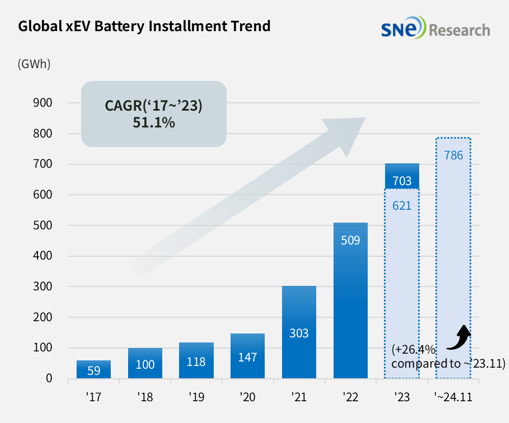

From Jan to Nov 2024, Global EV Battery Usage Posted 785.6GWh, a 26.4% YoY Growth

- From Jan to Nov 2024, K-trio’s M/S recorded

19.8%

From January to November 2024, the amount of

energy held by batteries for electric vehicles (EV, PHEV, HEV) registered

worldwide was approximately 785.6GWh, a 26.4% YoY growth.

(Source: 2024 Dec Global Monthly EV and Battery Monthly Tracker, SNE Research)

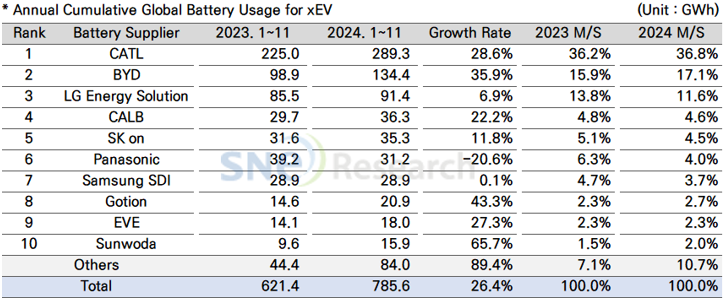

The combined usage of batteries made by the

K-trio companies for electric vehicles from Jan to November 2024 posted a YoY

growth. LG Energy Solution remained at the 3rd place on the list with a

6.9%(91.4GWh) YoY growth. SK On ranked 5th with a 11.8%(35.3GWh) growth.

Samsung SDI posted a 0.1%(28.9GWh) YoY growth. On the other hand, the combined

shares of K-trio in the global market were 19.8%, declined by 3.7%p compared to

the same period of last year.

(Source: 2024 Dec Global Monthly EV and Battery Monthly Tracker, SNE Research)

If we look at the usage of battery made by the K-trio in terms of the

sales volume of models, Samsung SDI’s battery was mainly used in BMW, followed

by Rivian and AUDI. BMW has Samsung SDI’s battery in its models such as i4, i5,

i7, and iX, and among these, i5, released at the end of last month, were

received well by customers. Rivian posted a steady sale of R1S and R1T in the

US. On the other hand, due to a decrease in sales of the Q8 e-Tron, the amount

of Samsung SDI batteries installed in AUDI has decreased by about 26% compared

to the previous year.

SK on’s batteries were found to be mainly installed in vehicles from

Hyundai Motor Group, Mercedes-Benz, Ford, and Volkswagen. In the case of

Hyundai Motor Group, the Ioniq 5 and EV6 showed sluggish sales at the beginning

of the year, but sales have gradually recovered after facelifts, and the Kia

EV9 is performing well with expanded overseas sales. Mercedes-Benz showed

stable sales with the compact SUV EQA and EQB equipped with SK on’s batteries

recording solid sales at the same level as the same period last year. In

addition, strong sales of the Ford F-150 Lightning and Volkswagen’s ID.7 had a

positive impact on the increase in SK on’s battery usage.

LG Energy Solution’s battery usage was mainly

found to be installed in Tesla, Volkswagen, Ford, and Hyundai Motor Group.

Among Tesla models equipped with LG Energy Solution’s batteries, the Model Y

recorded somewhat low sales, but the sales of the facelifted Model 3 surged,

driving the growth rate. In addition, Ford’s Mustang Mach E, Hyundai IONIQ 6

and KONA EV showed solid sales and maintained the growth trend of battery

usage.

Panasonic, who supplies its

battery to Tesla, ranked 6th in the list with 31.2GWh of its battery used this

year, but still posted a 20.6% YoY degrowth. The major reason for Panasonic’s

degrowth were a decline in sales of Tesla Model 3 due to facelift transformation

earlier this year and Tesla’s degrowth in sales in 2024. Panasonic, though, is

expected to rapidly regain its market share mainly focusing on Tesla by

launching its advanced 2170 and 4680 cells supplied to Tesla.

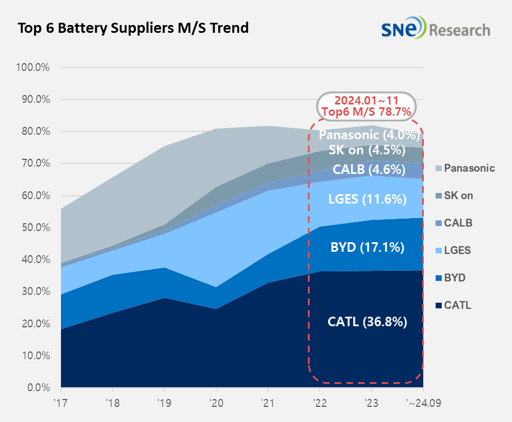

CATL remained No.1 in the global ranking with a 28.6%(289.3GWh) YoY

growth. Major Chinese OEMs, such as ZEEKR, AITO, and Li Auto in the Chinese

domestic market – the world’s largest electric vehicle market – have CATL’s

battery inside, and global major OEMs such as Tesla, BMW, Mercedes-Benz, and VW

also chose CATL’s battery for their EV models.

(Source: 2024 Dec Global Monthly EV and Battery Monthly Tracker, SNE Research)

With the inauguration of the second Trump administration, the possibility of the IRA policy being nullified is increasing, and the transition to electrification is expected to be slowed down. Due to the slowdown in demand for electric vehicles, the operating rates of secondary battery companies are also decreasing, and the market share of the K-trio companies, which are centered on the European and US markets, is decreasing even further. China is being restrained by the US and Europe, but is responding by expanding sales of excess volume to emerging countries based on its stable domestic market. In the short term, the growth of major regions excluding China is expected to fall short of expectations, and automobile and battery companies are analyzed to focus on securing future competitiveness through strategic diversification of businesses such as low-cost models and hybrids and technological innovation.