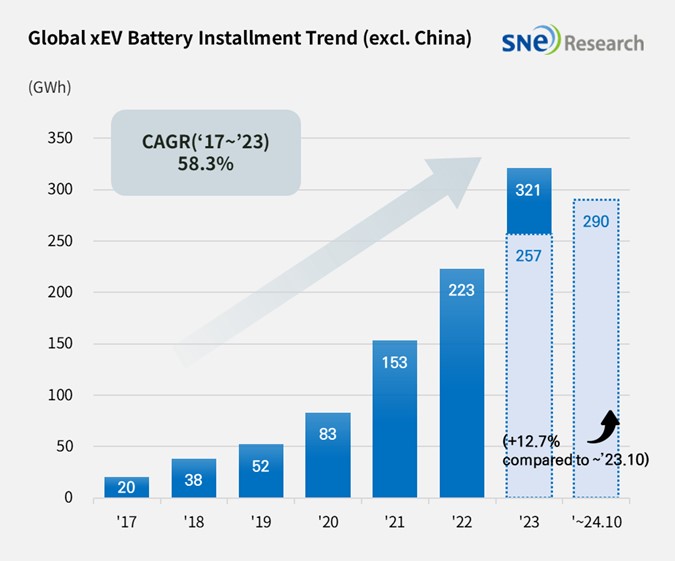

From Jan to October 2024, Non-Chinese Global[1] EV Battery Usage[2] Posted 290.2GWh, a 12.7% YoY Growth

- K-trio’s combined M/S recorded 45.6% from Jan to Oct 2024

Battery installation for

global electric vehicles (EV, PHEV, HEV) excluding the Chinese market sold from

January to October in 2024 was approximately 290.2GWh, a 12.7% YoY growth.

(Source: Global EV and Battery Monthly Tracker – Nov 2024, SNE Research)

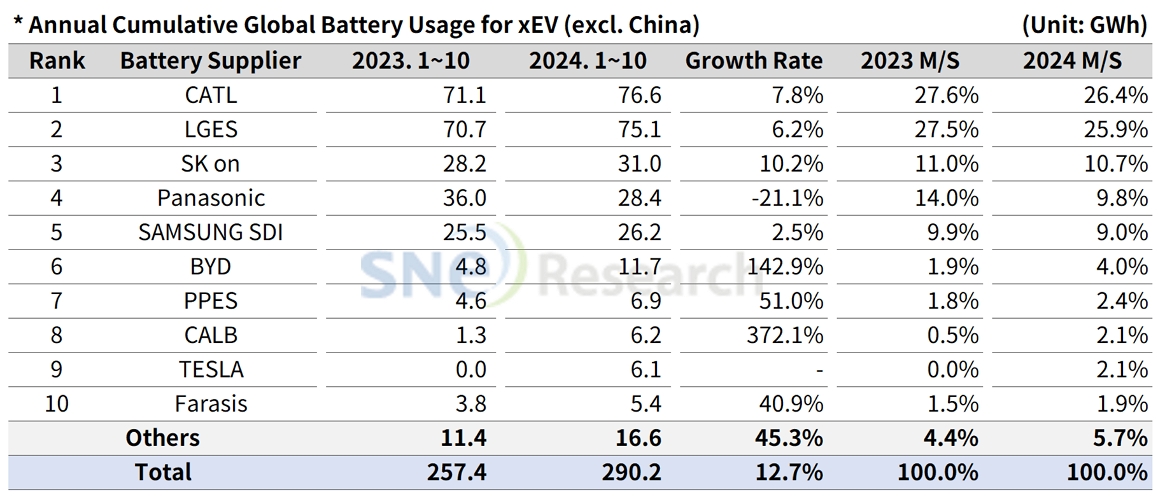

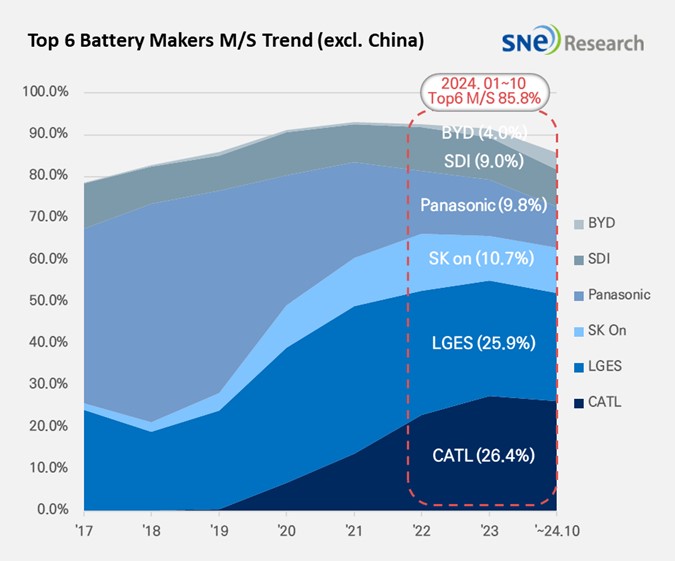

The combined usage of batteries made by the K-trio companies for electric vehicles from January to October 2024 was higher than that from the same period of last year. LG Energy Solution kept the 2nd place in the ranking with 6.2% (75.1GWh) YoY growth, while SK On ranked 3rd with a 10.2% (31.0GWh) YoY growth. Samsung SDI registered 2.5% (26.2GWh) growth. On the other hand, the combined market shares of K-trio were 45.6%, declined by 2.7%p compared to the same period of last year.

(Source: Global EV and Battery Monthly Tracker – Nov 2024, SNE Research)

If we look at the usage of battery made by the K-trio in terms of the sales volume of models, Samsung SDI’s battery was mainly used in BMW, followed by Rivian and AUDI. BMW has Samsung SDI’s battery in its models such as i4, i5, i7, and iX, and among these, i5, released at the end of last month, were received well by customers. Rivian posted a steady sale of R1S and R1T in the US. On the other hand, AUDI saw a decrease in sales of Q8 e-Tron, leading to approx. 21% decline in the usage of Samsung SDI’s battery compared to last year.

SK On’s battery was mainly installed in EV models made by Hyundai Motor Group, followed by Mercedes-Benz, Ford, and Volkswagen. Hyundai Motor Group saw 66.2% and 62.8% declines in sales of Bongo 3 EV and Porter 2 EV respectively compared to last year. On the other hand, IONIQ 5 and EV6 experienced a slowdown in sales from the beginning of this year, but, after facelifted versions were released, they saw a gradual recovery in sales. Kia’s EV9 performed well in terms of overseas sales. Mercedes-Benz’s compact SUV models – EQA and EQB, to which SK On’s battery is installed – posted a steady sales similar to the same period of last year. Other than these, Ford’s F-150 Lightning and VW ID.7 recorded favorable sales compared to last year, bringing out a positive influence to increases in the usage of battery made by SK On.

LG Energy Solution’s battery was mainly used by Tesla, followed by VW, Ford, and Hyundai Motor Group. Model Y, to which LG Energy Solution’s battery is installed, posted a 3.2% decrease in sales compared to last year, while the sales of Model 3, facelifted this year, skyrocketed, leading to a 79.3% increase in sales compared to last year. Other than these, Ford’s Mustang Mach E as well as Hyundai IONIQ 6 and KONA EV all posted a solid sale. All of these helped LG Energy Solution keep a growth in the usage of its battery.

Panasonic, who supplies its battery to Tesla, ranked 4th with 28.4GWh of its battery used this year, but still posted a 21.1% YoY degrowth. The major reason for Panasonic’s degrowth were a decline in sales of Tesla Model 3 due to facelift transformation earlier this year and Tesla’s degrowth in sales in 2024. Panasonic, though, is expected to rapidly regain its market share mainly focusing on Tesla by launching its advanced 2170 and 4680 cells supplied to Tesla.

CATL accounted for the biggest market share in the non-China global market with a 7.8% (76.6GWh) YoY growth. Currently, major global OEMs such as Tesla, BMW, Mercedes, Volkswagen, and Hyundai Motor Group adopt CATL’s battery for their electric vehicles. In order to address the oversupply issue in the Chinese domestic market, CATL turned their eyes to overseas markets such as Brazil, Thailand, Israel, and Australia, leading to an expectation that it would rapidly expand its market share around the globe.

(Source: Global EV and Battery Monthly Tracker – Nov 2024, SNE Research)

The EU commission declared to apply tariff rates, ranging from 17.8% up to 45.3%, to Chinese electric vehicles from Oct 31st. Tariff rates will vary depending on Chinese OEMs who make electric vehicles. It is expected that most of Chinese OEMs would be able to cope with such increase in tariff rates by adjusting their margins. Due to the EU’s tariffs against Chinese electric vehicles, the Chinese battery makers would also possibly see a slowdown in the pace of expanding their market shares in the region. However, as demand for electric vehicles in Europe has been already sluggish, it would be unlikely for the K-battery makers to benefit from the European OEMs who are also struggling with low demand. On the other hand, CATL has more diversity in the supply chain compared to its Korean competitors, and it has also maintained high profitability based on ternary prismatic battery as well as price-competitive LFP battery. In this regard, while the Chinese OEMs and battery makers experience a temporary slowdown in their share expansion, the Korean companies should place more focus on the development and adoption of LFP battery as well as prismatic battery in order to strengthen their competitiveness.

[1] The

xEV sales of 80 countries are aggregated. (excl. the China market)

[2] Based on battery installation for xEV registered during the relevant period.