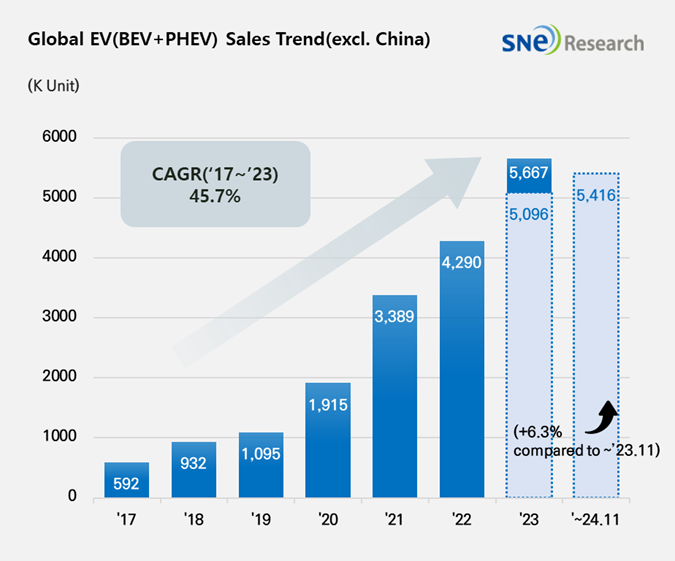

Title: Global[1] EV Deliveries[2] (Excluding China) Reach 5.42 Million Units from January to November 2024, Up 6.3% YoY

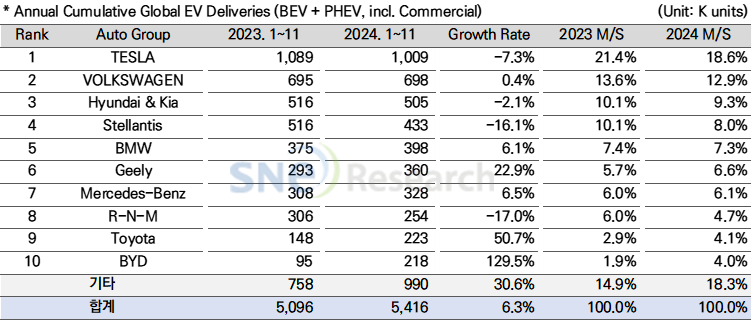

- Tesla Maintains Top Position Despite Declining Growth

From

January to November 2024, the total number of electric vehicles (EVs)

registered globally (excluding China) reached approximately 5.416 million

units, a year-on-year (YoY) increase of 6.3%.

(Source: December 2024 Global Monthly EV

and Battery Monthly Tracker, SNE Research)

Among

global automakers, Tesla retained its No. 1 position despite experiencing

negative growth. Tesla's two flagship models, the Model 3 and Model Y, which

account for about 95% of its total sales, saw declining sales, resulting in a

7.3% YoY decrease. Tesla’s sales fell by 12.9% in Europe and 7.0% in North

America. Tesla is targeting the launch of a new, more affordable model in the

first half of 2025, alongside enhancements in its Full Self-Driving (FSD)

technology, to improve its performance in the future.

Volkswagen

Group, including Audi, Porsche, and Skoda, secured the second position with a

modest 0.4% growth rate YoY. Audi's Q4/8 e-tron and plug-in hybrid electric

vehicle (PHEV) models showed steady sales growth, but Volkswagen's core models,

such as the ID.3/4/5, underperformed. This was attributed to weakening EV

demand in Europe, the primary market for these vehicles.

Hyundai Motor Group ranked third, selling approximately 505,000 units, a 2.1% YoY decline. While sales of key models like the Ioniq 5 and EV6 fell, Kia’s EV3 and EV9 saw expanded global sales. Hyundai also outpaced Stellantis, Ford, and GM in EV deliveries in North America. The group plans to begin local production of at least five EV models in the U.S. by 2025, meeting Inflation Reduction Act (IRA) requirements to secure tax credits of up to $7,500. However, with a potential second Trump administration pledging to reduce or eliminate these subsidies, Hyundai is expected to adapt to evolving policies to strengthen its position in the U.S. market.

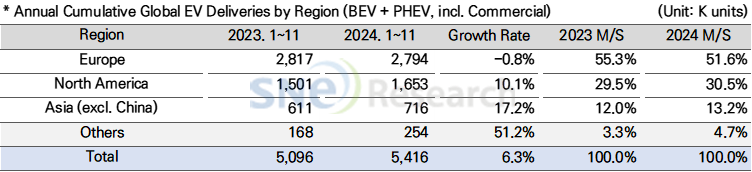

In Europe, the market

contracted by 0.8% YoY, reflecting a slowdown in growth. However, the region

continued to account for more than half of the global EV market (excluding

China). Companies like Geely, Mercedes-Benz, and BMW achieved significant

growth rates of 27.3%, 9.7%, and 8.7%, respectively, compared to the previous

year. Meanwhile, Tesla, Stellantis, and Renault experienced negative growth,

dampening the overall growth rate in the region.

North America recorded a

robust 10.1% YoY growth rate, despite persistent issues with slowing EV demand.

A surge in hybrid vehicle demand led many OEMs to prioritize hybrid

development. Hyundai Motor Group and others have announced plans to develop

Extended-Range Electric Vehicles (EREVs) to cater to this demand.

In Asia (excluding China),

the market expanded by 17.2% YoY, driven by OEMs like BYD, SAIC, and VinFast,

which actively pursued international expansion. VinFast leveraged its success

in Vietnam to enter neighboring markets such as the Philippines and Indonesia

while strengthening its competitiveness in North America through new model

launches and local production.

Despite falling short of

expectations in 2024, the EV market in regions outside China is projected to

recover gradually. The European Union's announcement of stricter CO₂ emission limits for new

cars—93.6g/km starting in 2025—is expected to pressure automakers to increase

EV sales, possibly leading to the revival of subsidies in major markets like

Germany and France.

In the U.S., a second Trump administration could potentially hinder EV market growth by repealing or reducing the IRA. However, given the complexities of reversing the policy swiftly, states with Democratic leadership, such as California, New York, and Pennsylvania, are likely to implement independent EV incentives. If subsidies are indeed phased out, the market may witness a surge in EV demand before their expiration, akin to the spike seen in China before subsidies ended in 2023.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period