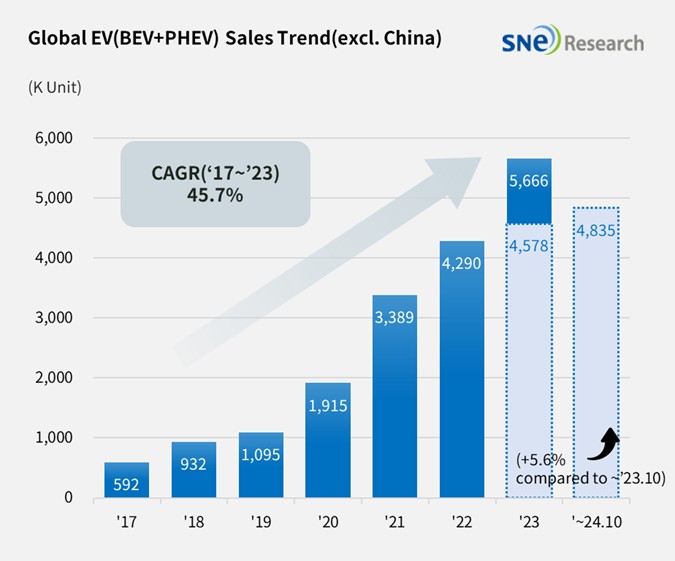

From Jan to Oct 2024, Non-China Global[1] Electric Vehicle Deliveries[2] Recorded About 4.84 Mil Units, a 5.6% YoY Growth

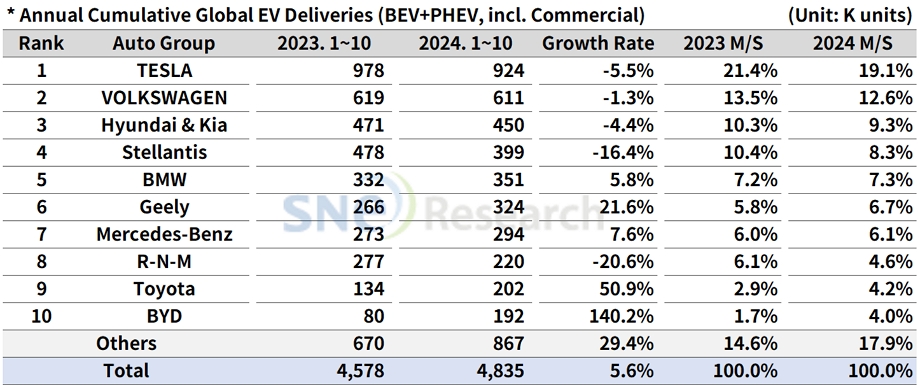

- Tesla ranked No. 1 in non-China EV market; EV major OEMs posted a degrowth again

From Jan to Oct 2024, the total number of electric

vehicles registered in countries around the world except China was approx. 4.835 million units, a 5.6% YoY increase.

(Source: Global EV & Battery Monthly Tracker – Nov 2024, SNE Research)

If we look at the number of electric vehicles sold in the world except the China market from Jan to Oct 2024, despite recording a degrowth, Tesla stayed No. 1 on the list. Tesla recorded a 5.5% YoY degrowth as the sale of Model 3 and Y, taking up about 95% of its entire sale, has declined. Tesla saw a 9.9% YoY increase in Europe and a 3.2% YoY decrease in sales in North America. Although Tesla posted a degrowth in EV sales, its sales profit in Q3 2024 was approx. US$ 2.7 billion, a 54% increase compared to last year. It seemed that Tesla was able to earn high net profit in Q3 2024 thanks to carbon credit sales and its effort to reduce the production cost.

The Volkswagen Group, where Audi, Porsche, and Skoda belong to, posted a 1.3% YoY degrowth and ranked 2nd. Although Audi’s Q4/8 e-tron and PHEV models showed a steady increase in sales, sales of VW’s main models, ID.3/4/5, have been sluggish. This seemed to be caused by a continuing slowdown in EV demand in the European market.

The 3rd place was taken by Hyundai Motor Group, selling about 450k units and posting a 4.4% YoY degrowth. Sales of IONIQ 5, EV 6, and Niro EV experienced a slowdown in Europe compared to the same period of last year, but the global sales of EV 9 have been expanding. In particular, Hyundai Motor Group outperformed Stellantis, Ford, and GM in terms of EV deliveries in the North American market. As sales of EV 3 and Casper Electric, to which LG Energy Solution’s battery is installed, have been rapidly expanding since their launch, Hyundai Motor Group is expected to turn to an upward trajectory around the end of this year, centered around the entry-level EV market.

(Source: Global EV & Battery Monthly Tracker – Nov 2024, SNE Research)

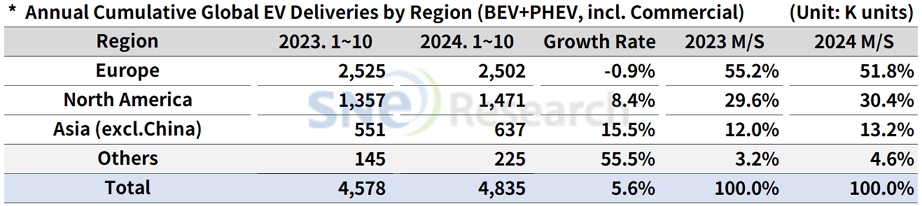

By region, the European market with a 0.9% degrowth saw a gradual slowdown in growth, but still it accounted for more than half of the non-China market. In the European market, Geely (26.7%), Mercedes-Benz (10.7%), and BMW (9.8%) all recorded a growth compared to the same period of last year. On the other hand, Tesla (-9.9%), Stellantis (-20.7%), Renault (-23.6%), and Hyundai & Kia (-11.3%) registered a degrowth in sales, showing that the European region has been blocked by a speed bump in growth.

North America posted a 8.4% YoY growth. Despite the implementation of IRA, the slowdown in EV demand has not been solved yet. Instead, demand for hybrid vehicles has been skyrocketing, leading OEMs to focus more on the development of hybrid models. In the North American market, Hyundai Motor Group, ranked 2nd, showed a high growth of 31.8%. Many OEMs, including Hyundai Motor Group, announced to develop EREV (Extended-Range Electric Vehicle) to actively address the demand for hybrid vehicles.

In Asia (excl. China), OEMs like BYD, SAIC, and VinFast have been actively working on overseas market entrance, and thanks to their sales expansion, the growth in the region posted 15.5% YoY. In particular, based on its success in Vietnam, VinFast has been expanding its target markets to countries neighboring Vietnam such as the Philippines and Indonesia. In North America, VinFast is currently working on launching various models and local production to reinforce its competitiveness in the region.

(Source: Global EV & Battery Monthly Tracker – Nov 2024, SNE Research)

In the non-China market, Geely Group enjoyed an increase in its market share thanks to favorable sales of Volvo electric vehicles in Europe. BYD also expanded its market share by selling a large volume of electric vehicles, based on competitive price, in emerging countries in the Southeastern Asia and Central and South America including Thailand and Brazil. The existing legacy OEMs maintained their growth or saw a decline in growth of electric vehicles as they placed more focus on hybrids and ICE vehicles to respond to a slowdown in the EV market. On the other hand, the Chinese makers have been boasting their growth in overseas markets including emerging countries after they made aggressive investments in those countries. Amidst growing uncertainties in the North American and European markets, where the Korean companies have found most of demand, due to the eased carbon emission regulations and possibility in repealing the IRA, it has become more important for industry players to establish strategies befitting different political and economic situations in different countries.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period