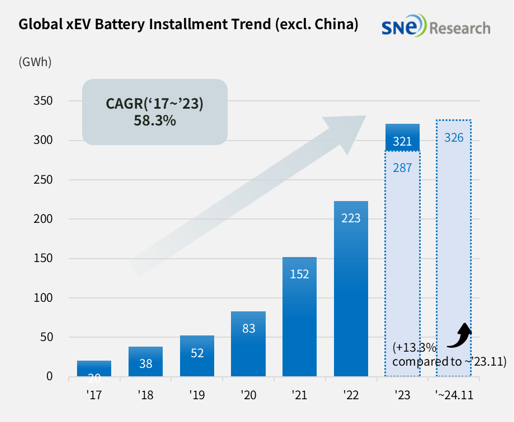

From Jan to Nov 2024, Non-Chinese Global EV Battery Usage Posted 325.6GWh, a 13.3% YoY Growth

- From Jan to Nov 2024,

K-trio’s M/S recorded 45.6%

Battery installation for global electric

vehicles (EV, PHEV, HEV) excluding the Chinese market sold from January to

October in 2024 was approximately 325.6GWh, a 13.3% YoY growth.

(Source: 2024 Dec Global Monthly EV and Battery Monthly Tracker, SNE Research)

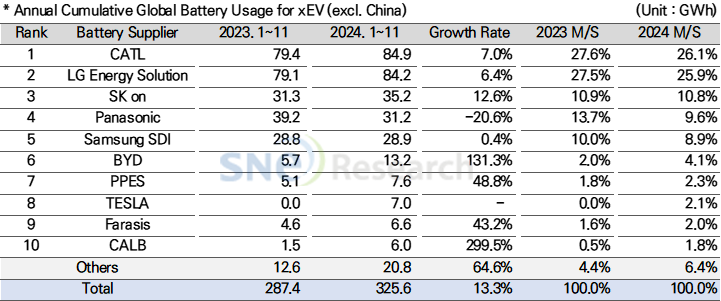

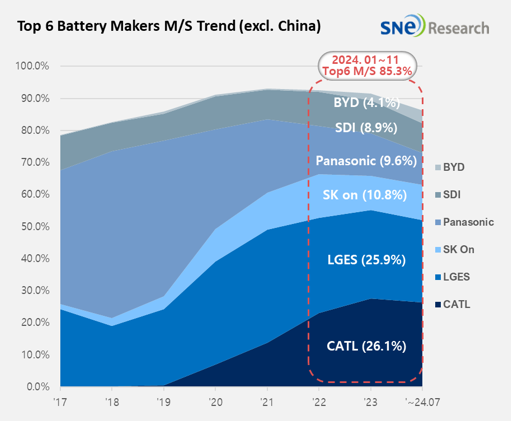

The combined usage of

batteries made by the K-trio companies for electric vehicles from January to

November 2024 was higher than that from the same period of last year. LG Energy

Solution kept the 2nd place in the ranking with 6.4%(84.2GWh) YoY growth, while

SK On ranked 3rd with a 12.6%(35.2GWh) YoY growth. Samsung SDI registered

0.4%(28.9GWh) growth. On the other hand, the combined market shares of K-trio

were 45.6%, declined by 2.7%p compared to the same period of last year.

(Source: 2024 Dec Global Monthly EV and Battery Monthly Tracker, SNE Research)

If we look at the usage of

battery made by the K-trio in terms of the sales volume of models, Samsung

SDI’s battery was mainly used in BMW, followed by Rivian and AUDI. BMW has

Samsung SDI’s battery in its models such as i4, i5, i7, and iX, and among these,

i5, released at the end of last month, were received well by customers. Rivian

posted a steady sale of R1S and R1T in the US. On the other hand, due to a

decrease in sales of the Q8 e-Tron, the amount of Samsung SDI batteries

installed in AUDI has declined approximately 26% compared to the last year.

SK on’s batteries were

found to be mainly installed in vehicles from Hyundai Motor Group,

Mercedes-Benz, Ford, and Volkswagen. In the case of Hyundai Motor Group, the

IONIQ 5 and EV6 showed sluggish sales at the beginning of the year, but sales

have gradually recovered after facelifts, and the Kia's EV9 is performing well

with expanded overseas sales. Mercedes-Benz showed stable sales with the

compact SUV EQA and EQB equipped with SK on’s batteries recording solid sales

at the same level as the same period last year. In addition, strong sales of

the Ford F-150 Lightning and Volkswagen’s ID.7 had a positive impact on the

increase in SK on’s battery usage.

LG Energy Solution’s

battery usage was mainly found to be installed in Tesla, Volkswagen, Ford, and

Hyundai Motor Group. Among Tesla models equipped with LG Energy Solution’s

batteries, the Model Y recorded somewhat low sales, but the sales of the facelifted

Model 3 surged, driving the growth rate. In addition, the Ford's Mustang

Mach-E, Hyundai Motor’s IONIQ 6, and KONA EV showed solid sales and maintained

the growth trend of battery usage.

Panasonic, which mainly supplies batteries to Tesla, ranked 4th this

year with 31.2GWh of battery usage, but it decreased by 20.6% compared to the

same period last year. The main reason is analyzed to be the decrease in sales

of Model 3, which was temporarily suspended due to a facelift at the beginning

of the year, and Tesla’s degrowth in sales in this year. Panasonic is expected

to quickly recover battery usage centered around Tesla in the future by

releasing improved 2170 and 4680 cells for Tesla.

China's CATL recorded a growth rate of 7.0% (84.9 GWh) and also

recorded the highest share in the global market excluding China. Currently,

CATL's batteries are installed in vehicles of many major global OEMs, including

Tesla, BMW, Mercedes, Volkswagen, and Hyundai Motors, in addition to Chinese

OEMs. In addition, it is expected to rapidly expand its global market share by

resolving the oversupply issue in the Chinese domestic market through overseas

exports to Brazil, Thailand, Israel, and Australia.

(Source: 2024 Dec Global Monthly EV and Battery Monthly Tracker, SNE Research)

Each region around the world is currently seeking strategies to maximize its own interests in the rapidly changing international situation. The United States is strengthening partnerships with friendly countries to check China’s growing influence, and China is responding by strengthening economic cooperation with emerging countries. Europe and ASEAN are maintaining diplomatic balance between the United States and China and preparing for policy changes in each country. Due to the intensifying competition caused by China’s low-price offensive, companies outside of China are in a situation where they must simultaneously achieve high price competitiveness and technological innovation. As the electric vehicle and secondary battery industries are currently facing a transitional situation, it is analyzed that the main task will be to establish sustainable growth strategies in response to policy changes and demand fluctuations in each country.