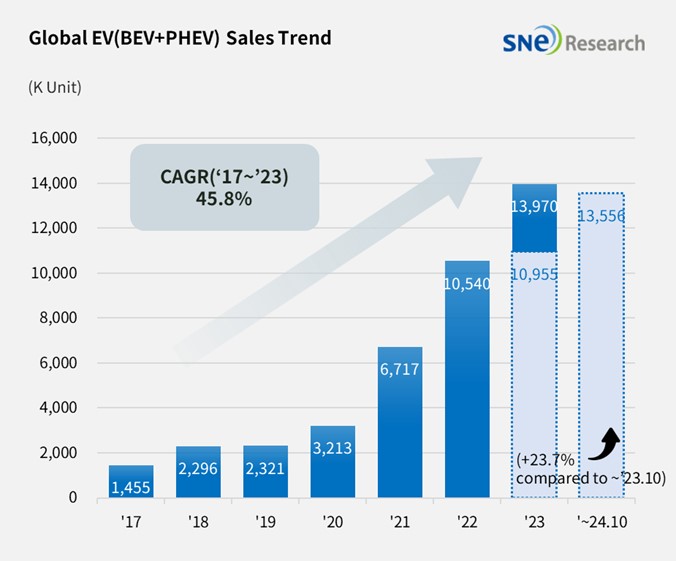

From Jan to Oct 2024, Global[1] Electric Vehicle Deliveries[2] Recorded approximately 13.56 Mil Units, a 23.7% YoY Growth

- In Oct 2024, approximately 1.80 million units of electric vehicles were delivered; BYD ranked No. 1 in the ranking of global EV sales

From

Jan to October 2024, the number of electric vehicles registered in countries

around the world was approximately 13.56 million units, 23.7% YoY increase.

(Source: Global EV and Battery Monthly Tracker – Nov 2024, SNE Research)

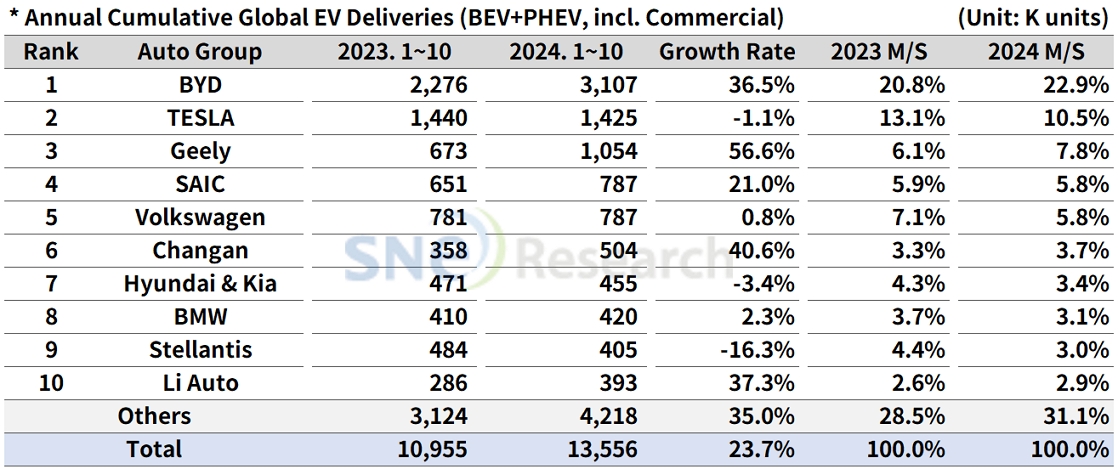

If we look at the global EV sales by major OEMs from Jan to Oct 2024, BYD ranked No. 1 in the world by selling 3.107 million units and posting a 36.5% YoY growth. Favorable sales of PHEV line-ups, such as Song(宋), Seagull (海鸥), Qin(秦), and Yuan(元), as well as BEVs led the growth of BYD. BYD has been steadily expanding its market share by diversifying its brand portfolio through many sub-brands such as Denza (腾势), Yangwang (仰望), and FangCheong Bao (方程豹). BYD takes a two-track approach to target different markets in the world. In Europe, the ASEAN-5 region, and South America, BYD tries to dominate the market in advance by taking advantage of its competitive price and establishing local production lines.

In Q3 2024, BYD posted approx. US$ 28.2 billion in sales, a 24% increase from last year. BYD’s Q3 sales is US$ 3 billion more than that of Tesla, US$ 25.2 billion. Even amidst the prolonged chasm phase in the global EV market (except the Chinese domestic one), BYD has been expanding its global presence under difficult circumstances such as the EU’s tariff rate against Chinese electric vehicles. BYD’s BEV sales recorded about 1.387 million units, which almost reached a similar level as Tesla of which sales (1.425 million units) consist of 100% BEVs. Recently, BYD revised its 2024 target upwards from 3.60 million units to 4 million units, it is expected that BYD would come close to the target of this year.

Tesla saw a decline in sales of Model 3 and Y, which take up about 95% of its entire sales, thereby posting a 2.1% YoY degrowth and taking the 2nd place on the list. To be specific, in Europe, Tesla registered 9.9% YoY decline and 6.2% YoY decline in North America. Due to a sluggish demand in the US, Tesla is now planning to make inroads into the Southeastern Asian market.

The 3rd place was taken by Geely Group which showed a high growth in the Chinese domestic market (79.6%) and Europe (26.7%). In the Chinese domestic market, Geely sold more than 100k units of ZEEKR 001 and 80k units of light EV Panda (熊猫) Mini. In other markets including Europe, excluding China, Geely has been expanding its market share centered around Volvo and Polestar. Other than these, Geely launched sub-brands such as Galaxy (银河) and LYNK & CO (领克), intensively targeting midsize/premium vehicle markets.

(Source: Global EV and Battery Monthly Tracker – Nov 2024, SNE Research)

Hyundai Motor Group sold approx. 455k units of electric vehicles, recording a 3.4% YoY degrowth. Although IONIQ 5, EV 6, and NIRO EV sold less than the same period of last year, the global sales of EV 9 have expanded. Especially in the North American market, Hyundai Motor Group delivered more electric vehicles than Stellantis, Ford, and GM. EV 3 and Casper Electric, to which LG Energy Solution’s battery is installed, have been sold well at a rapid pace since their launch. All of this led to an expectation that Hyundai would return to an upward trend at the end of this year, mainly centered around the entry-level electric vehicle market.

(Source: Global EV and Battery Monthly Tracker – Nov 2024, SNE Research)

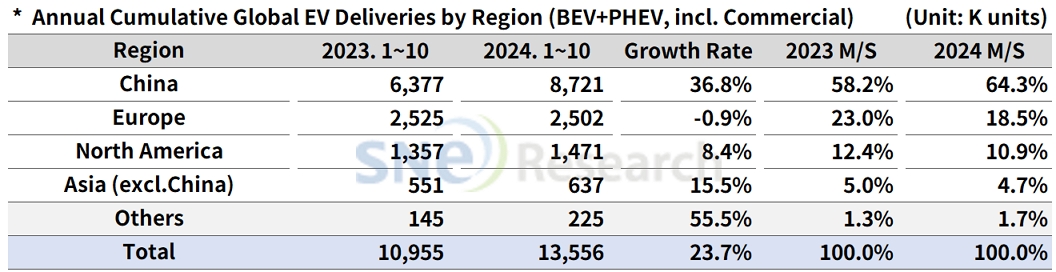

By region, China, accounting for 58.2% of global market share, firmly stayed top as the world’s biggest EV market. China, registering a 36.8% YoY growth, has been leading the growth of the global EV market.

Europe, hit hardest by the chams phase, posted a 0.9% YoY degrowth in the number of electric vehicles delivered. On the other hand, sales of HEVs in the region posted a 16.3% YoY increase. This has proven that the electrification trend has slowed down along with adjustments to the Euro 7 regulation. All of these are based on concerns about possible decreases in profit from the existing OEMs when EVs demand slows down.

The North American region posted an 8.4% YoY growth. In the US, demand for hybrid vehicles has increased, leading OEMs to place more focus on the development of hybrid cars. Recently, many OEMs, including Hyundai Motor Group, announced the development of EREVs (Extended-Range Electric Vehicle), actively responding to the market demand for hybrid vehicles.

Despite the implementation of IRA, a slowdown in demand for EVs has not been solved in the US. With the former president Donal Trump re-elected, the current slowdown in growth is expected to linger. While the repeal of tax credits for electric vehicles has been discussed in the US, the Zero Emission Transportation Association (ZETA), representing local companies in the US, issued a statement on the EV tax credits to oppose the repeal. Most of models made by the American companies qualify for tax credits, Hyundai Motor Group receive little benefits from the subsidy policy. Given these circumstances, if the IRA is abolished, even those American companies would be negatively affected. Taking all these into consideration, it is likely that the IRA would be partially withdrawn or maintained, not completely repealed. While China is expected to enjoy high growth next year thanks to the government campaign to replace old things with new ones, Europe and North America are expected to struggle from a slowdown in growth due to several factors: the re-election of Donal Trump in North America and economic downturn and business restructuring in Europe.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period