saw a 235.9% increase in battery usage thanks to an expansion in overseas sales. Mercedes-Benz’s compact SUV EQA and EQB, to which SK On’s battery was installed, posted steady sales similar to the same period of previous year. Other than these, Ford’s F-150 Lightning and VW’s ID.7 recorded favorable sales, having a positive impact on increases in the usage of battery made by SK On.

LG Energy Solution’s battery was mainly used by Tesla, followed by VW, Chevrolet, and Ford. Due to the increase in sales of models equipped with LG Energy Solution batteries, Tesla's usage of LG Energy Solution batteries increased by 9.6%. In particular, the battery usage by facelifted Model 3 increased by 47.0% from last year, which was quite noticeable. Other than these, Chevrolet’s usage of LG Energy Solution batteries increased by 24.0% thanks to an expansion in the sales of Chevrolet Equinox, Blazer, and Silverado EV to which the Ultium platform was applied.

Panasonic, who supplies its battery mainly to Tesla, ranked 6th in the list with 35.1GWh of its battery used in 2024, but posted an 18.0% YoY degrowth. The major reason for Panasonic’s degrowth were a decline in sales of Tesla Model 3 due to facelift transformation early 2024 and Tesla’s degrowth in sales in 2024. Panasonic, though, is expected to rapidly regain its market share mainly focusing on Tesla in the North American market by launching its advanced 2170 and 4680 cells supplied to Tesla.

CATL remained No. 1 in the global ranking with a 31.7%(339.3GWh) YoY growth. Major Chinese OEMs, such as ZEEKR, AITO, and Li Auto in the Chinese domestic market – the world’s largest electric vehicle market – have CATL’s battery inside, and global major OEMs such as Tesla, BMW, Mercedes-Benz, and VW also chose CATL’s battery for their EV models.

BYD ranked 2nd on the list with a 37.5%(153.7GWh) YoY growth. BYD, who does not only manufacture battery on its own but also produces EV (BEV+PHEV), has been drawing huge popularity in the market based on its diverse vehicle portfolio and competitive prices. In 2024, the sales volume of BYD’s electric vehicle reached approximately 4.14 million units. By maintaining the growth momentum, BYD plans to sell approx. 6 million new cars in 2025. In particular, BYD has been rapidly expanding its market share beyond the Chinese domestic market by making its way into the Asian and European markets.

Overall, the global EV battery market was in an upward trend in 2024, but there are local differences found in different regions. The Chinese companies have been expanding their global market shares based on their strong holds in the Chinese domestic market. Amidst growing uncertainties in the US and European markets, it is necessary for K-battery companies to come up with strategic response measures to secure their market shares. In particular, it is highly likely that recent changes in the US IRA would act as a major variable across the entire battery industry. To respond, K-battery makers should consider various strategies such as diversification in supply chain, cost reduction, and technology innovation. In addition, in order to expand their market shares in emerging markets, it is critical for them to make advance investment and establish strategic partnerships. If they want to be leading the global battery market in future, current players in the battery industry should move forward beyond simply expanding its production capacity and possess core competitiveness based on differentiated technology and establishment of sustainable supply chain. It is time for K-battery manufacturers to establish long-term strategies accordingly and find their ways in this ever-changing global market environment to pursue sustainable growth.

[2] Based on battery installation for xEV registered during the relevant period.