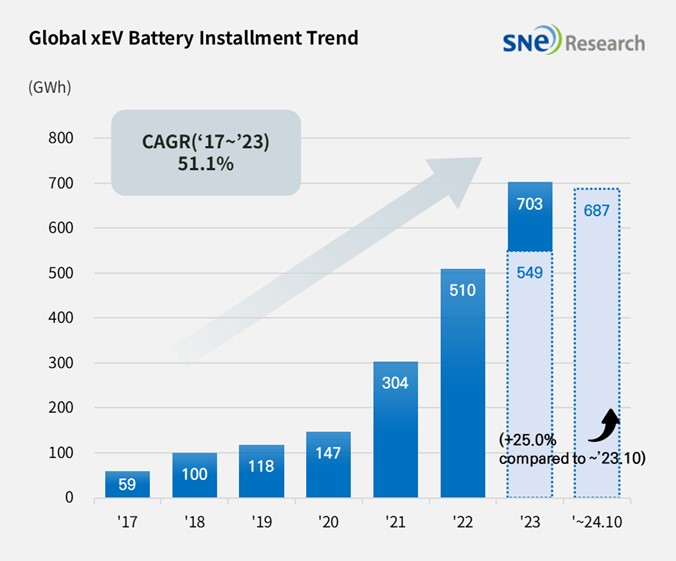

From Jan to Oct 2024, Global[1] EV Battery Usage[2] Posted 686.7GWh, a 25.0% YoY Growth

- From Jan to Oct 2024, K-trio’s M/S recorded 20.2%

From

January to October 2024, the amount of energy held by batteries for electric

vehicles (EV, PHEV, HEV) registered worldwide was approximately

686.7GWh, a 25.0% YoY growth.

(Source: 2024 Nov Global Monthly EV and Battery Monthly Tracker, SNE Research)

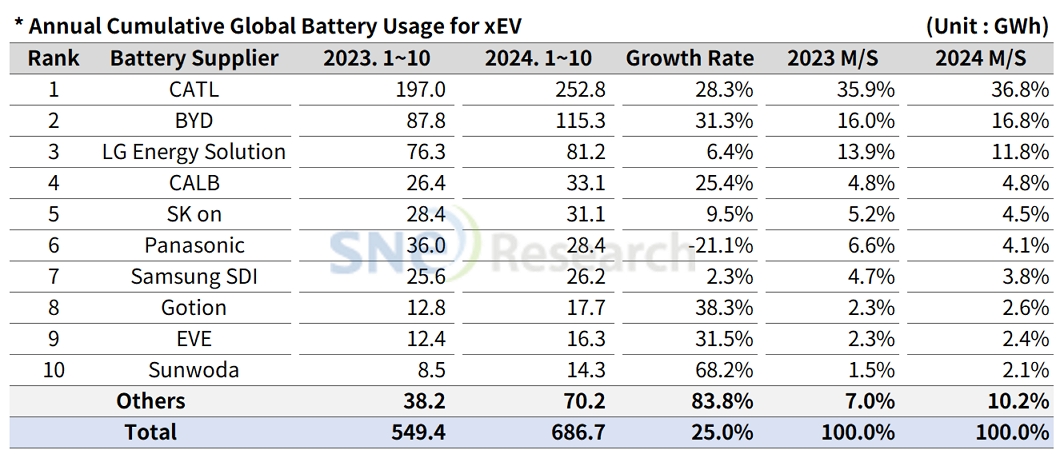

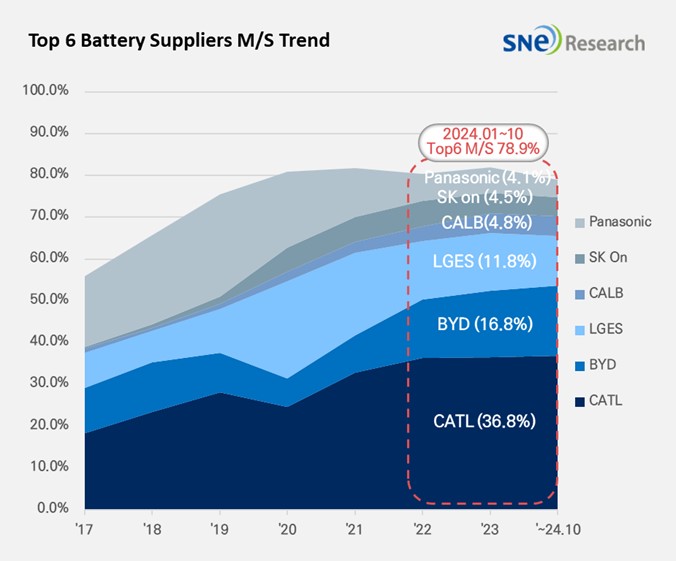

The combined usage of batteries made by the K-trio companies for electric vehicles from Jan to October 2024 posted a YoY growth. LG Energy Solution remained at the 3rd place on the list with a 6.4%(81.2GWh) YoY growth. SK On ranked 5th with a 9.5%(31.1GWh) growth. Samsung SDI posted a 2.3%(26.2GWh) YoY growth. On the other hand, the combined shares of K-trio in the global market were 20.2%, declined by 3.5%p compared to the same period of last year.

(Source: 2024 Nov Global Monthly EV and Battery Monthly Tracker, SNE Research)

If we look at the usage of battery made by the K-trio in terms of the sales volume of models, Samsung SDI’s battery was mainly used in BMW, followed by Rivian and AUDI. BMW has Samsung SDI’s battery in its models such as i4, i5, i7, and iX, and among these, i5, released at the end of last month, were received well by customers. Rivian posted a steady sale of R1S and R1T in the US. On the other hand, AUDI saw a decrease in sales of Q8 e-Tron, leading to approx. 21% decline in the usage of Samsung SDI’s battery compared to last year.

SK On’s battery was mainly installed in EV models made by Hyundai Motor Group, followed by Mercedes-Benz, Ford, and Volkswagen. Hyundai Motor Group saw 66.2% and 62.8% declines in sales of Bongo 3 EV and Porter 2 EV respectively compared to last year. On the other hand, IONIQ 5 and EV6 experienced a slowdown in sales from the beginning of this year, but, after facelifted versions were released, they saw a gradual recovery in sales. Kia’s EV9 performed well in terms of overseas sales. Mercedes-Benz’s compact SUV models – EQA and EQB, to which SK On’s battery is installed – posted a steady sales similar to the same period of last year. Other than these, Ford’s F-150 Lightning and VW ID.7 recorded favorable sales compared to last year, bringing out a positive influence to increases in the usage of battery made by SK On.

LG Energy Solution’s battery was mainly used by Tesla, followed by VW, Ford, and Hyundai Motor Group. Model Y, to which LG Energy Solution’s battery is installed, posted a 1.3% decrease in sales compared to last year, while the sales of Model 3, facelifted this year, skyrocketed, leading to a 68.2% increase in sales compared to last year. Other than these, Ford’s Mustang Mach E as well as Hyundai IONIQ 6 and KONA EV all posted a solid sale. All of these helped LG Energy Solution keep a growth in the usage of its battery.

Panasonic, who supplies its battery to Tesla, ranked 6th in the list with 28.4GWh of its battery used this year, but still posted a 21.1% YoY degrowth. The major reason for Panasonic’s degrowth were a decline in sales of Tesla Model 3 due to facelift transformation earlier this year and Tesla’s degrowth in sales in 2024. Panasonic, though, is expected to rapidly regain its market share mainly focusing on Tesla by launching its advanced 2170 and 4680 cells supplied to Tesla.

CATL remained No.1 in the global ranking with a 28.3%(252.8GWh) YoY growth. Major Chinese OEMs, such as ZEEKR, AITO, and Li Auto in the Chinese domestic market – the world’s largest electric vehicle market – have CATL’s battery inside, and global major OEMs such as Tesla라, BMW, Mercedes-Benz, and VW also chose CATL’s battery for their EV models.

BYD ranked 2nd on the list with 31.3%(115.3GWh) YoY growth. BYD, who does not only manufacture battery on its own but also produces EV (BEV+PHEV), has been drawing huge popularity in the market based on its diverse vehicle portfolio and competitive prices. From Jan to Oct 2024, the sales volume of BYD’s EV were approx. 3.11 million units, and among those, the number of BYD’s BEV sold was about 1.39 million units, which was only 30k units less than 1.42 million units of BEV sold by Tesla. BYD has been accelerating its growth by taking a two-track approach to target BEV and PHEV markets at the same time. In particular, BYD has been rapidly expanding its market share beyond the Chinese domestic market by making its way into the Asian and European markets.

(Source: 2024 Nov Global Monthly EV and Battery Monthly Tracker, SNE Research)

Uncertainties around the K-battery industry have been aggravating due to a slowdown in EV demand this year and the former US President Donald Trump’s re-election. Some suggested that there are possibilities that he may issue administrative orders to neutralize the Inflation Reduction Act enacted by the Biden Administration. To be specific, if tax credits established according to the AMPC were postponed or reduced, the K-battery makers, who have been working on ramping up their capacities to receive incentives offered under the IRA during the Biden Administration, would be hit hard. In order to brace for possible crisis, it would be necessary for the K-battery industry to closely monitor policy changes in the US, and in the long term, they should lower their dependence on the AMPC tax credits and establish capabilities to flexibly respond to unexpected changes in the market.

[2] Based on battery installation for xEV registered during the relevant period.